According to the Turkish Treasury and Finance Ministry, the economy expanded by 5.0% in the fourth quarter of 2019 and by 0.5% on an annualized basis. The country targets annualized GDP growth of 5.0% in 2020, with an inflation rate of 8.5%. In a separate report, the World Bank acknowledged the economic recovery in Turkey is exceeds previous estimates. President Erdogan fired sixteen heads or deputy-heads at the Treasury and Finance Ministry this month to further fuel the economic recovery. The EUR/TRY is favored to enter a fresh breakdown sequence on the back of a stronger economy.

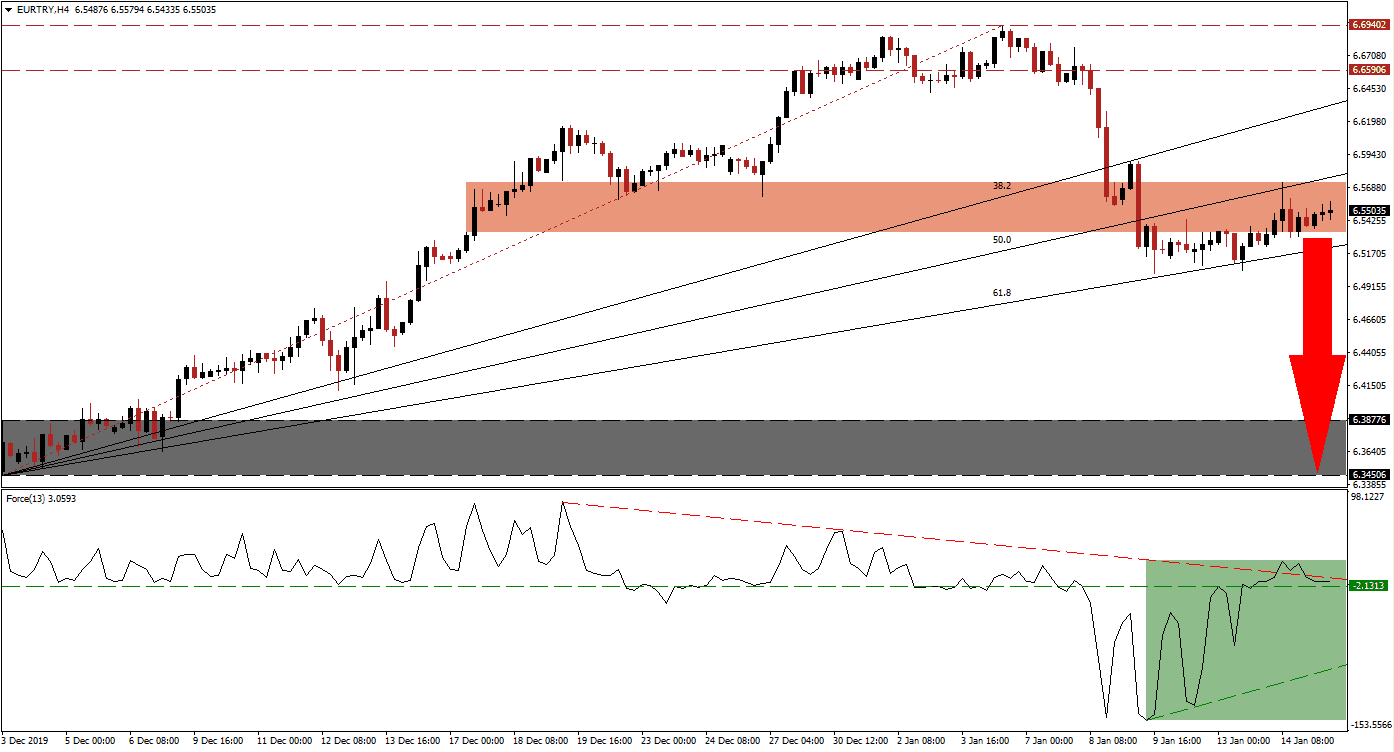

The Force Index, a next-generation technical indicator, lost bullish momentum after converting its horizontal resistance level into support. A brief push above its descending resistance level was reversed, as marked by the green rectangle. The Force Index is now expected to contract below its horizontal support level and into negative territory, allowing bears to take control of the EUR/TRY. This will close the gap to its ascending support level. You can read more about the Force Index here.

With the breakdown in this currency pair below its long-term resistance zone, the uptrend in the EUR/TRY ended. The profit-taking sell-off resulted in a move below its short-term resistance zone located between 6.53326 and 6.57256, as marked by the red rectangle. It was reversed by the ascending 61.8 Fibonacci Retracement Fan Support Level, which pushed it back inside its resistance zone. A fresh breakdown is anticipated as a result of the strong economic rebound. You can learn more about the Fibonacci Retracement Fan here.

Following a breakdown in price action below its 61.8 Fibonacci Retracement Fan Support Level, the path to the downside will face limited resistance. The EUR/TRY is likely to accelerate into its next support zone located between 6.34506 and 6.38776, as marked by the grey rectangle. A breakdown below the intra-day low of 6.50386, the low of the previous breakdown sequence, is favored to attract fresh net short positions in this currency pair. Forex traders are advised to monitor the Force Index for a move below the 0 center-line, expected to precede the pending breakdown.

EUR/TRY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 6.55250

Take Profit @ 6.34750

Stop Loss @ 6.61000

Downside Potential: 2,050 pips

Upside Risk: 575 pips

Risk/Reward Ratio: 3.57

Should the Force Index sustain a breakout above its descending resistance level, the EUR/TRY is anticipated to attempt a push into its long-term resistance zone. This zone is located between 6.65906 and 6.69402, which should be viewed as a great short selling opportunity. The fundamental outlook for this currency pair is increasingly bullish, with a technical breakdown pending.

EUR/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.63000

Take Profit @ 6.69000

Stop Loss @ 6.60000

Upside Potential: 600 pips

Downside Risk: 300 pips

Risk/Reward Ratio: 2.00