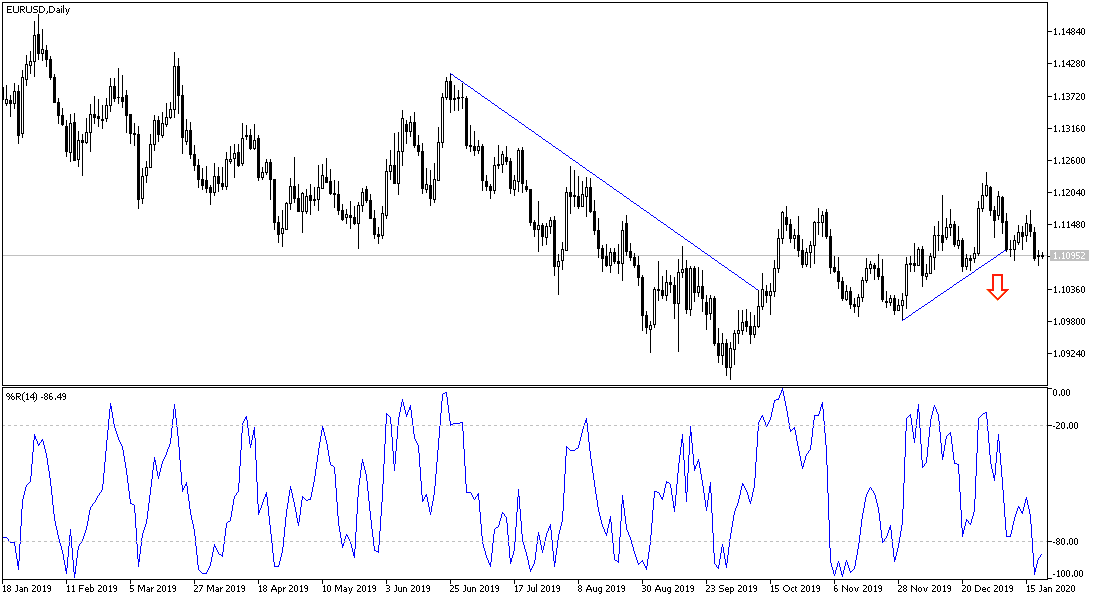

For three consecutive trading sessions, the price of the EUR/USD pair is stabilizing below the 1.1100 support, with the return of the bears dominating the performance, as the European currency losing the momentum to succeed in the recent correction attempts. The pair is stable around the 1.1090 support at the time of writing, and yesterday, it tested the1.1076 support and the trend is still leaning towards further decline unless the European Central Bank makes any surprise for the week when it updates its monetary policy this week.

The Euro fell, supported by increasing trade tensions between the United States and the European Union, amid market fears that the tariff war might turn into EU after the signing of the Phase 1 trade agreement with China. Also contributing to pressure on the pair at the end of trading last week, was the strong US retail sales results, that prompted investors to reassess the short-term outlook for the world's largest economy. At the same time, any strong talk from the European Central Bank, or bullish surprises in PMI polls this week, may be sufficient to support the single European currency rather than the current downward path.

Next Thursday at 12:45 pm, the latest interest rate decision will be issued by the European Central Bank, and although it is expected that all interest rates, and the various policy initiatives of the bank will remain unchanged, the markets will continue to closely examine the details of the statement and press conference in search of clues about the future of the bank's policy under the new administration. Christine Lagarde, the former head of the International Monetary Fund, now chairs the European Central Bank, conducting a strategic review of the bank's current policy position, which is the first item on her agenda.

This review is expected to take months and could mean that the policy event on Thursday lackes information that drives the market, which could leave investors looking to the PMI surveys on Friday, in search of evidence for the outlook of the Euro. IHS Markit's December PMI numbers were revised higher for the manufacturing and services sector in the Eurozone earlier this month, although the manufacturing sector is still mired in contraction similar to that of all global economies.

According to the technical analysis of the pair: The general trend of the EUR/USD pair is closer to more downward pressure, and the trend reversal will be strengthened if it moves towards the 1.1000 support.

As for today's economic calendar data: For the second consecutive day, there are no significant US economic releases. From the Eurozone, the German ZEW index will be announced.