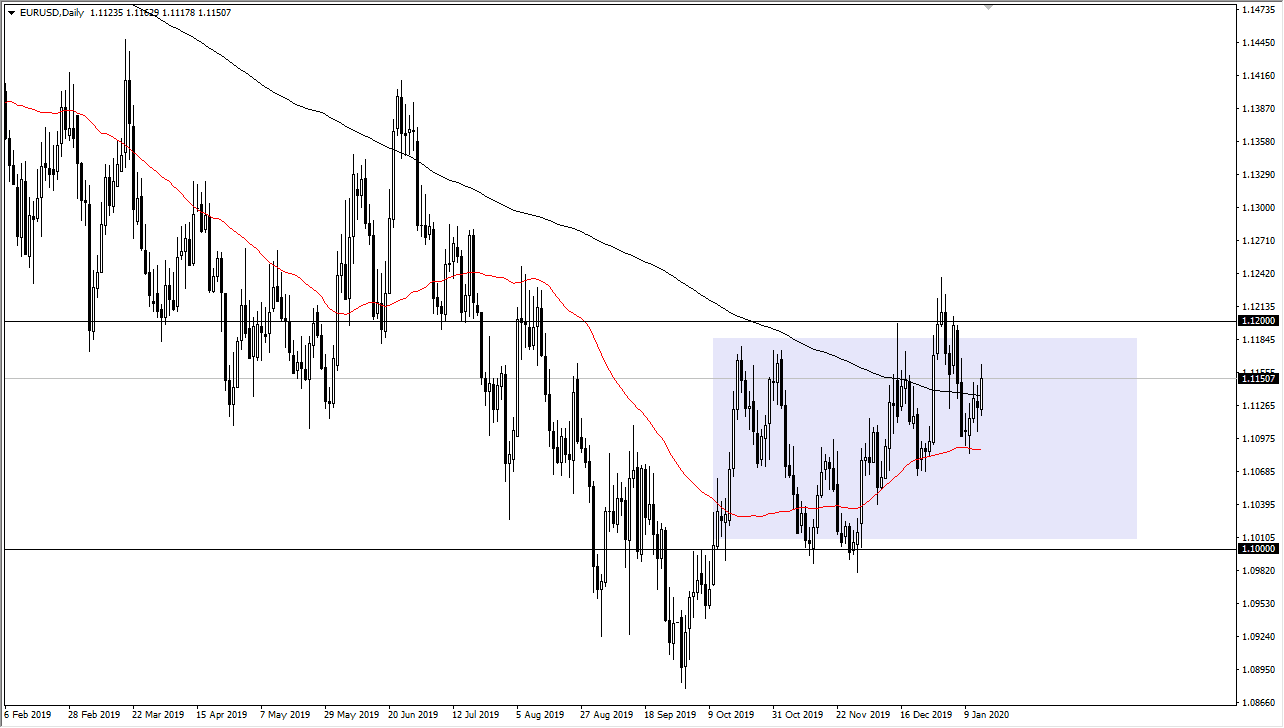

The EUR/USD broke higher during the trading session on Wednesday, breaking above the 200 day EMA during the course of the session. We even peaked above the 1.1150 level initially, but then pulled back a bit to show signs of exhaustion. That being said, this is a market that has been making “higher lows”, which shows signs of a return to the upside and a short-term bounce and reach towards the 1.12 level. Furthermore, the market could go as high as the 1.1250 level and still be fighting resistance. If we break above there, then it’s very likely that the market goes even higher, perhaps towards the 1.14 level after that.

At this point, I think that the market will continue to try to grind to the upside and the recent action of the market has been bullish in general. That being said though, the market is very choppy so I would not be looking for some type of explosive move. We are initially in the throes of a potential break out, but I don’t consider this market changing trend until we do that. That being said, if we break down below the 50 day EMA which is colored in red, then the market probably goes down to the 1.10 level after that. That would be a continuation of the 200 point range that we have been in, but I think at this point it is probably better sitting on the sidelines and waiting for some type of bigger move.

This market is very difficult to handle for anything more than a short-term trade, so having said that I believe that you should be looking at short-term pullbacks to take advantage of for intraday trades. It certainly has an upward bias, but to expect some type of big move anytime soon is a bit much. However, if we were to get that breakout I mentioned previously, then we could get a little bit more aggressive, at least as far as size is concerned. To the downside, if we did break down below the 1.10 level, that would be an extraordinarily negative sign and could send this market looking towards 1.09 level and then eventually the 1.0750 level which is the scene of a huge gap on the longer-term charts. That being said, pay attention to the bigger figures in the form of the 1.12 level and the 1.10 level for guidance. If you are a day trader, then short-term upward bias is probably the best way to go.