Although the announcement of inflation figures from the Eurozone does not bring about a major change in the performance of the European currency, as inflation is still far from the European Central Bank’s Goal, it usually witnesses rapid volatility, and any upward trend will be positive for the Euro. Prior to that, the EUR/USD price is trying to stabilize above the 1.1200 resistance of, in order to have a stronger opportunity to bounce higher, and is currently stable around 1.1188 at the time of writing. The Euro gains were stalled amid renewed tensions in the Middle East. Usually the US dollar benefits from the escalation of geopolitical tensions between the United States and Iran, and 2020 may be a new start for the US dollar, which may rise by almost 4%, partly as a result of the market's desire to obtain safe haven assets.

Global stock markets and commodities witnessed a decline after the United States assassinated Iranian military commander Qassem Soleimani, which sparked a rapid increase in tensions in the Middle East. Global financial markets continue to suffer from mistrust, as Iran has vowed to avenge his death, while US President Donald Trump has stated that the United States is ready to strike 52 Iranian targets in response to any Iranian retaliation.

Therefore, the factors of escalating geopolitical tensions remain. Foreign exchange markets are currently waiting and waiting for the next moves by the United States and Iran. Safe haven demand remains a major driver for both currency and bond markets, and therefore the dollar, which is a safe haven due to its large size, would be the biggest beneficiary in the event of escalating tensions between Iran and the United States.

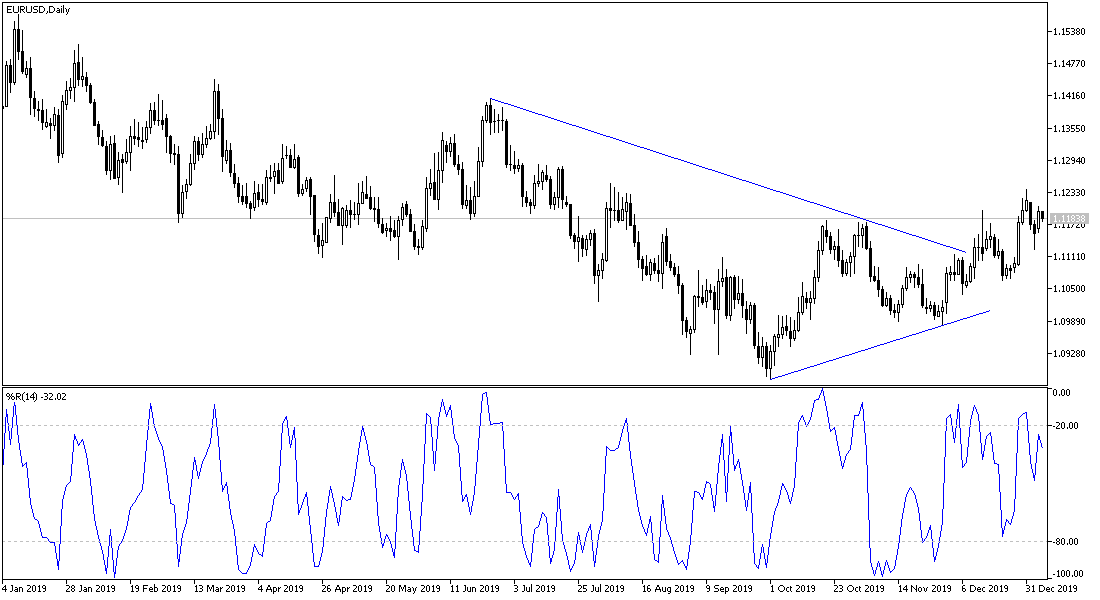

According to the technical analysis of the pair: the general trend of the EUR/USD pair is currently in a neutral position in the near term. Moving above the 1.1200 resistance gives it a new opportunity to reverse the trend in the long term which is still bearish, as is clear on the daily chart. Bulls are expected to head towards the peaks 1.1275 and 1.1330 to emphasize controlling performance. On the downside, any movement of the pair below the 1.1100 support collapses the upside aspirations.

For the economic calendar data: From the Eurozone, the consumer price index and retail sales will be announced. From the United States of America, the Trade Balance and ISM Services PMI will be announced, and American Factory Orders will be released.