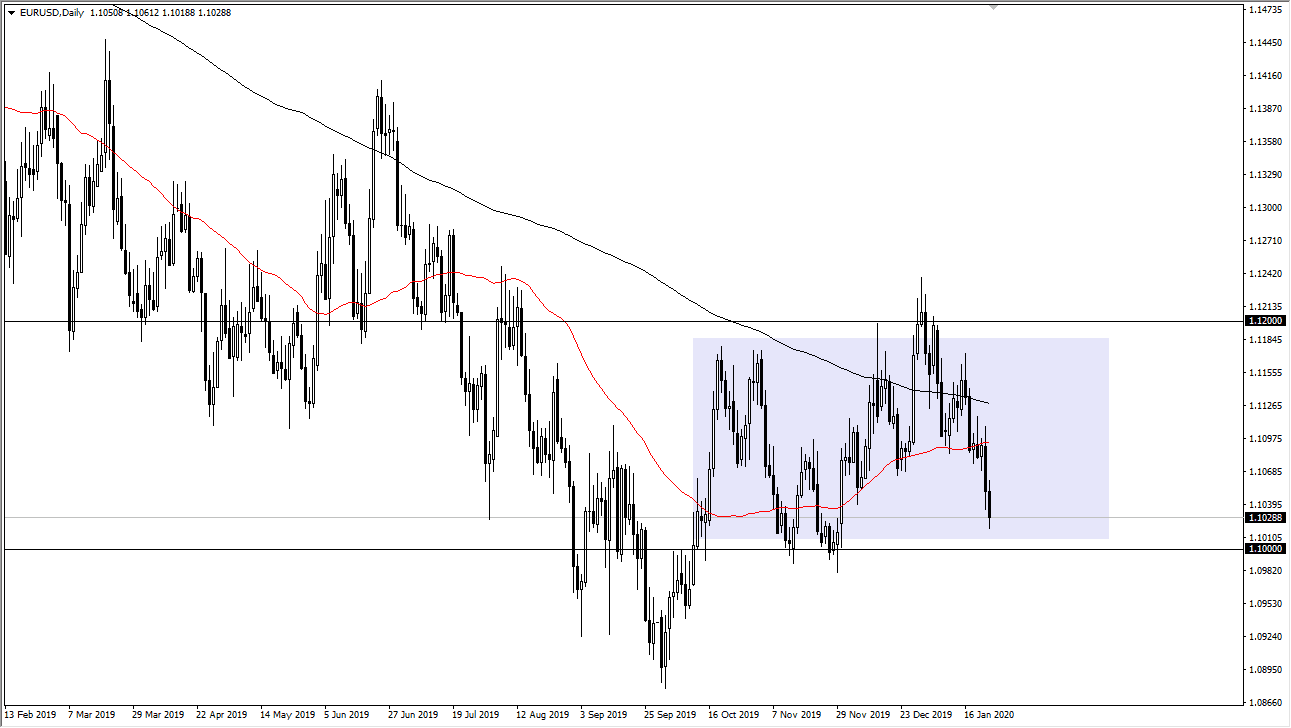

The Euro initially tried to rally during the trading session on Friday but gave back the gains to reach towards the 1.10 level. That’s an area that has been support more than once as we have been in consolidation for some time. Looking at the 1.10 level and the 1.12 level as the outer bounds of the rectangle, it’s likely that the market will continue to find these areas as important. The fact that the candlestick broke down a bit during the trading session on Friday after breaking down through Thursday tells me that there is quite a bit of weight around the neck of the Euro. The breakdown began when Christine Largarde suggested that the ECB was going to be very loose with monetary policy. In fact, they look to be accommodative for the foreseeable future, and that of course is bad for the currency.

The 50 day EMA looks as if it had offered some resistance previously, and now I think we are going to try to break down below the 1.10 level. However, you have to keep an open mind that it holds as support and causes a bounce. That being said though, if we do break down, I think that the 1.09 level and then the 1.0750 level will be targeted. The reason I say 1.075, it is a gap that has yet to be filled. Typically, those gaps eventually do get filled but sometimes it’s months or even years later.

To the upside, if we were to bounce, I suspect that the 50 day EMA will be resistance, but if we can clear that level then it’s very likely we go towards the 1.12 level after a while. The Euro will continue to be very noisy, but that’s nothing new for this market as it is visited by high-frequency traders quite a bit. I have no interest in trying to get too big in a position right now, but I do recognize that short-term back-and-forth training may be possible. Again though, paying attention to the 200 point range is probably the most important thing you can do, because once we do break out in one direction or the other, it will show a significant shift in attitude and momentum that could produce profits. At this point though, I would suspect that a bounce will probably be the most likely reaction to this level as it has been so supportive.