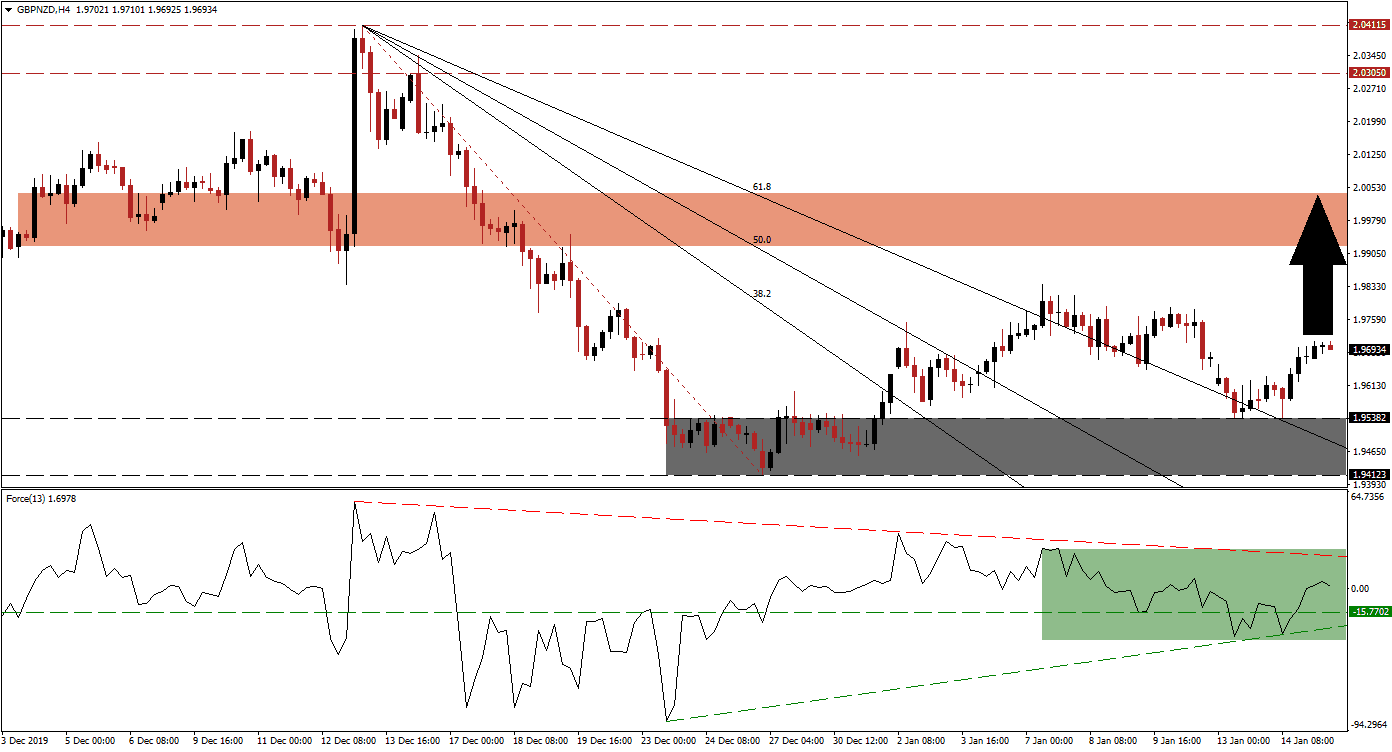

Bullish momentum in the GBP/NZD is gathering strength after price action bounced off of the top range of its support zone. News out of Washington that no more tariff cuts will be implemented until after the November election has dampened trade optimism, affecting the New Zealand Dollar, which depends on strong global trade. This currency pair has ended its extensive corrective phase following the breakout above its descending 61.8 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, indicates the rise in bullish momentum after the GBP/NZD pushed higher. The Force Index was able to recover after grazing its ascending support level, leading to a conversion of its horizontal resistance level into support. This technical indicator additionally advanced into positive conditions, placing bulls in charge of price action, as marked by the green rectangle. A breakout above its descending resistance level is favored to extend the advance in this currency pair.

Following the initial descend in the GBP/NZD into its support zone located between 1.94123 and 1.95382, as marked by the grey rectangle, bullish momentum started to recover from a fresh low. The short-covering rally in this currency pair elevated it above its 61.8 Fibonacci Retracement Fan Resistance Level, before retreating into the top range of its support zone. Price action quickly recovered from a higher low and is now anticipated to extend its advance. You can learn more about a support zone here.

Forex traders are advised to monitor the intra-day high of 1.97854, the peak of a previous bounce off of its 61.8 Fibonacci Retracement Fan Resistance Level. A breakout in the GBP/NZD above this level is expected to result in the addition of new net long positions. It will also clear the path into its short-term resistance zone located between 1.99209 and 2.00382, as marked by the red rectangle. This currency pair may pause its advance at the crucial 2.00000 psychological resistance level, and today’s UK economic data may provide a temporary catalyst.

GBP/NZD Technical Trading Set-Up - Reversal Extension Scenario

- Long Entry @ 1.96900

- Take Profit @ 2.00000

- Stop Loss @ 1.95900

- Upside Potential: 310 pips

- Downside Risk: 100 pips

- Risk/Reward Ratio: 3.10

A breakdown in the Force Index below its ascending support level is favored to lead the GBP/NZD to a breakdown attempt of its own. Should this currency move back inside its Fibonacci Retracement Fan, it is likely to guide it farther to the downside. The next support zone is located between 1.91825 and 1.92551. A fresh breakdown would require a fundamental shift in the current outlook.

GBP/NZD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 1.94400

- Take Profit @ 1.92400

- Stop Loss @ 1.95400

- Downside Potential: 200 pips

- Upside Risk: 100 pips

- Risk/Reward Ratio: 2.00