Mixed UK economic data is adding to downside pressure in the British Pound, with Brexit roughly two weeks away. The transition period, which will follow until December 31st 2020, is shaping up to be rather volatile. More battlefronts are appearing, with fishing the latest addition to disputes between the EU and the UK. An increasingly dovish Bank of England has provided more downside pressure in the GBP/CHF, enhanced by the safe-haven status of the Swiss Franc. Bullish momentum displays signs of strength, as this currency pair is pressuring its support zone.

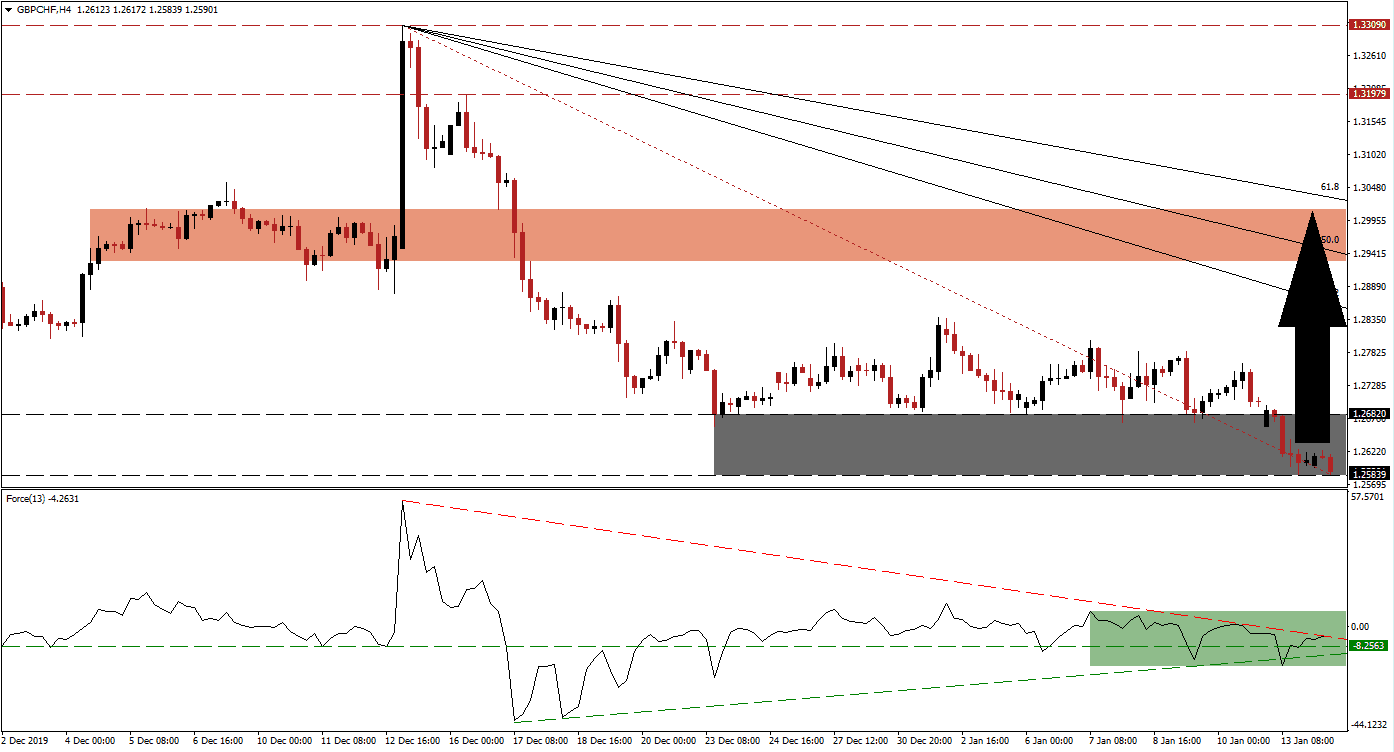

The Force Index, a next-generation technical indicator, has recovered from its latest dip and is now faced with its descending resistance level. A marginally lower low resulted from the previous contraction, which took the Force Index shortly below its ascending support level. With the rise in bullish momentum, this technical indicator eclipsed its horizontal support level, as marked by the green rectangle. Bears remain in control of the GBP/CHF, but a breakout above its descending resistance level is favored to lead price action into a recovery.

Bearish momentum is fading as this currency pair reached its support zone located between 1.25839 and 1.26820, being marked by the grey rectangle. Another bullish development emerged after the GBP/CHF moved above its Fibonacci Retracement Fan trendline. A breakout is expected to inspire a short-covering rally, which will close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. More upside is favored to follow unless a fresh fundamental catalyst disrupts the dominant technical outlook. You can read more about the Fibonacci Retracement Fan here.

One critical level to monitor is the intra-day high of 1.27635, the peak of a failed breakout attempt, which led to a lower low in the GBP/CHF. A sustained push above this level is anticipated to result in the net addition of buy orders in this currency pair. Price action will face its first challenge at its short-term resistance zone located between 1.29285 and 1.30120, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is enforcing the top range of it, from where more upside will require a new catalyst.

GBP/CHF Technical Trading Set-Up - Short-Covering Rally Scenario

Long Entry @ 1.25850

Take Profit @ 1.30000

Stop Loss @ 1.24850

Upside Potential: 415 pips

Downside Risk: 100 pips

Risk/Reward Ratio: 4.15

Should the Force Index complete a breakdown below its ascending support level, the GBP/CHF is likely to push farther to the downside. Given the long-term bullish outlook in this currency pair, forex traders are advised to consider any breakdown from current levels as an excellent buying opportunity. The next support zone awaits price action between 1.22892 and 1.23834, but volatility is expected to increase.

GBP/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.24350

Take Profit @ 1.23150

Stop Loss @ 1.24850

Downside Potential: 120 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 2.40