For five consecutive trading sessions, the price of the EUR/USD pair is trying hard to strengthen the opportunity for an upward correction and break through the 1.1200 psychological resistance, but the pair gains did not exceed the 1.1163 level, despite the announcement of many important economic data and influential events, before settling around 1.1145 at the time of writing. The European currency does not appear affected by the weak European economy yesterday. The worst performance of the German economy since 2013 was announced, and as is well known, Germany’s economy is driving the entire continent’s economy, not just the bloc. The Euro will not have the catalyst to do more unless pessimism about the state of the German economy is removed.

Yesterday, financial markets, including the forex market, were on a very important date, as the two largest two economies in the world - the United States of America and China - announced the formal signing of the Phase 1 trade agreement, which stipulates a halt to the tariff war between them, which led the global economy into recession. Although the agreement did not end all tariffs imposed by the two sides during the 18 months of the global trade war, the markets welcomed the move amid cautious anticipation of the extent of commitment by the two parties to the contents of the terms of the agreement.

We noted yesterday that the details of the agreement will be more important than signing it, because it will clarify the next steps for the path of negotiations between the two sides. Markets have not achieved stronger gains, as it was reported that the remaining tariffs may continue until after the US elections in November 2020. The United States has indicated that even after the deal is announced, the accessory that shows the quantities of goods that China has agreed to purchase will remain confidential. Some US officials denied that there were other secret deals. China has agreed to increase purchases of US services, manufactured products, energy and agricultural products by 200 billion dollars this year and next. This arrangement means that China is supposed to buy $40 billion annually from US agricultural exports.

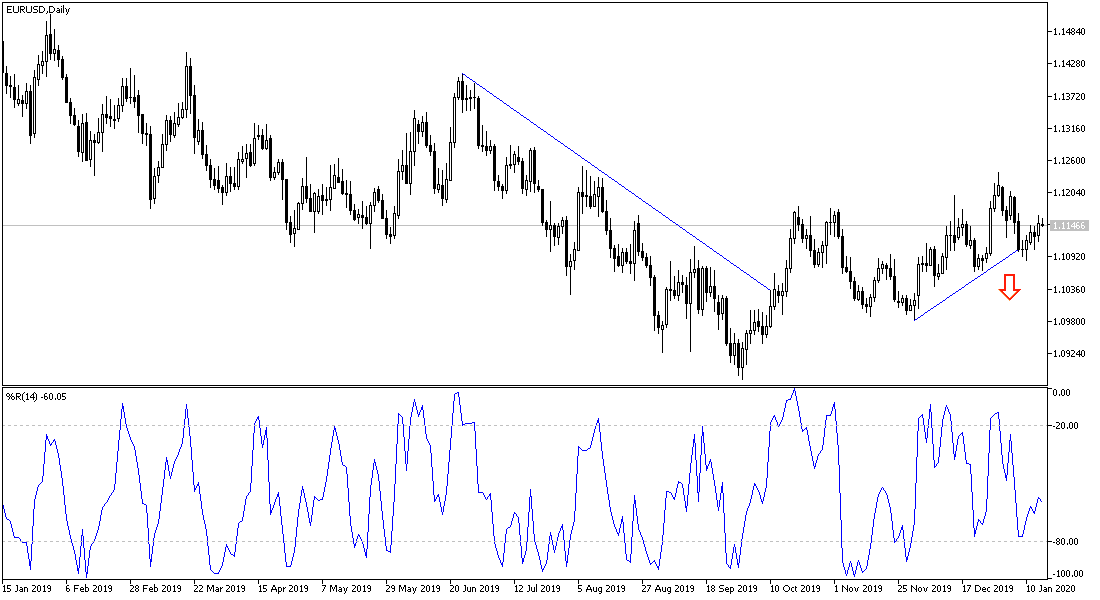

According to the technical analysis of the pair: The EUR/USD pair is currently neutral and still lacks stronger incentives to penetrate the 1.1200 psychological resistance to confirm the strength of the bullish correction, because that resistance may increase purchases to push the pair to stronger resistance areas at 1.1245 and 1.1330 Respectively. On the downside, the 1.1000 support is still key to the bears regaining control. I still prefer selling pair from every bullish level.

As for the economic calendar data: The Euro will react to the announcement of the German consumer price index, the minutes of the European Central Bank monetary policy meeting and the statements of the bank governor, Christine Lagarde, at a later time. From the U.S, the retail sales figures, the Philadelphia industrial index and unemployed claims data will be announced.