The frequency of losses for the EUR/USD stopped at the 1.1000 psychological support and did not exceed 1.0997, before settling around the 1.1020 level at the time of writing, in a temporary halt to the decline path before the US Federal Reserve announces its monetary policy decisions, as well as the important and influential statements by the governor Jerome Powell. Expectations strongly indicate that the bank will not change interest rates, but the anticipation will be for the content of the monetary policy statement that follows the decision, along with the reaction to Jerome Powell's statements at his press conference in order to get features of the bank's policy in the coming months, leading up to the presidential elections in the United States. The bank still has great confidence in the country's economic performance, and sees its policy well suited to this situation.

As for the Corona virus that rocked the financial markets recently, and gave the dollar more gains as a safe haven, it continued to spread rapidly in China, and yesterday the German Ministry of Health confirmed the transmission of the virus to one person "It has arrived in Germany. It has been isolated, the patient is receiving special medical care and is in good condition now ... The risk of the virus spreading in Germany remains low," a ministry spokesman said in a statement. At the same time, France announced 3 separate cases of infection at the end of the week. All three patients in France had recently traveled from China.

The Corona virus will push the world's second largest economy into a temporary recession, and given its strong trade relationship with Europe, it is unlikely that Germany and other continental economies will emerge without any harm from any other Chinese economic problems. The manufacturing sector in Germany - the largest economy in Europe - was hit by deflation last year even though Europe was not directly involved in the trade war between the United States and China.

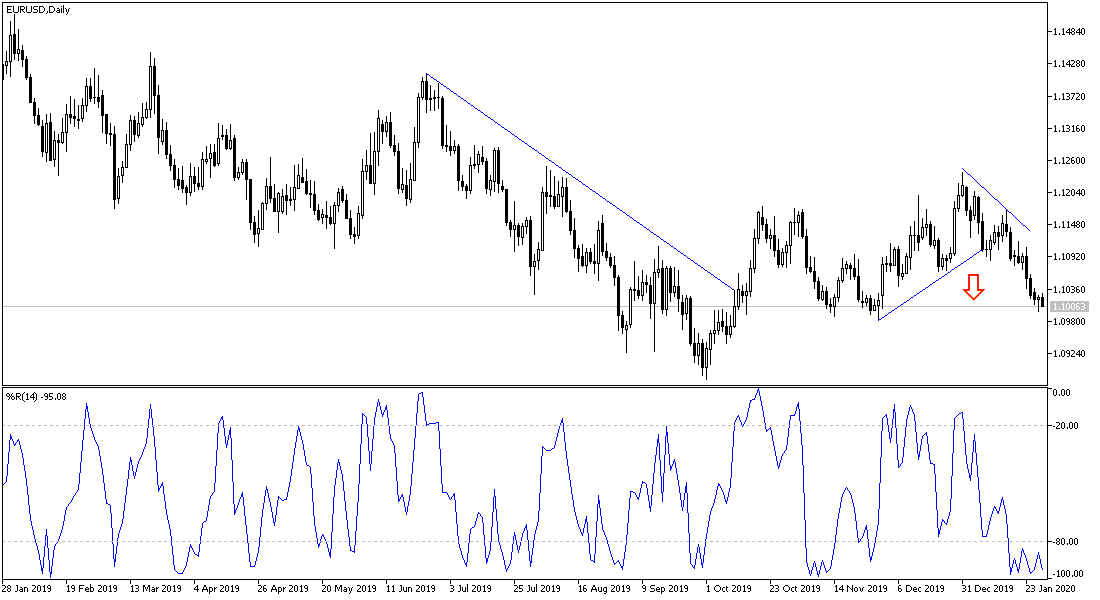

According to the technical analysis of the pair: The EUR/USD price path remains bearish, and stability around and below the 1.1000 psychological level will continue to support the bear's control over the performance. There will be no chance for the pair to correct higher without crossing the 1.1200 resistance barrier again. I still prefer to sell the pair from every upside level. The variation in economic performance and monetary policy between the euro area and the United States of America still favors the USD strength.

As for the economic calendar data: From Germany, the GFK consumer climate index will be announced along with the import price index. After that, the most important data during the American session today will be the announcement of Pending Houses Sales numbers, then the Federal Reserve monitory policy decisions and the press conference of Governor Jerome Powell.