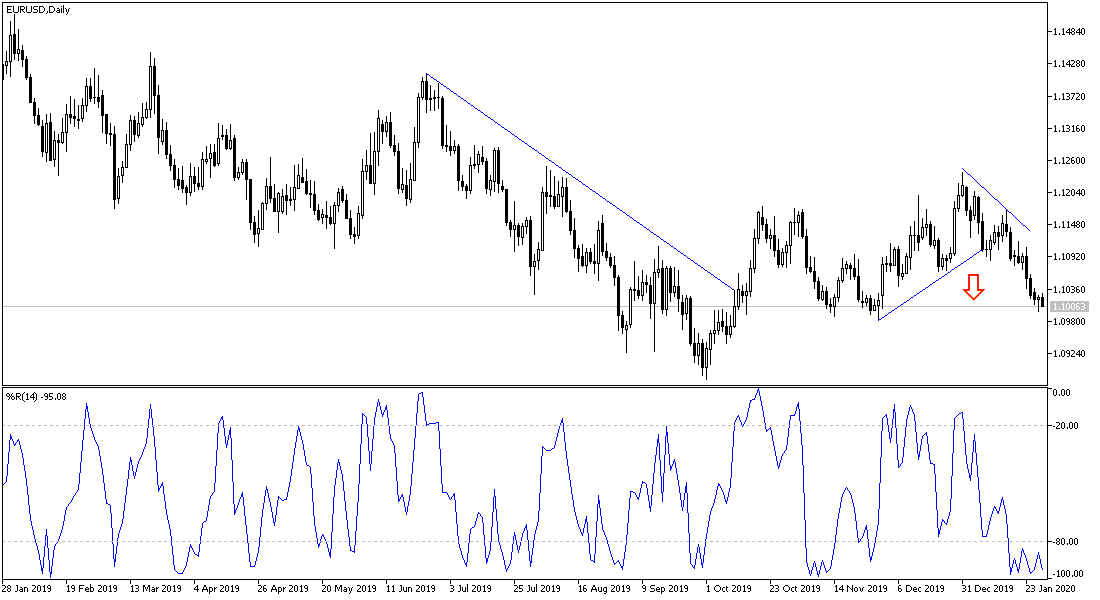

For the second consecutive day, the EUR/USD pair failed to exceed the 1.0992 support, its lowest level in nearly two months. The pair reached strong overbought levels, but the Euro did not find the sufficient momentum to exploit that, and remained under downward pressure. After announcing the Fed policy, the pair attempted to bounce higher, but its gains did not exceed 1.1027.

As expected. The Federal Reserve Board announced its decision to keep interest rates unchanged after the two-day monetary policy meeting ended yesterday. The bank said that it decided to maintain the target range for the price of the federal funds by 1-1/2 to 1-3/4 percent, while keeping interest rates unchanged for the second consecutive meeting after three consecutive quarter point cuts a time .

The policy statement accompanying the decision did not change significantly from last month, as the Federal Reserve indicated recent data suggesting that the labor market is still strong, and that economic activity has increased at a moderate rate. The central bank described household spending as rising "at a moderate pace" compared to last month's description of spending as rising "at a strong pace." The Federal Reserve also stressed that fixed investment and trade exports remain weak, and that the annual inflation rate is still below its 2 percent target.

Prior to the bank’s decision, the results of a survey conducted by the market research group GfK showed that German consumer confidence will improve in February amid additional improvement in economy and income expectations, and private consumption is expected to grow by 1 percent in 2020. The GfK survey of consumer confidence index for the month of February rose to 9.9 points from 9.7 in January, which was revised from 9.6. Economists had expected the result to remain unchanged at 9.6.

The most recent consumer climate study was conducted at GfK between January 8 and 20 among about 2,000 consumers.

"The first settlement of the trade dispute between the United States and China facilitates things in Germany as well, because Germany is an export country, and it depends on the free and unimpeded exchange of goods in this country”. Said consumer expert at GfK, Rolf Bürkl. "The positive start to the consumer climate in 2020 confirms our assessment that private consumption will remain an important pillar of the German economy this year," he added.

According to the technical analysis of the pair: The general trend of the EUR/USD pair remains bearish, and stability below the 1.1000 support will continue to support the bear's control over performance for a long time. The pair's arrival in oversold areas, according to all technical indicators, did not provide the pair with the opportunity to correct, because the single European currency still lacks incentives to exploit the situation. The European economy is still suffering, after a temporary halt to the global trade war, the Corona virus came to end hopes again. The closest support levels for the pair are currently at 1.0965 and 1.0880, respectively. As we expected before, we confirm now that there will be no chance for the pair to correct higher without crossing the 1.1200 psychological resistance barrier.

As for the economic calendar data: From the Eurozone, the Germany unemployment rate and inflation will be announced, in addition to the unemployment rate in the whole bloc. From the United States, the GDP growth rate and jobless claims will be announced.