The price of the EUR/USD pair is trying to correct higher for the third consecutive day, but gains are still limited and not exceeding the 1.1146 level, before settling around 1.1138 at the time of writing. The performance may remain as is until the US inflation figures are announced starting from today, in addition to the formal signing tomorrow of the Phase 1 trade agreement between the U.S and China. Optimism prevails in the global markets due to this agreement, as the two sides show a strong desire to end the tariff war between them. Details of the agreement will be important for investors to get to know the next stages and where things have arrived.

The Trump administration abandoned its designation of China as a currency manipulator before signing that agreement. The initial agreement signed between the two sides this week includes a section aimed at preventing China from manipulating its currency to gain trade advantages. The measure announced on Monday comes five months after the Trump administration described China as a manipulator of currency - the first time any country has been named as such since 1994 during the Clinton administration.

Although China has been removed from its blacklist of currencies, the Treasury has named China as one of 10 countries it says needs to be included in a watch list, meaning that its currency practices will be closely monitored. In addition to China, the countries included in that list are Germany, Ireland, Italy, Japan, South Korea, Malaysia, Singapore, Switzerland and Vietnam.

Passing the Phase 1 agreement ends a difficult two-year trade conflict between the two countries, where tariffs have been imposed on billions of dollars of products from both sides. This trade war increased uncertainty and caused companies to retreat from their investments, which slowed global growth. This negatively affected the global financial markets amid fears that the trade war might become dangerous enough to push the American economy into recession.

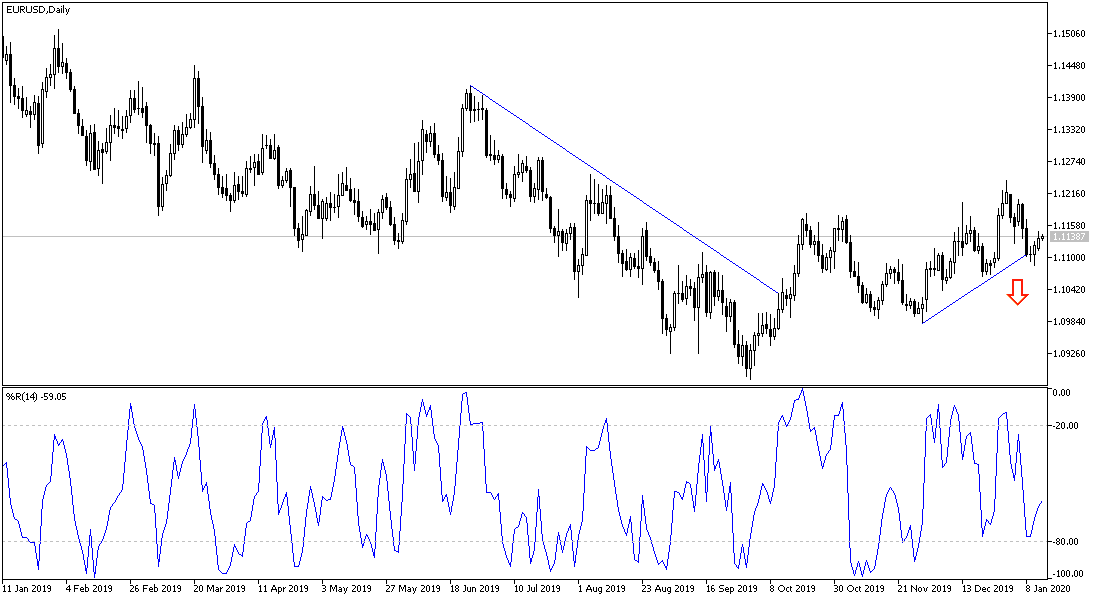

According to the technical analysis of the pair: The price of the EUR/USD still needs a momentum to confirm the trend reversal by stability above the 1.1200 resistance, which supports the bulls control over the performance to push the pair towards the resistance levels at 1.1275 and 1.1330, but at the same time, any gains for the Euro are considered opportunities to return to sell, as the economic performance of the Eurozone remains weak. On the downside, the move towards 1.1000 support will remain supportive for the bears to take over again, as is the case for the long term trend.

As for the economic calendar data: There are no significant releases from the Eurozone. From the U.S, the US CPI will be announced.