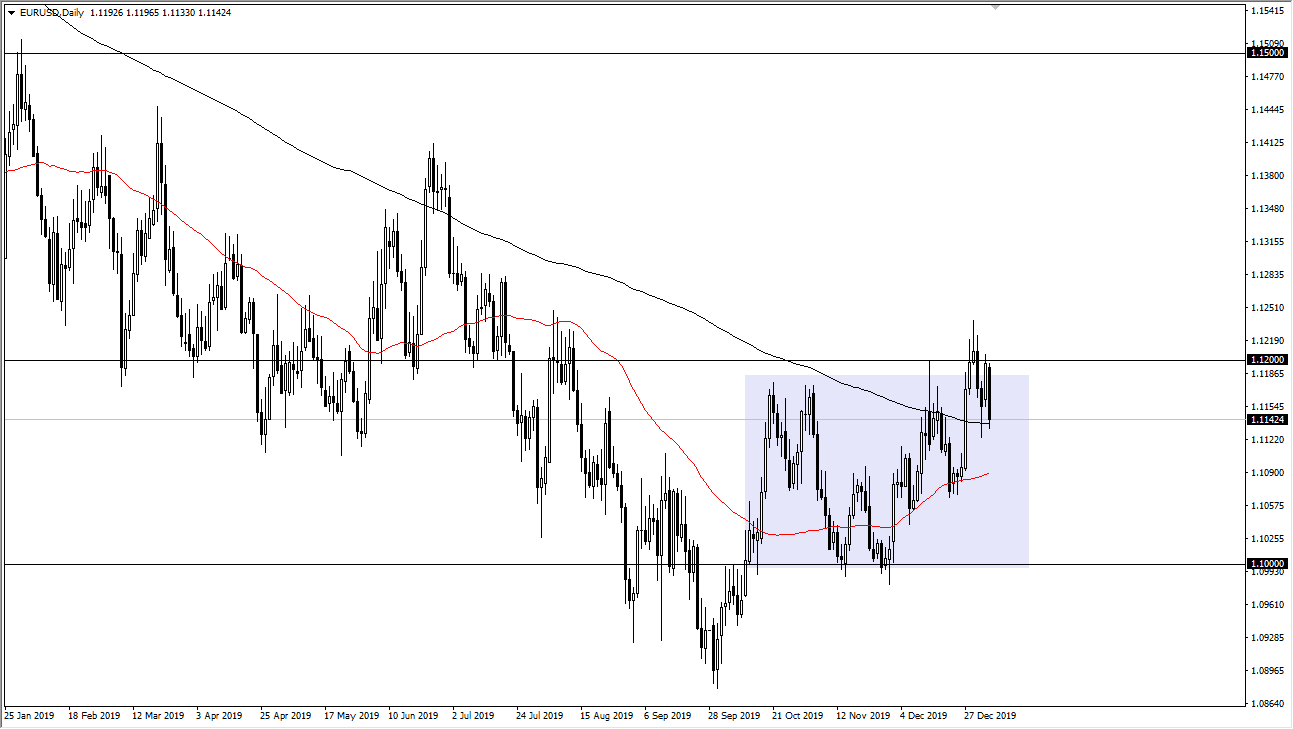

The Euro has broken down significantly during the trading session on Tuesday, as the 1.12 level continues offer a significant amount of resistance. That being said, the market did find the 200 day EMA at the bottom of the range and is trying to show signs of bouncing from it. This is an area that should offer support and did just a few days ago based upon the hammer that had formed on the Friday trading session. However, the shooting star above offers significant resistance in the form of the 1.12 handle, so at this point I think it’s only a matter of time before the markets continue to bang around in this general vicinity.

Underneath, the 50 day EMA is starting to reach towards the 200 day EMA, forming a potential “golden cross”, something that is relatively bullish for longer-term technical analysts. The fact that the market is hanging around the 200 day EMA tells me that there is a decent chance that the market bounces from here, but we will also see trouble at the 1.12 handle. The US dollar has been softening a bit, and if the jobs number disappoints later this week that might be yet another reason to think that this market takes off to the upside as the market will have to redefine Federal Reserve expectations.

Currently, the Federal Reserve is on the sidelines and somewhat neutral. However, lately we have seen less than impressive economic figures coming out of the United States, so at that continues it’s very likely that the Euro will be a major beneficiary as economic figures in the European Union, although low, are starting to stabilize. Europe offers a lot of value at this point, but you will need to be patient to benefit from it. Having said that, if the United States starts to slip a bit, then it will accelerate the profits that can be made owning the Euro or some European assets. At this point, it’s very likely that the Euro will bounce but if we were to break down below the 1.11 handle, then it’s likely that the market will break down towards the 50 day EMA, followed by the 1.10 level which should be supported based upon previous action and of course the fact that it is a large, round, psychologically significant figure. That being said, I think over the next couple of days it’ll be more range bound than anything else.