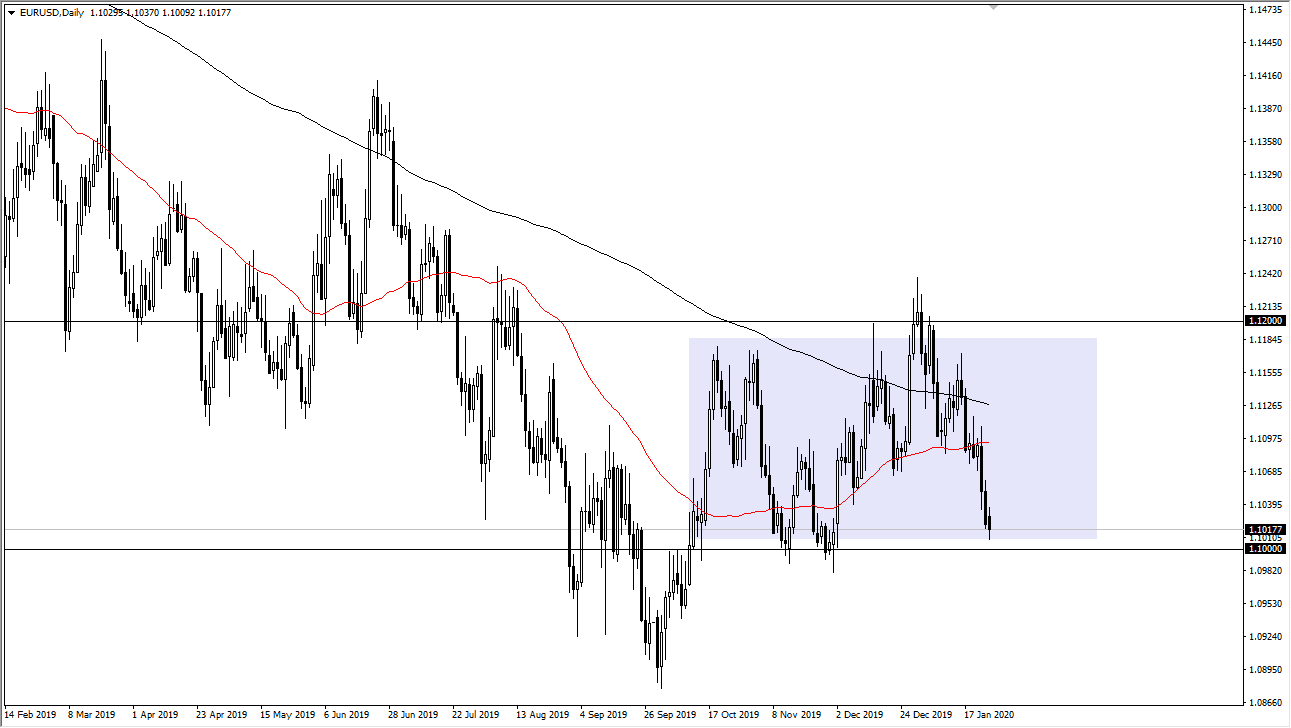

EUR/USD: Bearish

Yesterday’s signals were not triggered, as none of the key levels were reached.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered between 8am and 5pm London time today.

Short Trade Idea

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1039.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0993, 1.0966 or 1.0941.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote yesterday that I would remain at least weakly bearish provided the price could stay below 1.1039. Although the price still looked a little more likely to fall, the area around the big round number at 1.1000 could be very supportive.

This was a good call as the price has moved down by just a little over the past 24 hours but has not traded below 1.1000.

There has been absolutely no change to the technical picture so I can make exactly the same call today as I made yesterday: weakly bearish below 1.1039, but bears should want to see the price trade below 1.1000 soon or we have a greater chance of a deeper bullish retracement.

Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time. There is nothing of high importance due today regarding the EUR.