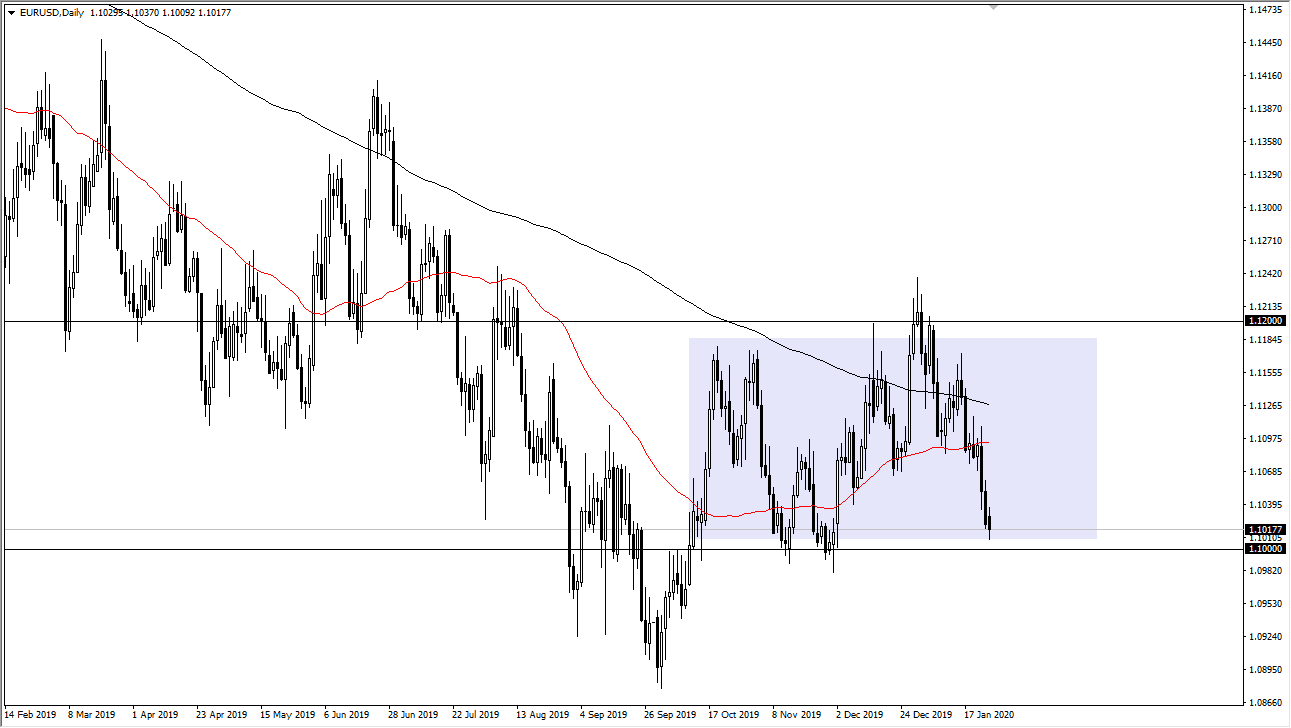

The Euro initially tried to rally during the trading session on Monday, but then fell rather hard to reach towards the psychologically and structurally important 1.10 level. The fact that the market has set above there most the day suggest that buyers are willing to step in and try to hold this range yet again. That being said, it’s not necessarily a sign that the market should take off to the upside, rather that it may struggle to break down. If the market was to break down below the 1.0980 level, then it would be a continuation of the massively negative sign, perhaps opening up the door down to the 1.09 level and then eventually the 1.0750 level underneath which is the scene of a gap from longer-term charts.

Looking at the chart, you can see that we have clearly been in a 200 point range for some time, with the 1.10 level offering significant support. The upside is closer to the 1.12 handle, so we are most certainly at an extreme where we have seen buyers come into the market previously. This is why a breakdown below the 1.0980 would be so negative, because it would break through the last attempt to break down below the range.

With the main drivers of Euro weakness during the trading session was the German Ifo Business Climate numbers coming out during the day, which were extraordinarily disappointing. With that in mind, keep in the back of your head that the German economy is a huge part of the European Union economy. There are still a lot of concerns when it comes to the European Union, and the currency reflects that. That being said, we could very well turn around a break above the highs of the Monday session, which could give the market the excuse to rally back towards the 50 day EMA which is closer to the 1.11 level and is also the middle of the overall range, making it “fair value.” Ultimately, this is a market that continues to be very noisy and go back and forth based upon the latest headline numbers. There are several US numbers coming out this week, so keep that in mind and understand that it will have a massive influence on this pair. With this, we have some very obvious levels to watch, at least for the short term that tells us where we could go next.