Battle lines are being drawn by the EU and the UK, pointing to intense trade negotiations during the Brexit transition period. The EU is threatened by the UK as a competitor as well as a potential tax haven and prefers for the country to foster close to EU rules. After UK Prime Minister Johnson’s landslide victory last month, the Brexit government is favored to deliver a clean break, and the British Pound has come under selling pressure as a result. The GBP/CAD is now trending sideways inside of its support zone, but bullish momentum remains solid.

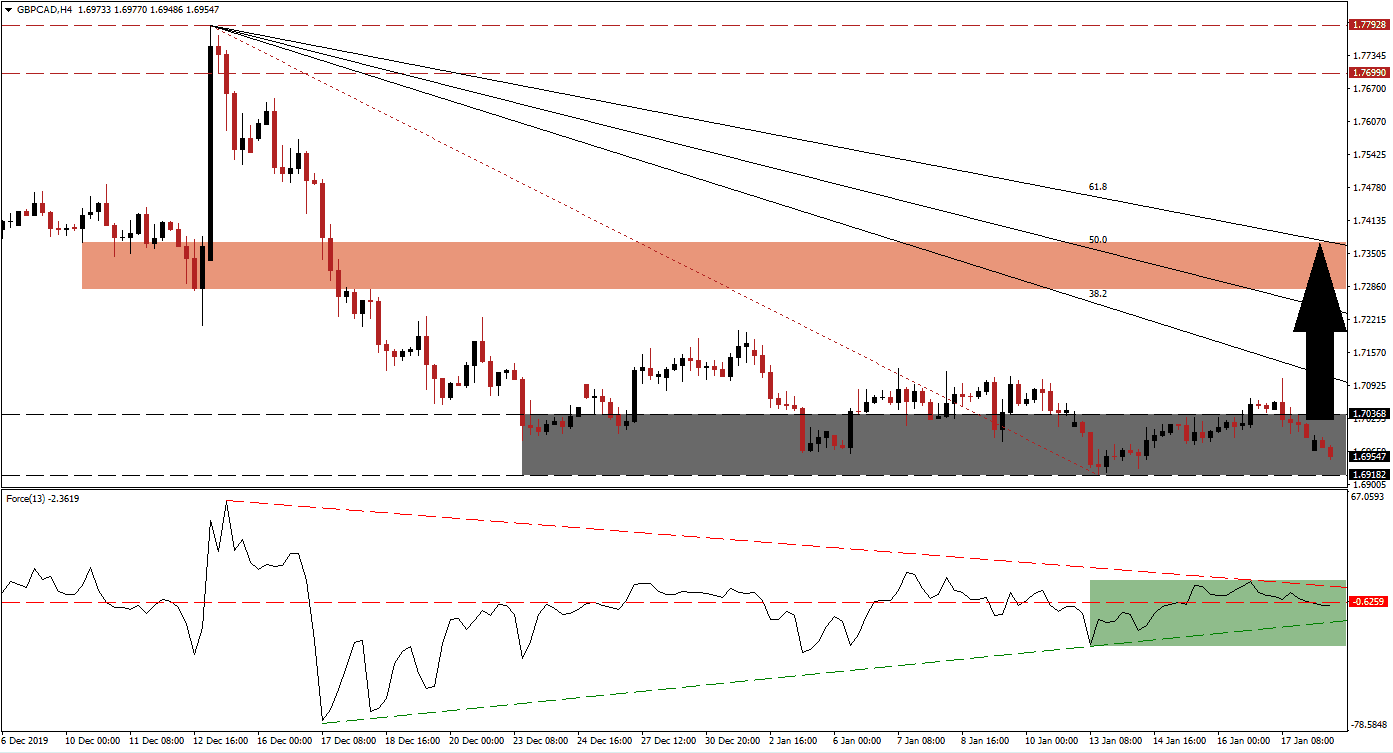

The Force Index, a next-generation technical indicator, points towards a narrowing range, with the ascending support level and descending resistance level closing in on each other. Pressures are increasing for the Force Index to either break out or break down, which will precede the next move in the GBP/CAD. This technical indicator moved below its horizontal resistance level, as marked by the green rectangle, and into negative conditions. With bears temporarily in control of this currency pair, a breakout is anticipated to materialize. You can learn more about the Force Index here.

Adding to pressures on the GBP/CAD is the descending Fibonacci Retracement Fan sequence, and the 38.2 Fibonacci Retracement Fan Resistance Level is approaching the top range of its support zone. This zone is located between 1.69182 and 1.70368, as marked by the grey rectangle. A bullish development emerged after this currency pair moved above its Fibonacci Retracement Fan trendline. UK economic data has been soft over the past two months, but Canadian data has followed suit, in-line with a slowing global economy.

Both currencies are home to a dovish central bank, but inflationary pressures in the UK exceed those in Canada, boosting the long-term fundamental outlook for this currency pair. A breakout is favored to initiate a short-covering rally, and a push above the intra-day high of 1.71071 is expected to usher in new net long positions. This should elevate the GBP/CAD into its next short-term resistance zone located between 1.72798 and 1.73705, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is enforcing this zone, and a breakout will require a new catalyst. You can learn more about a breakout here.

GBP/CAD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.69550

Take Profit @ 1.73550

Stop Loss @ 1.68450

Upside Potential: 400 pips

Downside Risk: 110 pips

Risk/Reward Ratio: 3.64

In the event of a breakdown in the Force Index below its ascending support level, the GBP/CAD is likely to be pressured to the downside. While volatility may increase, the outlook for this currency pair remains bullish. Forex traders are advised to consider a breakdown attempt as a great long-term buying opportunity. The next support zone awaits this currency pair between 1.67182 and 1.67765.

GBP/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.68200

Take Profit @ 1.67200

Stop Loss @ 1.68600

Downside Potential: 100 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.50