Despite the improvement in the reading of the ZEW index of German economic sentiment to the highest level since 2015, the EUR/USD pair still suffers from weak bullish correction, with the continued strength of the US dollar, and the loss of confidence towards the economic performance of the Eurozone, and at the same time, the state of waiting and anticipation until the European Central Bank announces its monetary policy on Thursday. The pair's gains did not exceed the 1.1118 level and is stable at 1.1090 level at the time of writing.

The German ZEW Institute has reported that analysts have become more optimistic in their assessment of their current economic situation, as well as the outlook, in January 2020, before announcing identical improvements to the Eurozone. The ZEW Economic Outlook rose 16 points to a reading of 26.7 this month, the highest reading for the index since July 2015. The current situation index in Germany rose 10.4 points to -9.5. For the Eurozone, the ZEW index rose 14.4 points to 25.6 while the current economic situation index rose 4.8 points to -9.9.

The ZEW survey comes a few days after the official signing of the Phase 1 agreement between the United States and China, which halts, even temporarily, the tariff war between the two largest economies in the world, which was a major reason for the weakness of the Eurozone economy in 2018 and 2019, even if its impact was felt in the German industrial power economy.

Financial markets welcomed the decision of the United States and France to discuss digital taxes for a year instead of worsening things about the new French tax.

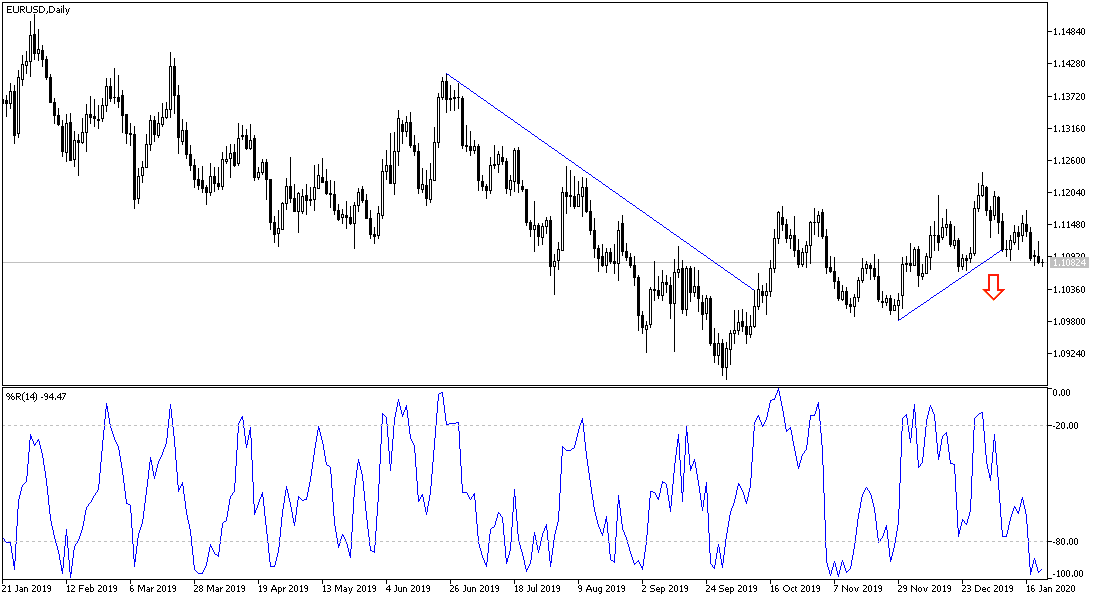

Technical analysis of the pair: The single European currency still lacks the momentum, so that the price of the EUR/USD pair can have an upward correct, and the bulls' goal is still hovering around the 1.1200 psychological resistance to pull the pair out of its bearish channel, which the pair has been in for the long run. Bears will gain strength in performance if the pair moves towards the 1.1000 support. As we mentioned before, we now confirm that the variation in economic performance and monetary policy between the Eurozone and the United States of America will continue to be a pressure factor on any gain achieved by the pair in the future.

As for the economic calendar data: There are no significant releases today from the Eurozone. From the United States, existing home sales data will be announced.