A sideways trend emerged in this currency pair after the GBP/CAD descended into its support zone. Weak economic data out of Canada has countered the positive impact of a commodity rally inspired by tensions in the Middle East. The Canadian Ivey PMI plunged to near the 50.0 level, barely avoiding a contraction in the sector. UK economic data has been soft, but with signs of a labor market recovery in its early phase, it paints a more optimistic long-term scenario. The bullish momentum recovery in this currency pair is likely to force more upside.

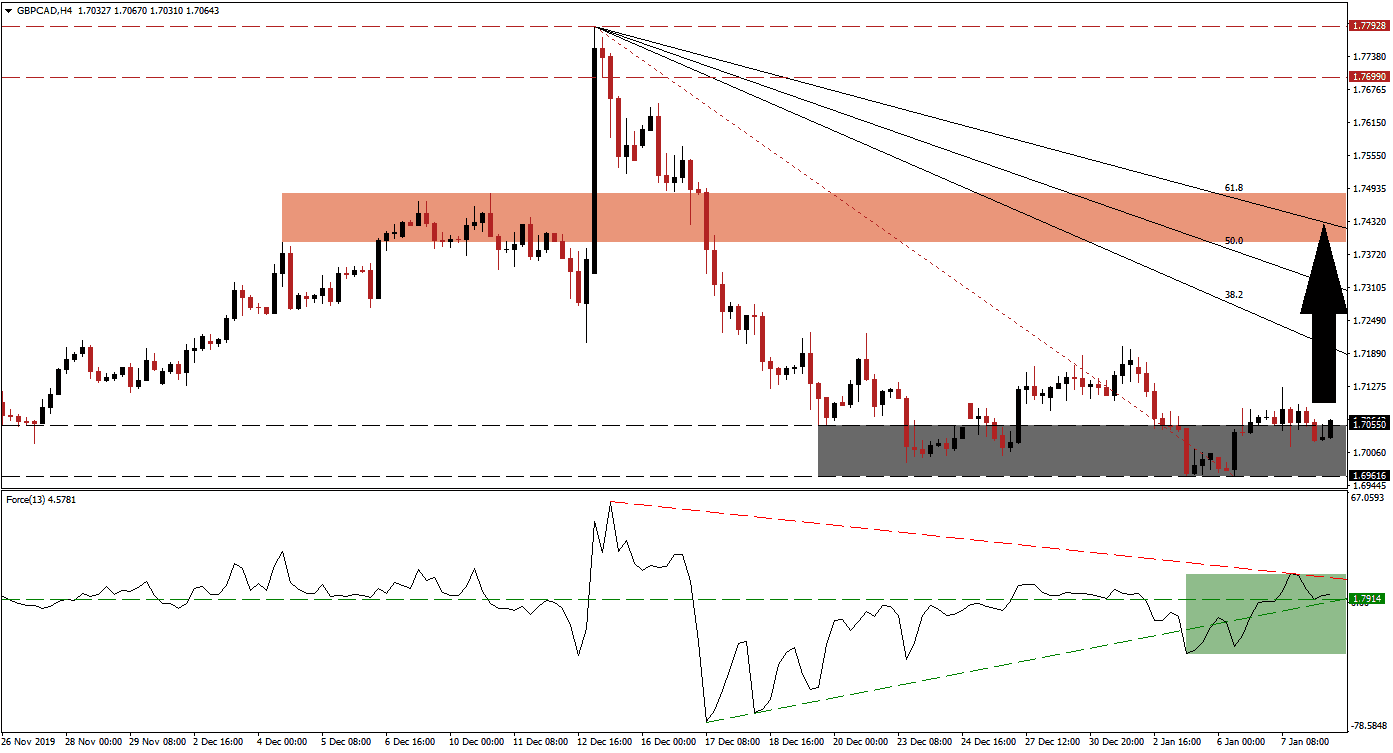

The Force Index, a next-generation technical indicator, points towards a bullish momentum recovery with more potential to extend farther to the upside. The Force Index converted its horizontal resistance level into support, assisted by its ascending support level. After this technical indicator advanced to a multi-week high, a minor pullback followed, and a descending resistance level formed, as marked by the green rectangle. A breakout above the 0 center-line placed bulls in charge of the GBP/CAD. You can learn more about the Force Index here.

Another bullish development concluded with the move by this currency pair above its Fibonacci Retracement Fan trendline. This materialized inside the support zone located between 1.69616 and 1.70550, as marked by the grey rectangle. A short-covering rally is anticipated to follow, which will close the gap between the GBP/CAD and its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders are recommended to monitor the intra-day high of 1.72010, the peak of a previous breakout. Should price action eclipse this level, more net buy orders are expected.

Uncertainty over the Brexit transition period is favored to keep volatility across British Pound currency pairs elevated, but a long-term bullish bias remains dominant. Given the current fundamental conditions, the GBP/CAD should be able to challenge its short-term resistance zone located between 1.73941 and 1.74846, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is enforcing this zone, and a breakout would require a fresh catalyst. You can learn more about a breakout here.

GBP/CAD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.70600

Take Profit @ 1.74200

Stop Loss @ 1.69500

Upside Potential: 360 pips

Downside Risk: 110 pips

Risk/Reward Ratio: 3.27

In the event of a reversal in the Force Index, initiated by its descending resistance level, the GBP/CAD may be pressured into a breakdown. Any move to the downside from current levels should be considered an excellent buying opportunity, as the long-term outlook is increasingly bullish. The next support zone awaits this currency pair between 1.67182 and 1.68175.

GBP/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.69150

Take Profit @ 1.67700

Stop Loss @ 1.69750

Downside Potential: 145 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 2.42