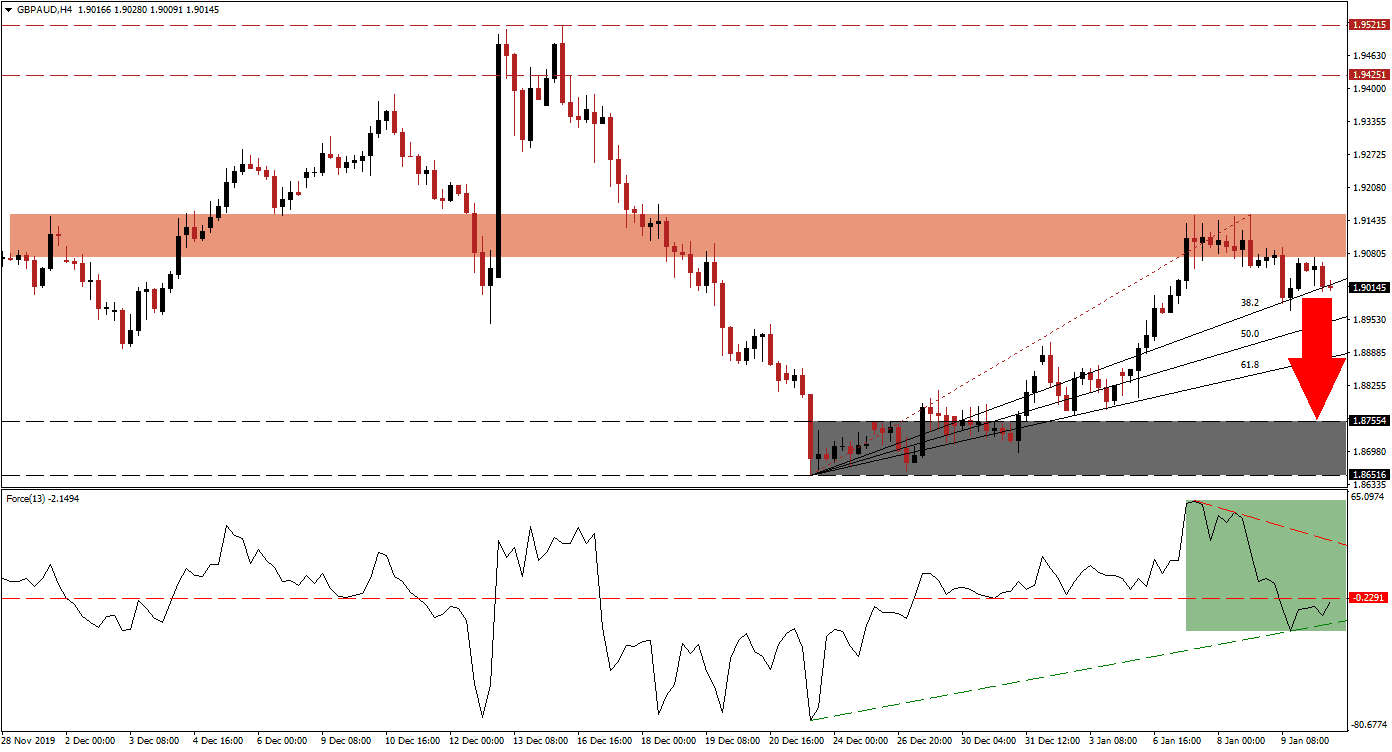

Economic data out of Australia this morning showed the service sector entering a recession while retail sales surprised to the upside. This combination sufficed to increase demand for the Australian Dollar and pushed the GBP/AUD below its ascending 38.2 Fibonacci Retracement Fan Support Level. Price action was rejected by its short-term resistance zone, leading to a collapse in bullish momentum. This currency pair is now vulnerable to a profit-taking sell-off.

The Force Index, a next-generation technical indicator, reversed from a fresh high, and a second extension attempt led to a marginally lower high. The contraction converted its horizontal support level into resistance, where the Force Index remains. While it was able to stabilize, leading to the formation of an ascending support level, a new push to the downside is favored. This technical indicator is also located in negative conditions, with bears in control of the GBP/AUD. You can learn more about the Force Index here.

This currency pair failed to keep its bullish recovery intact, as the short-term resistance zone rejected more upside. This zone is located between 1.90722 and 1.91558, as marked by the red rectangle. The redrawn ascending Fibonacci Retracement Fan sequence is approaching the bottom range of it, which adds significance to the breakdown in the GBP/AUD below its 38.2 Fibonacci Retracement Fan Support Level. Volatility may increase, as this currency pair is exposed to bullish and bearish forces, at a key support/resistance area.

Forex traders are advised to monitor the intra-day low of 1.89696, the low of the breakdown in price action below its short-term resistance zone. A move below this level is anticipated to attract fresh net sell orders in the GBP/AUD. This should provide the necessary downside momentum to complete the breakdown sequence below its Fibonacci Retracement Fan. It will additionally clear the path for this currency pair to challenge the strength of its support zone located between 1.86516 and 1.87554, as marked by the grey rectangle.

GBP/AUD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.90150

Take Profit @ 1.87550

Stop Loss @ 1.91000

Downside Potential: 260 pips

Upside Risk: 85 pips

Risk/Reward Ratio: 3.06

A breakout in the Force Index above its descending resistance level is expected to lead the GBP/AUD into a breakout attempt of its own. This would invalidate the profit-taking scenario, and allow price action to attempt to regain its post-election peak recorded in December. The next long-term resistance zone awaits price action between 1.94251 and 1.95215, from where more upside would require a major fundamental catalyst.

GBP/AUD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.92150

Take Profit @ 1.94250

Stop Loss @ 1.91400

Upside Potential: 210 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 2.80