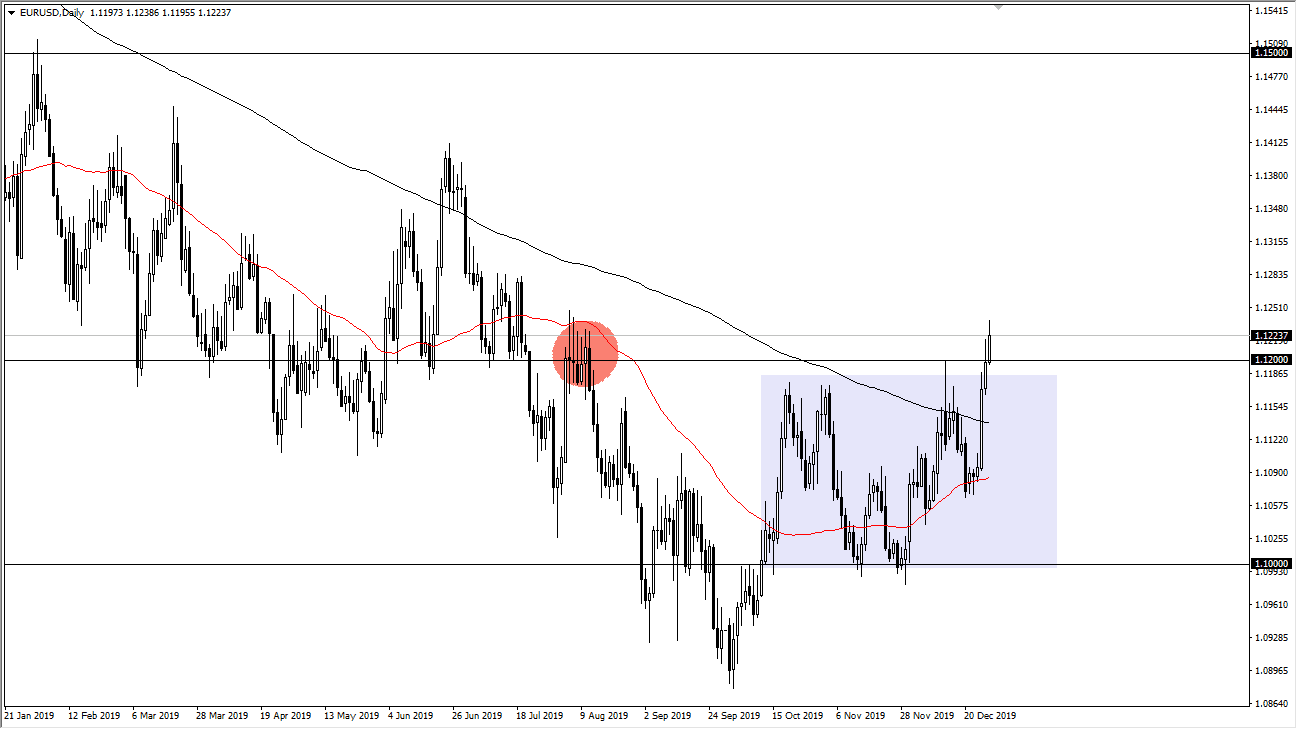

The Euro has broken higher during the trading session again on New Year’s Eve, as we are above the 1.12 handle. That of course is a bullish sign and we are now finally closing above that handle, suggesting that perhaps we are about to see some type of trend change. That being said, I think that if we can break above the highs of the Tuesday session it’s likely that we will go looking towards the 1.14 level above. We could get pullbacks, but that pullback will probably find plenty of buyers underneath, especially near the 200 day EMA. It also looks as if the 50 day EMA is trying to work its way to the upside, forming the so-called “golden cross.”

That being said, the market is likely to continue being very noisy, which is typical for this pair anyway. We know that the European Central Bank is going to continue to be very loose with monetary policy, but at the end of the day we are starting to see a lot of traders bet on the fact that the Federal Reserve may have to do the same thing going forward. After all, US economic numbers have gotten worse as of late, so people are starting to think along those lines. Beyond that, the 1.12 level has been significant resistance recently, and therefore it makes quite a bit of sense that we would see the market react accordingly.

At this point, I would anticipate a lot of noise, but it looks like the US dollar is starting to get beat up a bit by various currencies around the world, not the least of which would be the Euro, Pound, and of course the Australian dollar. At this point, I like the idea of buying dips unless of course we were to break down below the 200 day EMA, which would be very negative in general. That being said though, this is the beginning of the year so it’s going to be very difficult to handle the day-to-day gyrations until everybody comes back to work. Because of this, the first couple of days for the new year will be crucial, but in the meantime, we will probably need to take a bit of a breather and simply wait for the market to show what they are going next. We are at a crucial juncture, so keep that in mind.