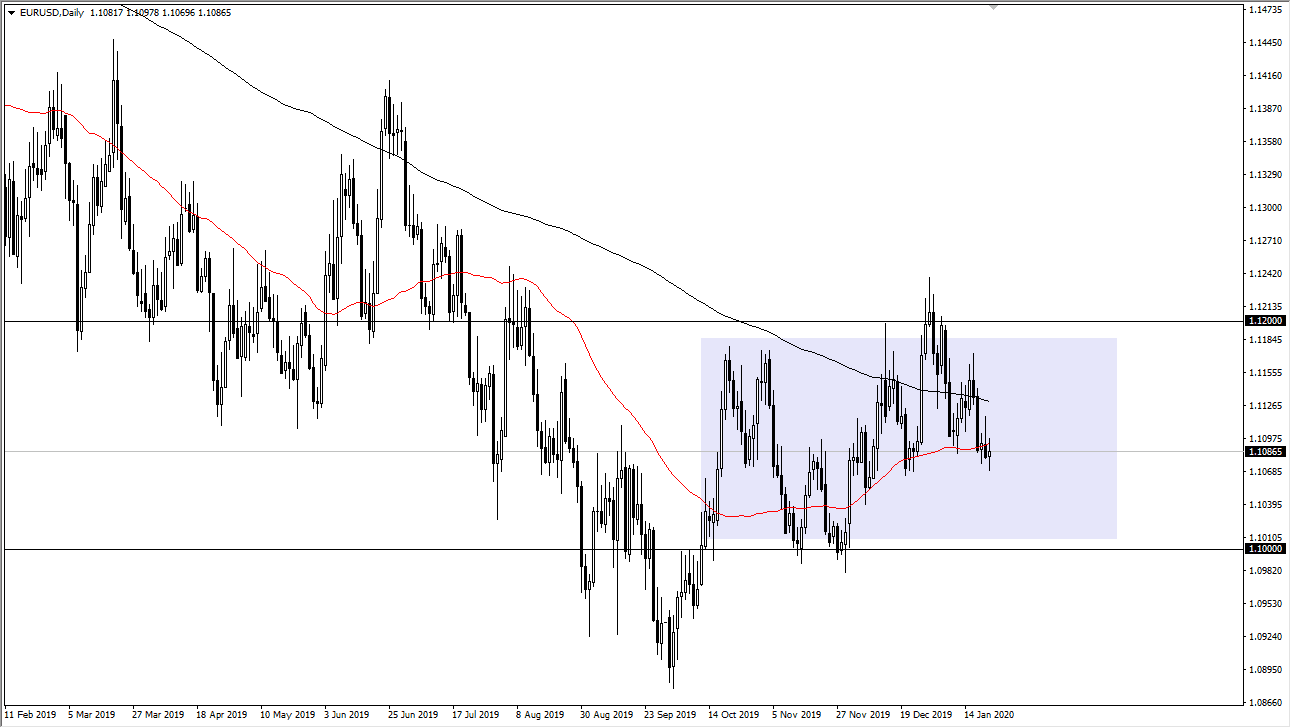

The Euro has continued to do almost nothing during the trading session on Wednesday, as we are simply going back and forth around the 50 day EMA. We are just below the 1.11 level, which is an extraordinarily important level due to the fact that it is the middle of the larger consolidation area that we have been in for some time. The bottom of this consolidation area is at the 1.10 level, just as the top is at the 1.12 handle. The fact that we are in the middle of that, roughly speaking of course, suggests that the market is at “fair value.” In other there isn’t a lot to do as the assets are not mispriced, at least in the short term.

The last three days have shown us just how lackluster the market is right now, and the reality is that the Forex markets in general have been very sluggish. This pair is probably one of the sluggish of all anyway, so if you want to see just how poor trading conditions have been, simply look at this chart. That being said, if we can break above the top of the inverted hammer that formed during the Tuesday session, we will probably go looking towards the 1.1150 level. Alternately, if we break down below the lows of the trading session on Wednesday, we probably drift towards the 1.10 level, but that could take several sessions, if not a couple of weeks.

At this point, you are probably better off trying to play the range in general, meaning that if we get a bit lower from here and reach towards the 1.10 level, you can try to play for a bounce back to the 1.11 handle. Furthermore, if we were to rally towards 1.12 handle, it’s likely that we could pull back to the 1.11 handle. In this area, it’s a simple guess as to where we go next, so it does not serve the trader well to be involved. However, you can use this as an idea as to where the US dollar goes. If this pair rises, then that means you might want to short the US dollar against other currencies. Of course, the exact opposite is true as well. As this is the biggest Forex pair out there, it shows you just how strong or weak the US dollar is at the moment, so it certainly worth paying attention to. However, as far as trading is concerned you will be stuck for a moment.