Throughout this week's trading, the EUR/USD price is moving within a downward correction that pushed the pair towards the 1.1108 support, as investors flee to buy the US dollar as a safe haven after the recent developments in the Middle East region. Fluctuations in the exchange rate of the Euro against the dollar increased over the past 24 hours, after the dollar rose sharply in response to some better-than-expected US data, and this resulted in a drop of EUR/USD by half a percent. Meanwhile, news of Iranian retaliation against the United States in the Middle East - with an attack on a US bases in Iraq - was met with little reaction in the Forex markets except for gold and crude oil.

The US ISM Services Purchasing Managers' Index rose 1.1 points to 55.0 in December, better than expectations for a reading of 54.5. The ADP survey of the change in the number of non-agricultural jobs in the United States showed an increase by more than expected, as American companies succeeded in creating 202,000 new jobs, while expectations were for the addition of 160,000 jobs, after a previous weakness of only 67,000 jobs in November 2019.

In contrast. Eurozone data still point to stability after weak performance in 2019. Expectations for recovery in economic growth may provide better support for the Euro in 2020, and these expectations may be a driver for the continued recovery of the Euro/US dollar exchange rate from its lowest levels in October 2019. Euro expectations also improved after Eurostat data showed that inflation in the bloc hit a nine-month high in December, consumers increased spending in shops in November, and Eurozone inflation rose from 1% to 1.3% in December, its highest level Since April 2019, due to price gains in basic commodities, while core inflation remained unchanged at its highest level after the crisis of 1.3% last month.

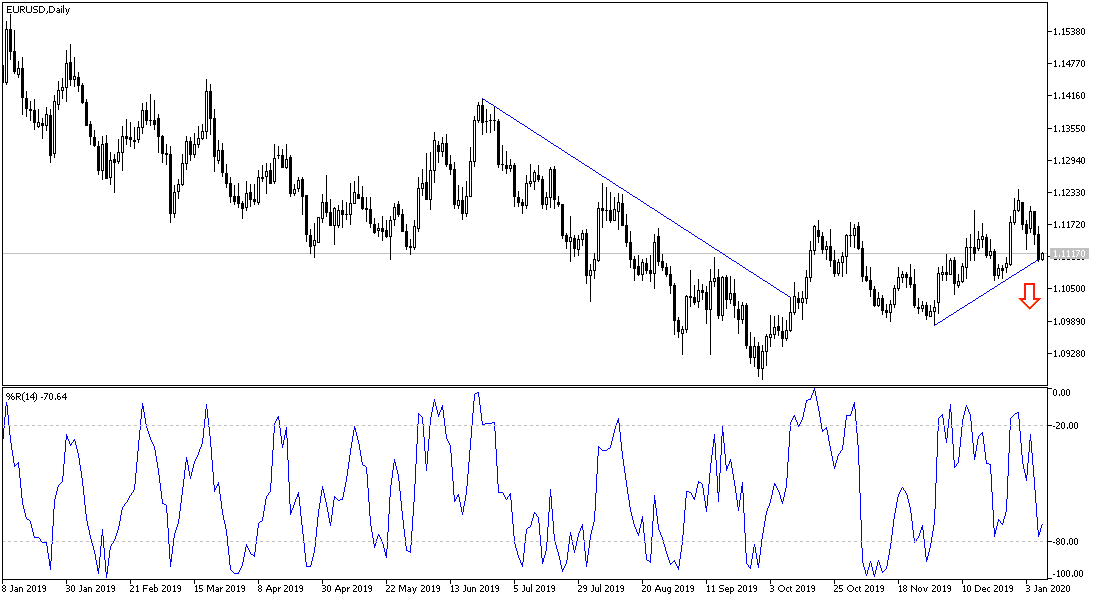

According to the technical analysis of the pair: On the daily chart of the EUR/USD pair, the general trend is getting stronger towards the downside, and breaking the 1.1100 support will increase the selling operations and push the pair towards stronger support areas at 1.1055 and 1.0980 respectively. There will be no chance for an upward correction without moving steadily above the 1.1200 resistance. The performance may remain relatively stable until the important US job figures are released tomorrow, Friday.

As for the economic calendar data today: From the Eurozone, German industrial production and trade balance will be announced, as well as the unemployment rate for the Eurozone. And from the US, weekly unemployed claims will be released.