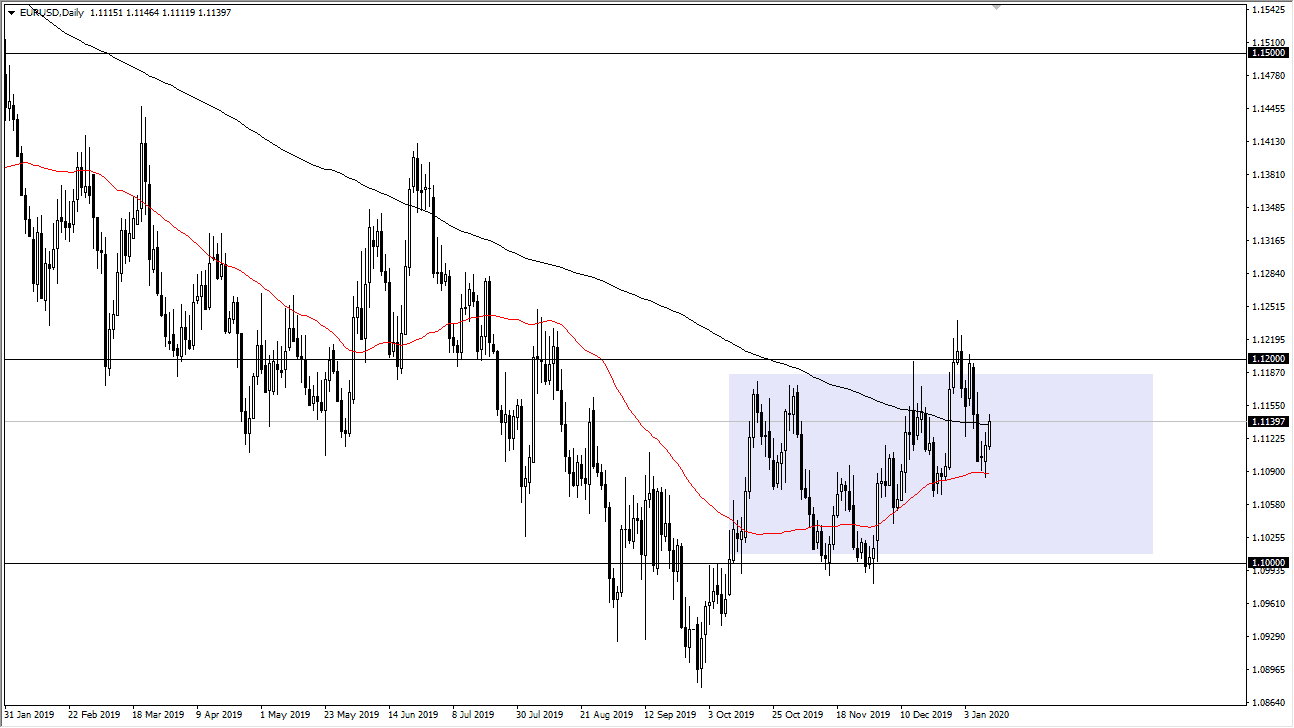

The Euro has rallied nicely to kick off the week on Monday, peeking above the 200 day EMA. That being said, this is a market that is still typically choppy, and although it has been bullish on the daily timeframe, the reality is that it wasn’t as smooth of a move as the daily candlestick would have you believe. In fact, one point it almost looked as if we were going to form a shooting star, which of course is a very negative sign. We are currently trading right around the 200 day EMA, so if we can break above the highs of the trading session on Monday, then I think that shows significant strength. That would set up a move towards the 1.12 handle, which is resistive and extending all the way to the 1.1250 handle.

Above there, then the market is free to go looking towards 1.14 level, and then eventually the 1.15 handle. If we turn around a break down below the 50 day EMA which is pictured in red on the chart, then it opens up a move down to the 1.10 level. Keep in mind that this pair is very choppy in general, so keep your position size relatively small. This is a marketplace that will continue to be very noisy and driven by various headlines, but it does look as if it is trying to break out to the upside from a longer-term standpoint. This doesn’t mean that it will happen in the short term, but it certainly looks as if it is a market that is making “higher lows”, which of course is the first sign of a trend change after you have fallen significantly.

There is also the possibility that the 50 day EMA starts to turn higher, causing the so-called “golden cross”, but at this point the 50 day EMA has been flattening out a bit. While the pair does tend to rally in more of a “risk on” type of environment, this may have more to do with the US dollar losing a little bit of its shine in accordance to other currencies. Either way, the market looks as if it is trying to go higher and at the end of the day that’s the most important bit. I believe that the resistance at the 1.12 level extends 50 pips higher, so if we were to break above the 1.1250 level, then I fully believe that this market would take off.