The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases, it will be trading the trend. In other cases, it will be trading support and resistance levels during more ranging markets.

Big Picture 26th January 2020

In my previous piece last week, I forecasted that the best trades were likely to be long of the S&P 500 Index in USD terms and long of the currency pair USD/JPY. The S&P 500 Index fell by 0.63% and the USD/JPY currency pair fell by 0.80% so these trades produced an averaged loss of 0.72%.

Last week’s Forex market saw the strongest rise in the relative value of the Japanese Yen, and the strongest fall in the relative value of the Australian Dollar.

Fundamental Analysis & Market Sentiment

Fundamental analysts are leaning in favor of a weaker USD as the Federal Reserve is set on a course of inflating its balance sheet, and as there is little prospect of a rate increase in the foreseeable future.

The U.S. economy is still growing, and fears of a pending recession have receded. Sentiment has been aided by the completion of a “Phase One” U.S. / China trade deal. There are solid reasons to be bullish on stock markets generally, especially the U.S. stock market.

However, market sentiment had moved by the end of the week into “risk off” territory, caused mainly by fears of the Chinese coronavirus outbreak which may become a major epidemic causing serious human and economic damage, although this is still unclear.

The flight into safety has seen money flow into Gold and the Japanese Yen as safe havens, but interestingly, not the Euro.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows last week printed a small and inconclusive doji candlestick. The close is in an area of possible resistance. It was also below its levels from both 6 and 3 months ago, which indicates a bearish trend. Therefore, there is some evidence that we are likely to see a downwards move in the UI.S. Dollar Index next.

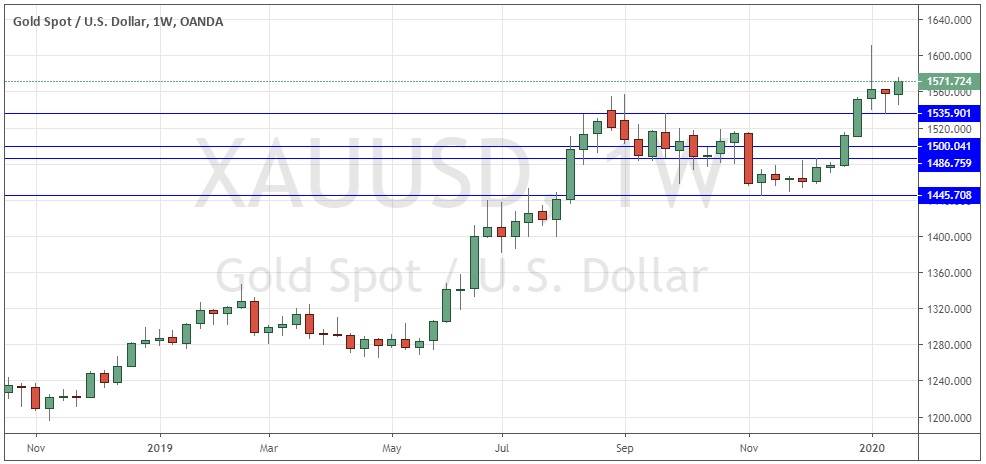

GOLD/USD

Gold in USD terms just made its highest weekly close in more than six and a half years. The weekly candlestick was not especially large but was a bullish engulfing candlestick which closed very near to the top of its price range, which is a bullish sign. I would like to see a daily close above $1575 confirming a bullish breakout beyond the minor resistance leading up to the price before entering a new long trade.

Conclusion

This week I forecast the best trade is likely to be long of Gold in USD terms following a daily (New York) close above $1575.