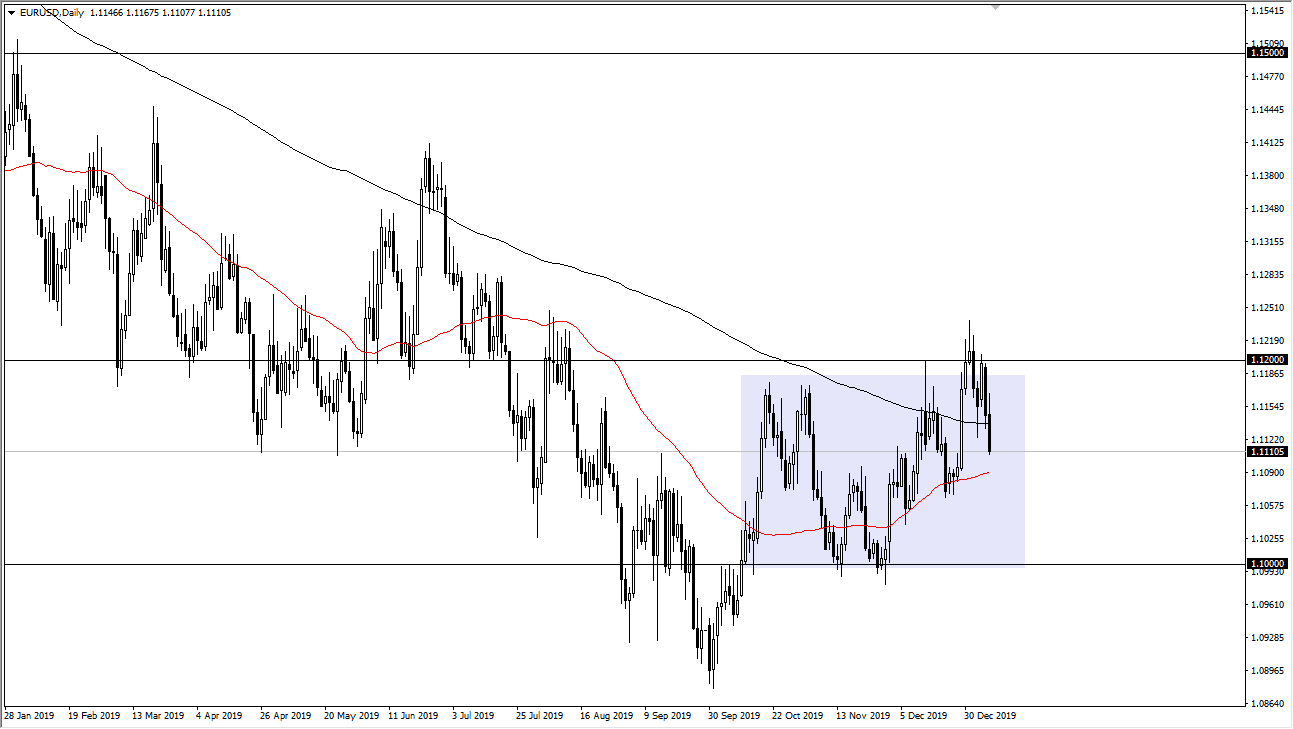

The Euro initially tried to rally initially during the trading session on Wednesday, but then broke down a bit from there to reach towards the 1.11 level underneath. The market is currently trading between the 50 day EMA on the bottom and the 200 day EMA above. This is an area that typically causes a lot of noise, but at this point we need to find some stability before we start getting involved on a bounce. After all, the candlestick was very ugly looking, and it looks very likely that we will continue to gyrate around this area. At this point though, I am looking for some type of supportive candlestick in order to start buying again.

That being said, the Friday session will feature the Non-Farm Payroll figures, so the Thursday session might be a bit quiet. At this point, the market is likely to see a lot of back-and-forth trading situation, and therefore it’s very interesting to see how the market behaves in this area as we have made a series a “higher lows”, and of course “higher highs.” Ultimately, the market looks as if it is trying to change the overall trend but it’s also going to be an area where we need to make some type of significant determination.

To the downside, if we were to break down below the most recent low at the 1.1075 handle, the market is likely to go down to the 1.10 level underneath. At this point, the market does look like it’s trying to find its way to the upside, but Thursday is probably going to be more about stabilizing the situation more than anything else. If we do break to the upside, the 1.12 level extends resistance all the way to the 1.1250 level. If we can break above all of that, the market is free to go higher, perhaps reaching towards 1.14 handle over the longer term. However, I think that the jobs number need to get out of the way before we can start seeing that move, and at this point with the better than anticipated ADP Employment Change numbers coming out of America during the trading session on Wednesday, we did see the US dollar rally a bit. Overall, the Federal Reserve will be paid attention to employment, so if it stays relatively strong, that probably keeps monetary policy where it is now. If we start to see more weakness as we have been some other indicators, that could send the Euro higher as monetary policy will probably be relatively loose.