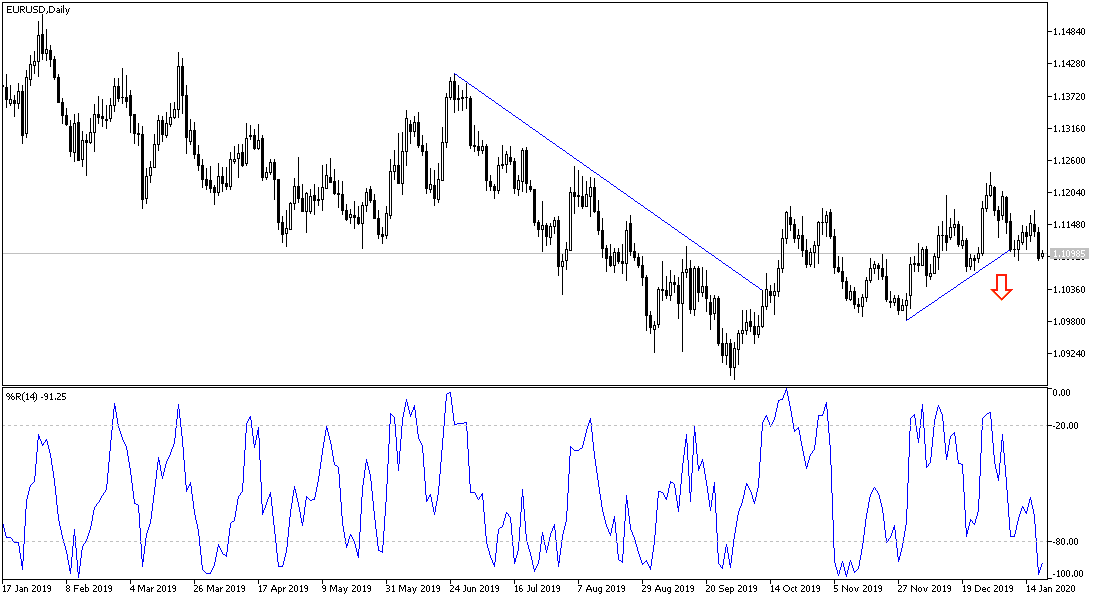

The EUR/USD attempts for a bullish correction during last week's trading did not achieve gains above the 1.1172 level, and with the European currency not getting more catalysts to achieve more during the Friday trading session, the pair returned the 1.1086 support, ending all previous gains. Bears are back to take over the pair's performance. We have permanently noted in the technical analyses of the pair, that gains are still under the threat of weak Eurozone economic performance, and we pointed that the best trading strategy would be selling the pair from each upper level.

On the economic level. The pair did not benefit much from the recent optimism after the formal signing of the Phase 1 commercial agreement between the United States and China. This is with renewed fears of a shift in the US tariff compass towards the European Union, with the growing dispute between France and the US administration over Macron's intention to impose taxes on major American companies. In this context, French Finance Minister Bruno Le Meyer said on Friday that the European Union would respond to any US retaliation against the digital services tax imposed by President Emmanuel Macro, which entered into force in the beginning of January, and mainly targets American companies, in order to fight American hegemony on Internet technology.

At the same time. The US Treasury has been preparing to respond to France, and the two sides have been holding fruitless talks for nearly two years, aimed at resolving a US complaint about unbalanced and protective tariffs in the European Union in the area of agriculture - as much of the US agricultural industry has experienced difficulty accessing the European Union market.

The inflation data from the Eurozone did not provide any updates. This week, the Euro will be on an important date with the European Central Bank's monetary policy meeting, as markets await any new signals from Christine Lagarde.

From the United States, the results of the economic releases were better than expected, which supported the US dollar recent gains, because compared to other global economies, it is still the best. It weakened expectations of a possible rate cut by the Federal Reserve soon.

The opinion of analysts and investors is divided on the outlook for the two economies - the US and the European - and interest rates, which may all be harmed, or otherwise negatively affected, due to commercial skirmishes between the United States and the European Union. Uncertainties related to the US election and its potential effects on Trump's economic and foreign policy may erode the dollar’s gains this year, but some doubt that the single European currency will sustain its gains for a very long time, due to what the emerging currency of the European Central Bank may mean.

According to the technical analysis of the pair: the EUR/USD pair is poised for more weakness, and will strengthen the downtrend strongly if it moves towards the 1.1000 support. The pair may move in a narrow range today with an American holiday to celebrate Martin Luther King