Geopolitical tensions are on the verge of escalating in the Middle East after the US killed a top Iranian general in Iraq. US foreign policy regarding Iran was at odds with its allies after US President Trump withdrew from the agreed nuclear deal. Efforts by France to get the US back to the negotiating table failed. After the killing was confirmed, safe-haven assets like the Japanese Yen attracted bids. This accelerated the corrective phase in the GBP/JPY, which was rejected by its short-term resistance zone.

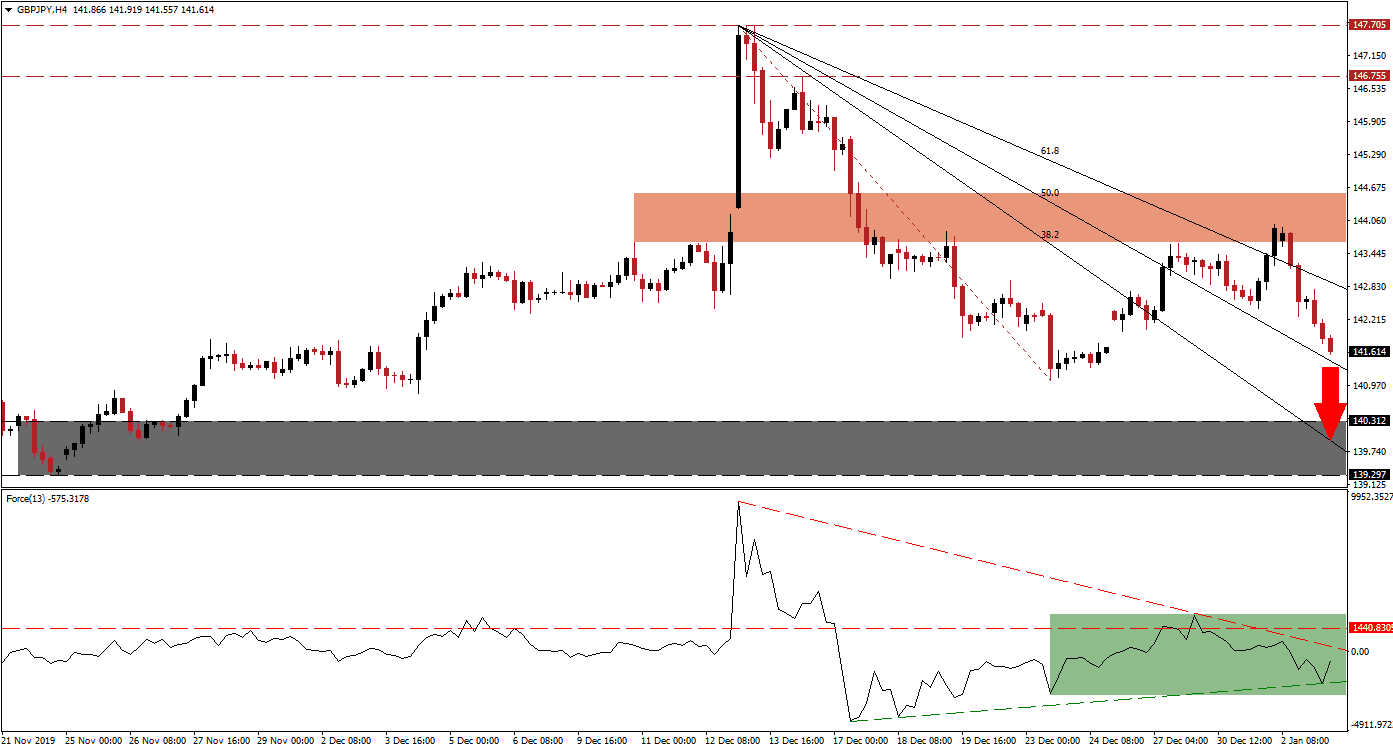

The Force Index, a next-generation technical indicator, formed a negative divergence before the rejection of this currency pair by its short-term resistance zone. Bearish momentum increased, assisted by its descending resistance level. The Force Index halted its move to the downside after reaching its ascending support level, as marked by the green rectangle. This technical indicator remains in negative territory with bears in control of the GBP/JPY. With the build-up in bullish momentum off of a higher low, the sell-off in price action may be limited. You can learn more about the Force Index here.

This currency pair started its corrective phase after an advance was rejected by its short-term resistance zone. This zone is located between 143.569 and 144.659, as marked by the red rectangle. Following the rejection, the GBP/JPY moved below its descending 61.8 Fibonacci Retracement Fan Resistance Level, adding to bearish momentum. The Fibonacci Retracement Fan sequence is favored to guide price action farther to the downside until bullish momentum can recover. The long-term outlook for this currency pair remains cautiously bullish.

A breakdown in the GBP/JPY below its 50.0 Fibonacci Retracement Fan Support Level is anticipated to take it into its support zone. The 38.2 Fibonacci Retracement Fan Support Level has already entered this zone located between 139.297 and 140.312, as marked by the grey rectangle. A breakdown below this zone remains unlikely unless a major fundamental catalyst emerges. The Japanese Yen is expected to remain in demand until clarity about the Iranian response materializes. You can learn more about a breakdown here.

GBP/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 141.600

Take Profit @ 139.750

Stop Loss @ 142.100

Downside Potential: 185 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.70

In case of a breakout in the Force Index above its descending resistance level, the GBP/JPY is favored to accelerate to the upside. A short-covering rally is expected to provide the fuel for a fresh breakout sequence. The short-term resistance zone will pose the first major test for price action, and given the current geopolitical landscape, a breakout will be challenging. The next long-term resistance zone is located between 146.755 and 147.705.

GBP/JPY Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 142.500

Take Profit @ 144.000

Stop Loss @ 141.900

Upside Potential: 150 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 2.50