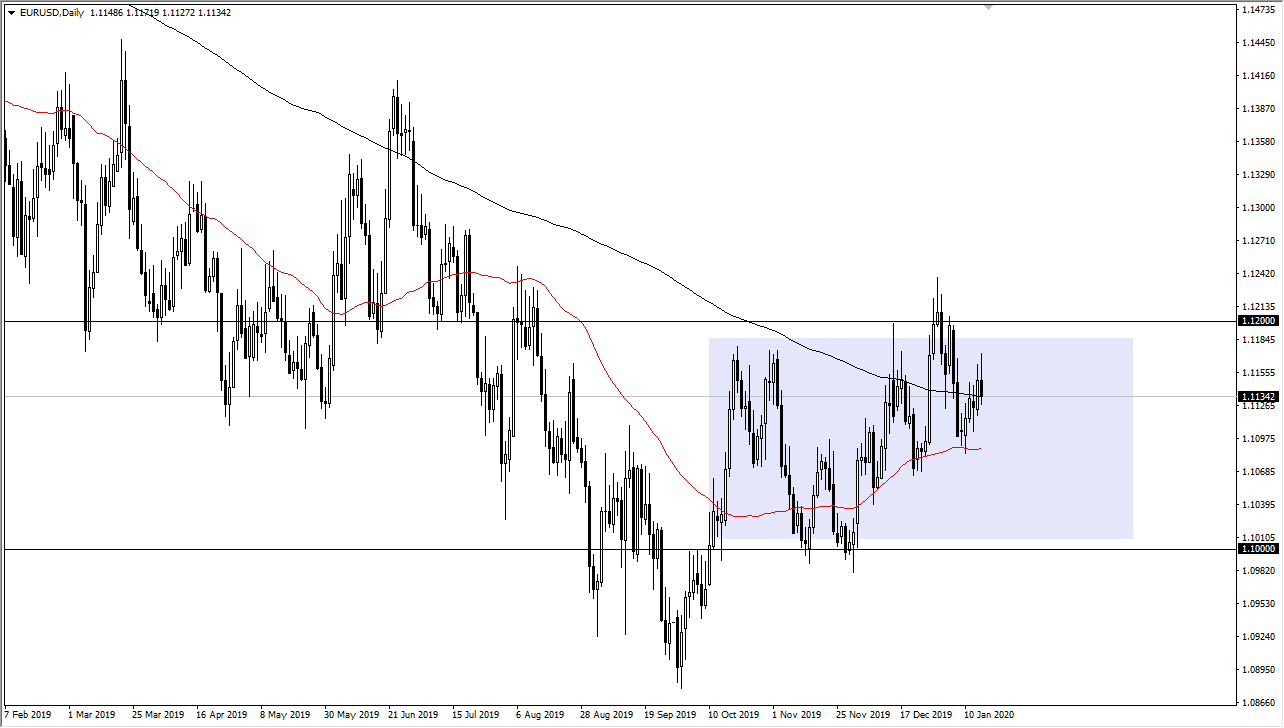

The Euro rallied a bit during the trading session on Thursday but then pulled back to form a shooting star. This suggests that the market is ready to pull back between the 200 day EMA and the 50 day EMA. I think there is support underneath though, but the market just isn’t quite ready to take off to the upside. This is the domain of high-frequency traders, so unless you are able to sit there in front of the computer and trade five minute charts, this isn’t going to be the pair for you. That being said, there are some discernible levels that are worth paying attention to from a longer-term standpoint.

To the upside I believe that the 1.12 level is massive resistance that extends all the way to the 1.1250 level. If we were to clear that 50 PIP range, the market could then go much higher, perhaps breaking out towards the 1.15 level as it would be a major breach of resistance. I wouldn’t go so far as to say that it was a trend change, but it certainly would be something that you can make an argument for at that point. What does help the idea of this market breaking higher is that we have recently rallied from the 1.10 level with a certain amount of strength.

To the downside, if we were to break down below the 50 day EMA, we could see this market looking towards the 1.10 level underneath, which was massive support in the past. However, we have seen “higher lows” going forward and that suggests that we are in an uptrend, at least for the short term. Keep in mind that the thick resistance barrier above is going to be difficult to break through, so if you are a short-term trader you may be able to buy short-term dips in order to go long. I wouldn’t hang on for more than about 20 pips though, this pair is that choppy and noisy. This is probably going to have more to do with the US dollar than the Euro itself, and part of the reason that the market turned around was that we had very strong retail sales and unemployment figures coming out of America during the trading session. With that, I would anticipate that there is some type of buying pressure underneath just waiting to get involved.