Economic fundamentals continue to improve for Turkey as the Eurozone is at risk from its central bank’s monetary policy, fueling structural issues. During the crisis, Turkey’s military pension fund OYAK grew into one of the most dominant local investors, while the geographical location and young age of its population continue to make it an attractive destination for foreign direct investment. The EUR/TRY is currently reversing its previous breakout above its support zone, with more downside anticipated.

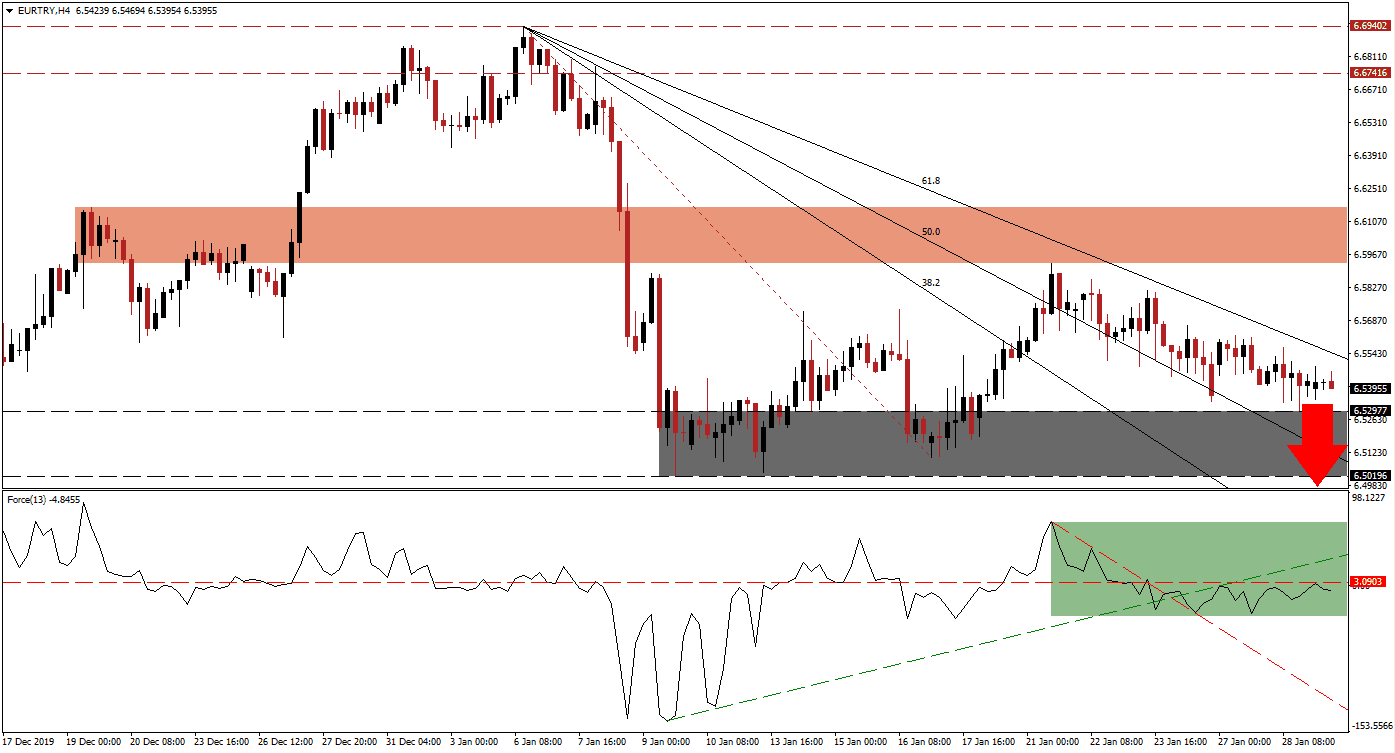

The Force Index, a next-generation technical indicator, points towards a pending acceleration to the downside. Following a reversal from a high high, the Force Index contracted below its horizontal support level, converting it into resistance. It resulted in a move below its ascending support level and above its descending resistance level, as marked by the green rectangle. Bears are in control of price action in the EUR/TRY, and the Force Index is likely to be pulled down into its descending support level.

This currency pair is being guided to the downside by a cone consisting of its descending 50.0 Fibonacci Retracement Fan Support Level and its 61.8 Fibonacci Retracement Fan Resistance Level. The Fibonacci Retracement Fan sequence was redrawn after the short-term resistance zone located between 6.59272 and 6.61676, as marked by the red rectangle, rejected an extension of the breakout in the EUR/TRY. As the bearish cone widens, the downside potential increases, supported by fundamental developments.

A breakdown in the EUR/TRY below its support zone located between 6.50196 and 6.52977, as marked by the grey rectangle, will clear the path for a bigger sell-off. The 38.2 Fibonacci Retracement Fan Support Level already crossed below its support zone, and forex traders are advised to monitor price action fort a breakdown below its 50.0 Fibonacci Retracement Fan Support Level. This would place it in a steeper bearish cone and favored to lead it into its next support zone located between 6.38701 and 6.41126. You can learn more about a breakdown here.

EUR/TRY Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 6.54000

- Take Profit @ 6.38700

- Stop Loss @ 6.57500

- Downside Potential: 1,530 pips

- Upside Risk: 350 pips

- Risk/Reward Ratio: 4.37

Should the Force Index sustain a breakout above its ascending support level, which currently acts as resistance, the EUR/TRY is expected to push through its 61.8 Fibonacci Retracement Fan Resistance Level. With the dominant bullish outlook for the Turkish economy, the upside for any breakout remains limited to its short-term resistance zone. Forex traders should take advantage of any push higher with new short positions.

EUR/TRY Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 6.58250

- Take Profit @ 6.61500

- Stop Loss @ 6.57000

- Upside Potential: 325 pips

- Downside Risk: 125 pips

- Risk/Reward Ratio: 2.60