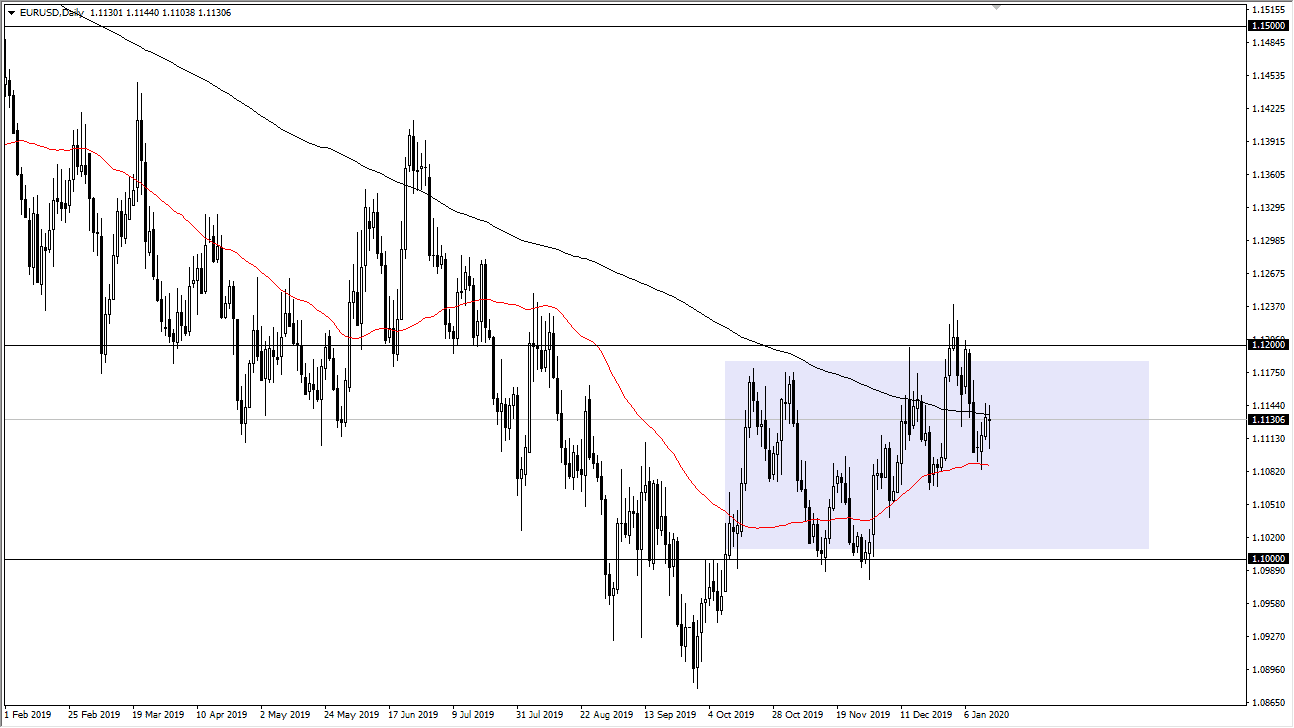

The Euro went back and forth during the trading session on Tuesday, as we continue to bounce around between two of the bigger moving averages that traders follow out there. The 50 day EMA underneath is significant support, just as the 200 day EMA above is offering resistance. All things being equal though, the fact that we are starting to try to recover again, it’s likely that we will try to reach towards 1.12 level above. On the other hand, this market breaks down below the 50 day EMA, the Euro is likely to start reaching towards 1.10 level.

At this point, the market looks as if it did recover after initially falling during the trading session, and this shows that there is still a bit of an upward proclivity when it comes to this market. With that in mind, I like the idea of buying dips in this market as long as we can continue to make “higher highs”, but I also recognize that the market is still within the consolidation area of 200 pips. If we were to break above the 1.12 level, then there is resistance extending all the way to the 1.1250 level. Clearing that allows this market to go much higher, perhaps reaching towards 1.14 level, maybe even the 1.15 level after that.

If the market was to turn around and breakdown below the 1.10 level, then it’s likely that the market goes down to the 1.09 handle, followed by the 1.0750 level because there is a gap down there that is trying to get filled eventually. Nonetheless, right now it does look as if there is more upward pressure than down, so I believe that a quick move to the 1.12 level will probably be the most likely of outcomes. Keep in mind that this pair is very choppy to say the least, as high frequency algorithmic trading is a mainstay here. That being said, we are also watching the 50 day EMA underneath starting to turn a little higher, and if it can break above the 200 day EMA, that would be the so-called “golden cross”, something that longer-term traders tend to pay attention to. It shows that momentum in the short term is starting to change to an uptrend, and that the longer-term trend should follow right along with it. If you’re a short-term day trader, this might be a good back-and-forth type of market, otherwise expect a lot of noise.