The crucial day for financial markets is the date for signing the initial trade agreement between the United States of America and China. A state of anticipation and cautious waiting takes over the performance until the details of that deal are announced and the future of the coming stages to end the tariff war between the two largest economies in the world, which contributed to slowing global economic growth, which very close to stagnation if this conflict continues. This optimism helped the EUR/USD pair to correct upward towards the 1.1146 level, but the rebound was not strong, as the single European currency is still facing pressure from the weak economic performance of the Euroarea. The pair did not benefit much from the disappointing results of the US jobs numbers by the end of 2019, nor the announcement of weak US inflation levels.

Although losses to US inflation may be limited, because price pressures are believed to be sufficient to prevent the Federal Reserve from cutting interest rates again soon.

US consumer prices rose 0.2% in December, according to the Labor Department's statistics office, and markets were expecting a 0.3% increase. The loss was sufficient to fluctuate the US dollar performance, although the annual inflation rate is still above 2.1% to 2.3%, in line with expectations. In contrast, core inflation - which excludes more volatile food and energy elements- increased by 0.1%, below expectations for 0.2%, although the annual rate remains steady at 2.3%. Core prices are seen as a more reliable measure of inflation trends.

The numbers indicate that inflation pressures in the US are not quite strong as markets had expected, and with both indicators remaining comfortably above the 2% target, they are not bad enough to make the Fed think of new interest rate cuts, even if the central bank itself prefers to take the cues from the personal consumption expenditures price index last seen at just 1.6% in November.

In a special ceremony held at the White House today, US President Trump will sign with Chinese officials the Phase 1 agreement, which halts the pace of increasing tariffs on the goods of the two countries, and recommends reducing what already exists, and will not be completely removed in this agreement, but with the rest of the coming stages. Details of the agreement and Trump's comments after the signing will have a strong reaction to the performance of the US dollar against other major currencies.

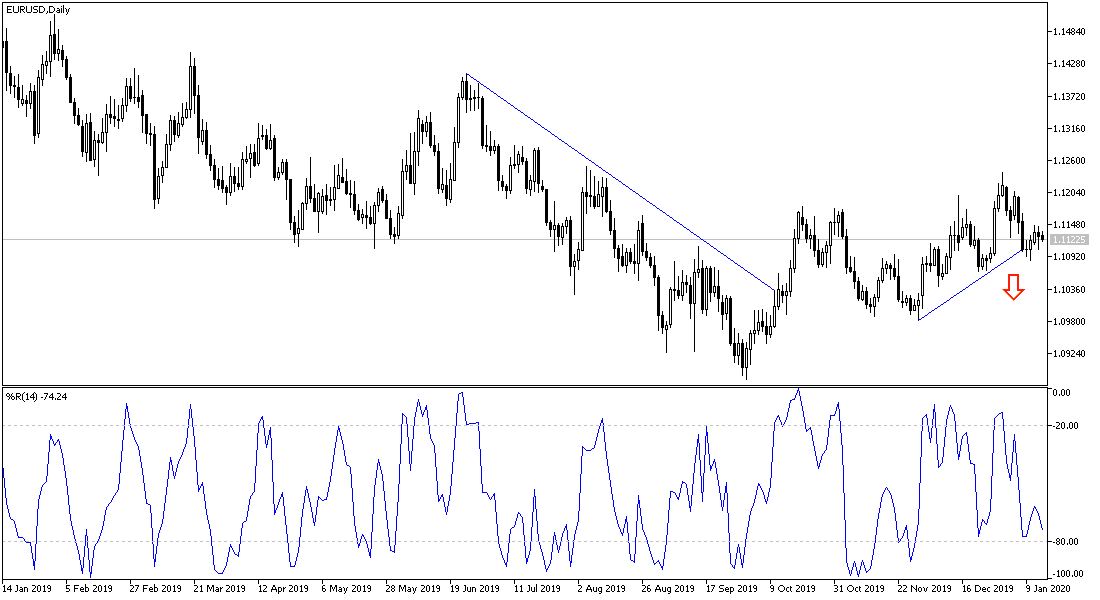

According to the technical analysis of the pair: On the daily chart of the EUR/USD pair, the general trend is reversed to an uptrend, and still needs to move towards the resistance levels 1.1200 and 1.1285, then to the 1.1400 psychological resistance, respectively. The downside risk might remain in the event that the price returns to move around and below the 1.1000 support. I still prefer to sell the pair from every upside level.

As for the economic calendar data today: The French consumer price index, industrial production and the Eurozone trade data balance will be announced. From the U.S, the Producer Price Index, the Empire State Industrial Index, and US oil stocks data will be released.