After the GBP/SGD completed a breakout above its support zone, the downtrend ended. More upside is anticipated, and a series of higher highs and higher lows is likely to emerge over the next few trading sessions. While UK economic data finished 2019 weaker than expected, the first signs for 2020 are more bullish. The latest evidence of this came in the form of an upside surprise in house prices, one of the key drivers for consumer spending. You can learn more about a support zone here.

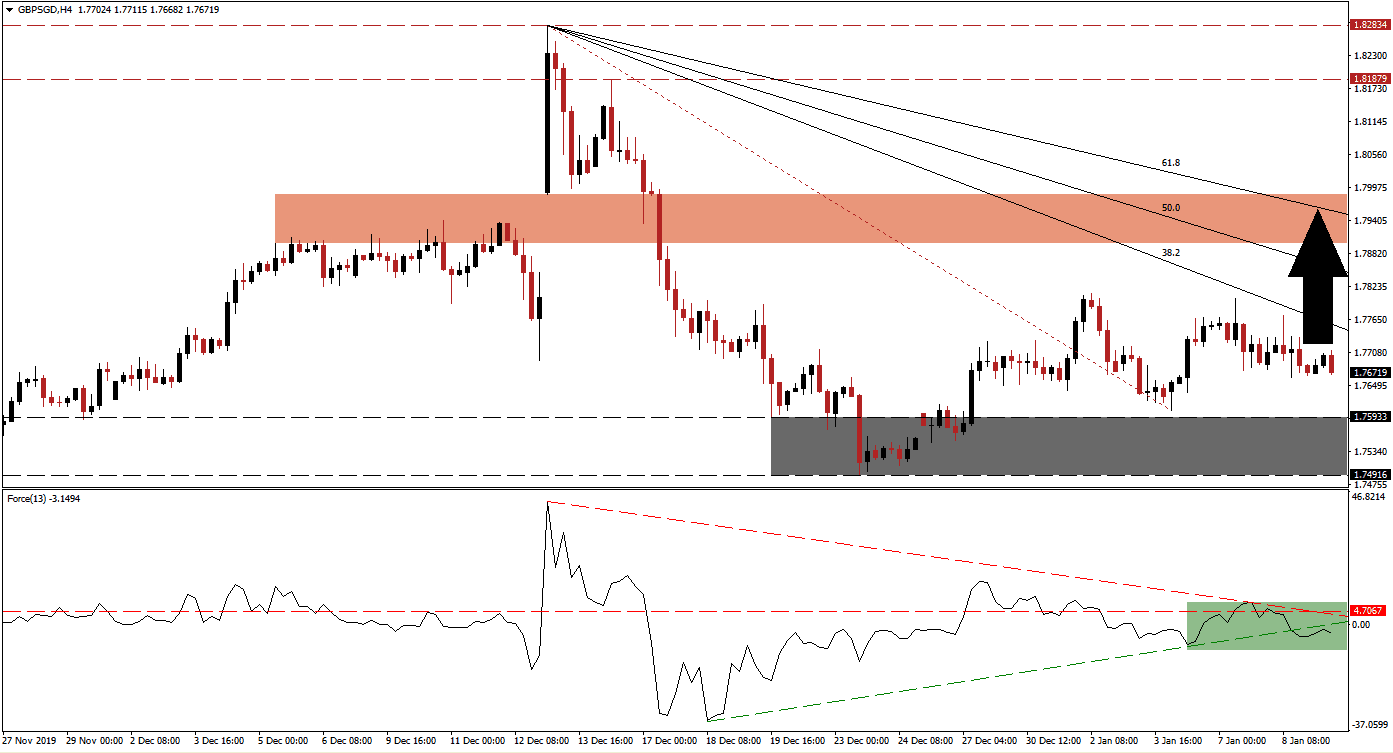

The Force Index, a next-generation technical indicator, displays a decrease in volatility in this currency pair. After the descending resistance level pushed the Force Index below its horizontal resistance level, bearish pressures started to ease. This technical indicator created a marginally higher low following the breakdown below its ascending support level, as marked by the green rectangle. Bears remain in control of the GBP/SGD, as the Force Index remains in negative territory. A triple breakout is anticipated to initiate the next push to the upside.

Following the breakout in this currency pair above its support zone located between 1.74916 and 1.75933, as marked by the grey rectangle, the Fibonacci Retracement Fan sequence was redrawn. Bullish fundamental developments in the Singapore Dollar as a result of the Hong Kong protests have eased, and economic developments have disappointed. This is adding to upside pressure, and price action is favored to eclipse its descending 38.2 Fibonacci Retracement Fan Resistance Level, converting it into support.

Forex traders are advised to monitor the intra-day high of 1.78118, the peak of the current breakout series, which led to a higher low in the GBP/SGD. A breakout above this level is likely to result in the addition of new net long positions. This should allow for an extension of the uptrend into its short-term resistance zone located between 1.78995 and 1.79860, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is enforcing this zone, which additionally includes a price gap to the upside.

GBP/SGD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.76750

Take Profit @ 1.79400

Stop Loss @ 1.76000

Upside Potential: 265 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 3.53

In case of a deeper push by the Force Index into negative conditions, supported by its descending resistance level, the GBP/SGD is expected to move back into its support zone. As a result of the long-term bullish outlook in this currency pair, a breakdown below this zone remains unlikely unless a fresh catalyst emerges. Forex traders should take advantage of a temporary reversal with new buy orders.

GBP/SGD Technical Trading Set-Up - Short-Term Reversal Scenario

Short Entry @ 1.75750

Take Profit @ 1.75000

Stop Loss @ 1.76100

Downside Potential: 75 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.14