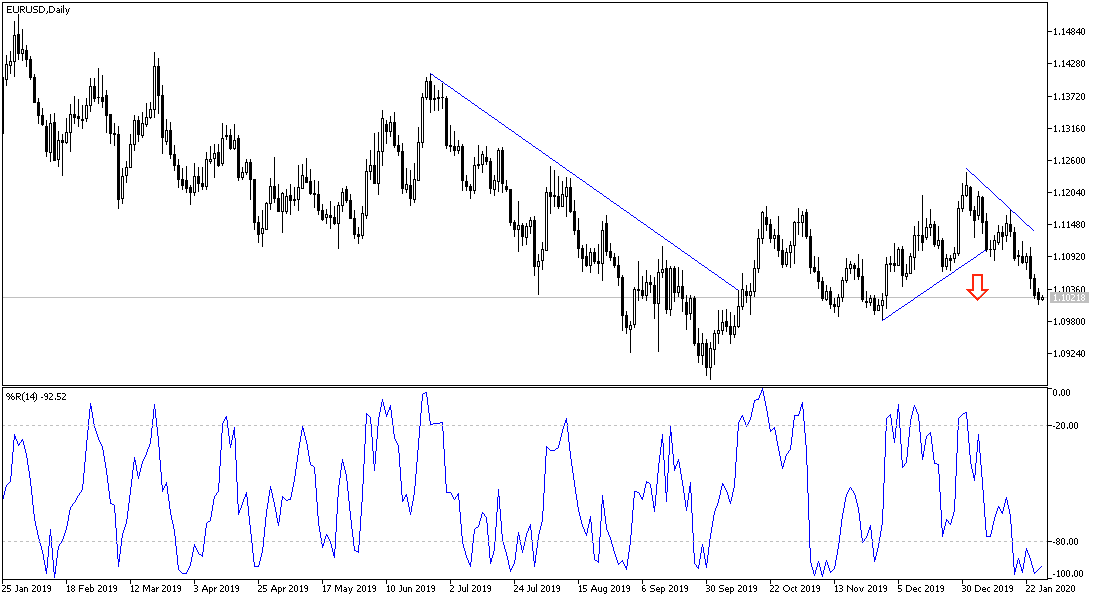

The strength of the US dollar, as investors took it as a safe haven in light of fears of a virus epidemic, along with a lower-than-expected reading of the German business climate IFO index, put pressure on the EUR/USD pair to retreat to the 1.1009 support, its lowest level in nearly a month. A break of the 1.1000 psychological support will increase the bear's control of the trend, and up to the moment there are no strong indications that the bullish correction is close.

The IFO German Business Climate index reading was at 95.9 in January, which is disappointment against expectations for a reading of 97.0. In fact, this indicates that sentiment declined between December and January as the previous month's reading was higher at 96.3. Markets expect an improvement in German economic performance in 2020 following the conclusion of the Phase 1 trade deal between China and the United States, which created months of concern about the future of global trade. “A cold shower for all optimists,” said Karsten Brzezsky, chief economist at ING Germany. Germany's most prominent leading indicator, the Ifo index, started the new year with disappointment, as it fell for the first time since August of last year.

The reading of the current assessment component of the survey at 99.1 is slightly worse than the expected 99.2 by the markets, but it is nevertheless the strongest improvement in this component since February 2017. The business expectations component reading came at 92.9, which fell from 93.9 for the previous month, and worse than the 95.0 expected by the markets.

On the American side. New US home sales fell 0.4% in December, and dropped slightly after higher mortgage rates supported strong gains for 2019. The US Department of Commerce announced that new homes were sold at an annual rate of 694,000 homes last month. But for 2019, sales increased 10.3% to 681,000, the highest total sales since 2007 when 776,000 new homes were sold as the housing bubble started to contract before the Great Recession.

According to the technical analysis of the pair: On the daily chart, the price of the EUR/USD pair is still in the range of a descending channel, and this reversal will be strengthened if the pair penetrates below the 1.1000 psychological support. The closest support levels currently for the pair are 1.0985 and 1.0880, and there will be no control of the bulls on performance without moving above the 1.1200 resistance, which it tested at the beginning of January 2020. The pair still lacks catalysts to reverse the current downward outlook. The economic performance of the Eurozone is still weak, and the European Central Bank is sticking to its policy, contrary to the desire of the markets to announce more stimulus plans.

As for the economic calendar data today: The Spanish unemployment rate will be announced first, and from the United States of America, durable goods orders and the US consumer confidence index data will be released.