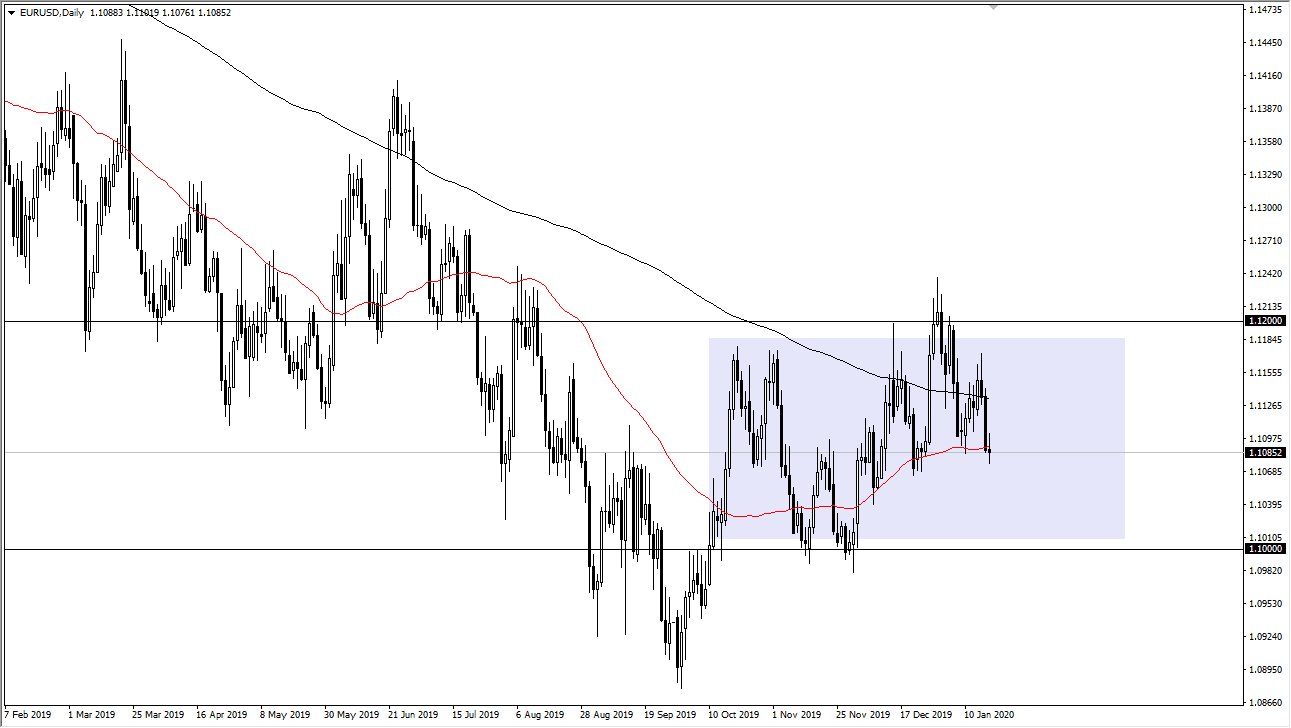

The Euro stabilizes a bit during the trading session on Monday, as we continue to dance around the 50 day EMA. More importantly, we are just below the 1.11 level, an area that seems to be “fair value” in general, as the market has been bouncing around in a 200 point range. All things being equal, the market looks as if it does favor the downside in general, but even if we do break down below the bottom of the candlestick for the Monday session, I think that the 1.10 level will certainly cause a lot of issues.

If we break above the top of the candlestick for the trading session on Monday, then we probably go looking towards the top of the Friday session which is closer to the 200 day EMA and the 1.1150 handle. Further complicating things is the fact that we are trading between the 50 day EMA and the 200 day EMA, causing a lot of confusion for longer-term traders. The European Union continues to post very poor economic figures, and that of course is negative for the Euro. However, we are also starting to see a lot of stability in these numbers and it looks like the European Union is trying to turn itself around.

The question now is whether or not the Federal Reserve is going to loosen monetary policy going forward. It does look like the Fed is willing to do whatever it takes to keep asset prices elevated, and that means that could go to loosen monetary policy if necessary. That being said, I expect to see the market going back and forth in this general area that I have marked by the purple box. All things being equal, this is a market that I think is going to be more of a range bound market, one that you can trade on short-term charts more than anything else. However, if we were to break out as 200 point range you could have a bigger position on, perhaps hanging on for a longer amount of time. Until then, it’s all about short-term day trading at best, with a back-and-forth proclivity and a longer-term negativity but a confluence of major indicators, and of course a large, round, psychologically significant figure. All things being equal, this is a pair that is going to continue to be very difficult to hang onto for any amount of time.