After this currency pair was able to eclipse its support zone, bullish momentum faded as a result of the US killing attack on Iraqi soil to kill a top Iranian general. Commodity prices spiked, led by gold and oil, and are expected to remain elevated. This will support commodity currencies like the New Zealand Dollar in the short-term, but an escalation of the tensions will have a devastating impact on the fragile global economy that continues to slow. While the long-term outlook for the GBP/NZD remains bullish, a short-term breakdown is anticipated. You can learn more about a breakdown here.

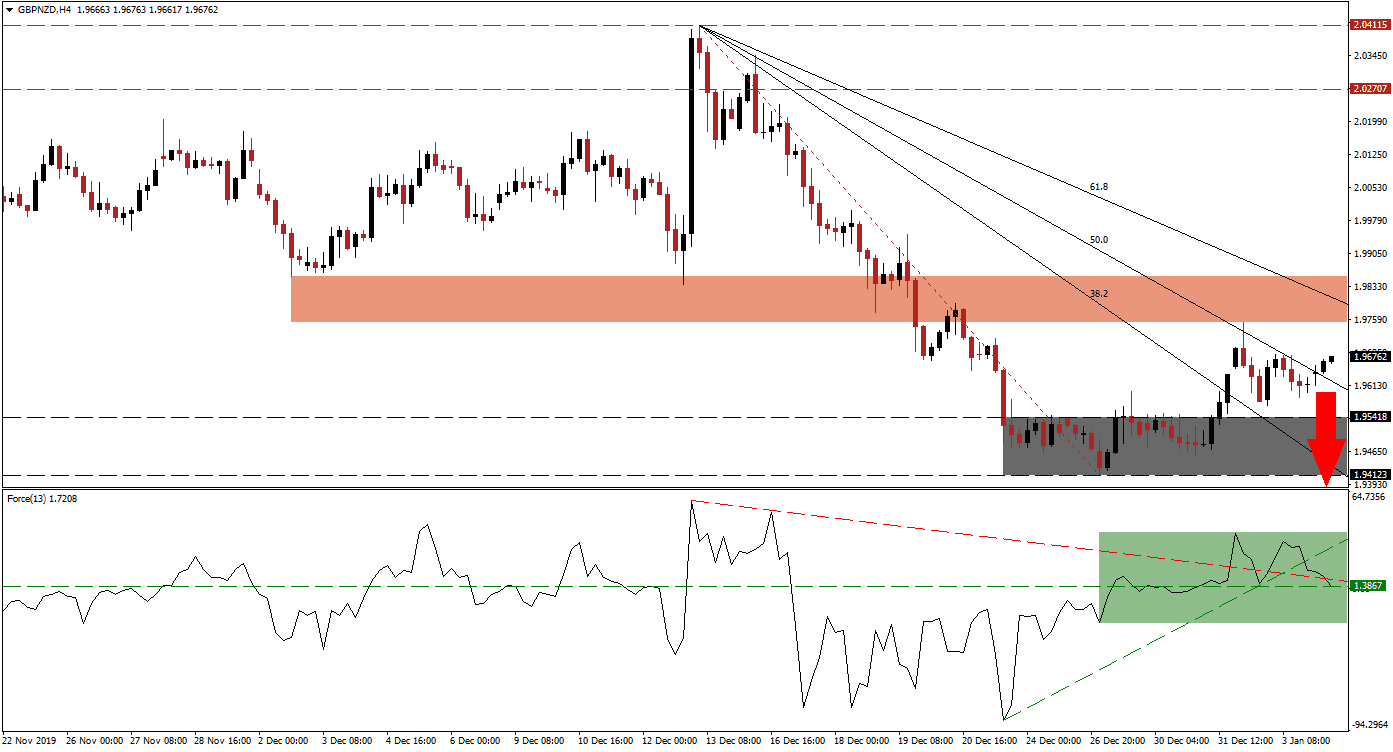

The Force Index, a next-generation technical indicator, accelerated with the breakout in this currency pair. After it reached the bottom range of its short-term resistance zone, bullish momentum started to contract, and the Force Index retreated. A bounce off of its horizontal support level resulted in a lower high, leading to the breakdown below its ascending support level. This technical indicator additionally moved back below its descending resistance level, as marked by the grey rectangle. A breakdown in the Force Index below its horizontal support level is pending, which will take it into negative conditions and lead the GBP/NZD to the downside.

This currency pair was rejected by its short-term resistance zone located between 1.97517 and 1.98548, as marked by the red rectangle. While the GBP/NZD may attempt another push higher, the descending 61.8 Fibonacci Retracement Fan Resistance Level is anticipated to force a reversal. The Fibonacci Retracement Fan is expected to keep keep the existing downtrend intact and reignite the breakdown sequence. Forex traders are advised to monitor the Force Index, as a move below the 0 center-line will put bears in control of price action. You can learn more about the Fibonacci Retracement Fan here.

Following a breakdown in the GBP/NZD below its 50.0 Fibonacci Retracement Fan Support Level, the path will be cleared into its support zone. This zone is located between 1.94123 and 1.95418, as marked by the grey rectangle. The 38.2 Fibonacci Retracement Fan Support Level has already moved below this zone and may guide this currency pair farther to the downside. Economic data out of the UK came in weaker than expected throughout December, adding to short-term downside pressures. The next support zone awaits price action between 1.89990 and 1.90930.

GBP/NZD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.96750

Take Profit @ 1.94000

Stop Loss @ 1.97600

Downside Potential: 275 pips

Upside Risk: 85 pips

Risk/Reward Ratio: 3.24

Should the Force Index maintain a breakout above its ascending support level, the GBP/NZD is favored to follow suit. A move in this currency pair above its 61.8 Fibonacci Retracement Fan Resistance Level will invalidate the bearish pattern. The next long-term resistance zone is located between 2.02707 and 2.04115, but the psychological 2.00000 level may halt any advance. More upside would require a fresh catalyst, but it currently remains unlikely given uncertainty regarding the Brexit transition period.

GBP/NZD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.98700

Take Profit @ 2.00000

Stop Loss @ 1.98200

Upside Potential: 130 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.60