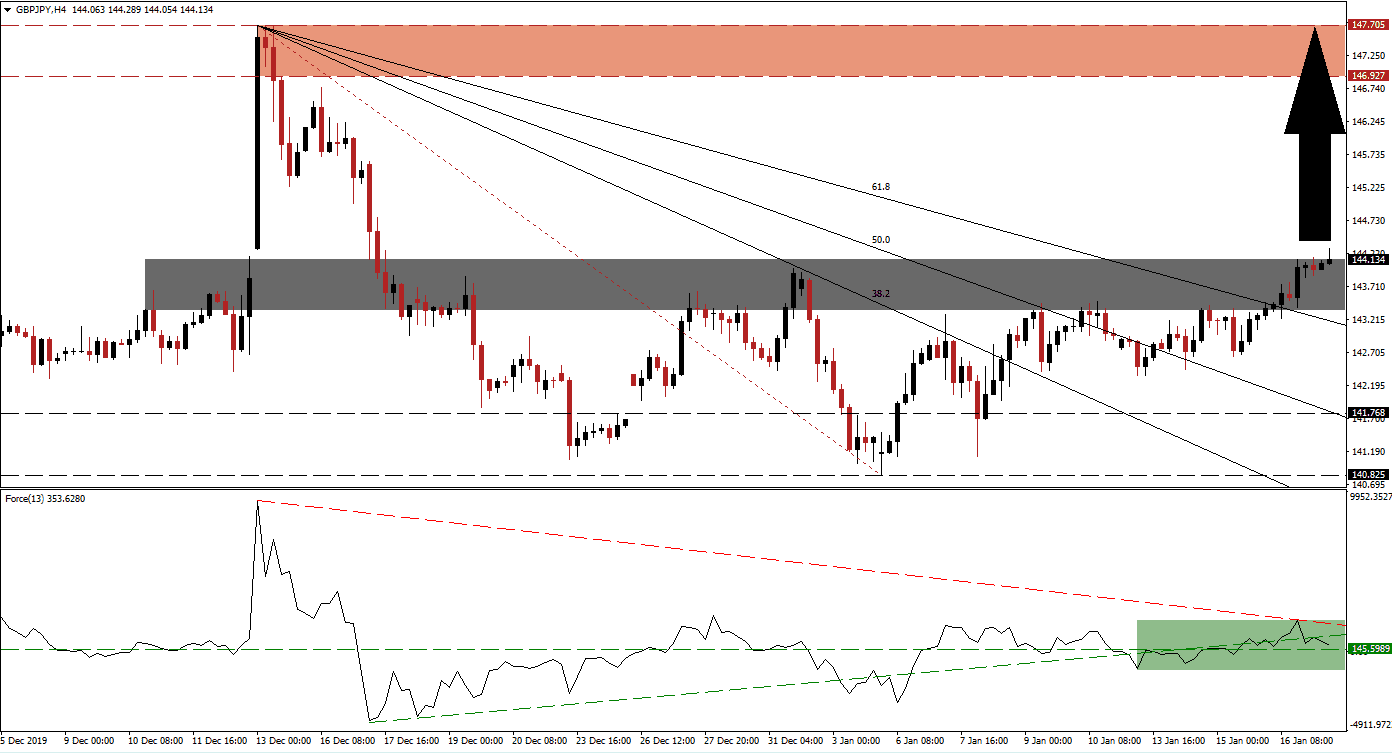

After this currency pair was able to bounce off of its descending 61.8 Fibonacci Retracement Fan Support Level, it managed to eclipse its short-term resistance zone. Volatility is expected to increase at this crucial zone, as a sustained breakout will clear the path for a more massive advance in the GBP/JPY. Today’s retail sales data out of the UK may provide the next short-term fundamental catalyst, while the focus remains on Brexit, and the transition period which will follow. You can learn more about a resistance zone here.

The Force Index, a next-generation technical indicator, has been confined to a narrow range with a bullish bias in positive conditions. Momentum has gradually increased together with the advance in the GBP/JPY. Its descending resistance level pressured the Force Index below its ascending support level, as marked by the green rectangle. This technical indicator remains above the 0 center-line, suggesting bulls are in control of price action. A fresh push to the upside is anticipated to precede the next wave of buy orders in this currency pair.

Price action is in the process of confirming a breakout above its short-term resistance zone located between 143.350 and 144.130, as marked by the grey rectangle. The Fibonacci Retracement Fan has moved below this zone and the advance in the GBP/JPY off of added to bullish developments in this currency pair. While the Japanese Yen is the top safe-haven currency, domestic economic worries overshadow its appeal against the British Pound, which features an increasingly bullish outlook. You can learn more about the Fibonacci Retracement Fan here.

Due to the sharp sell-off in this currency pair, after UK Prime Minister Johnson introduced an amendment making an extension of the Brexit transition period illegal, the path is clear for a push into its long-term resistance zone. This zone awaits the GBP/JPY between 146.927 and 147.705, as marked by the red rectangle. A breakout above this zone will require a fresh fundamental catalyst. The long-term outlook is bullish, but the advance is likely to be volatile. Forex traders are advised to monitor price action for a series of higher highs and higher lows, which will keep the uptrend intact.

GBP/JPY Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 144.150

Take Profit @ 147.700

Stop Loss @ 143.150

Upside Potential: 355 pips

Downside Risk: 100 pips

Risk/Reward Ratio: 3.55

In case of a sustained move in the Force Index into negative conditions, pressured by its descending resistance level, the GBP/JPY is likely to attempt a breakdown. As a result of the dominant bullish fundamental outlook, any breakdown attempt remains limited to its next long-term support zone. This zone is located between 140.825 and 141.768, and forex traders may take advantage of such a short-term event with fresh buy orders.

GBP/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 142.900

Take Profit @ 141.400

Stop Loss @ 143.500

Downside Potential: 150 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 2.50