While US President Trump and French President Macron announced a truce to allow for negotiations regarding digital taxes and fresh tariffs to continue, the Eurozone economy remains under pressure. Breakdown pressures in the EUR/NZD are rising, and the short-term resistance zone is expected to force a price action reversal. A head-and-shoulders chart pattern emerged, which constitutes a bearish formation. Some economic data out of the Eurozone surprised to the upside from depressed levels, keeping the long-term cautious outlook intact.

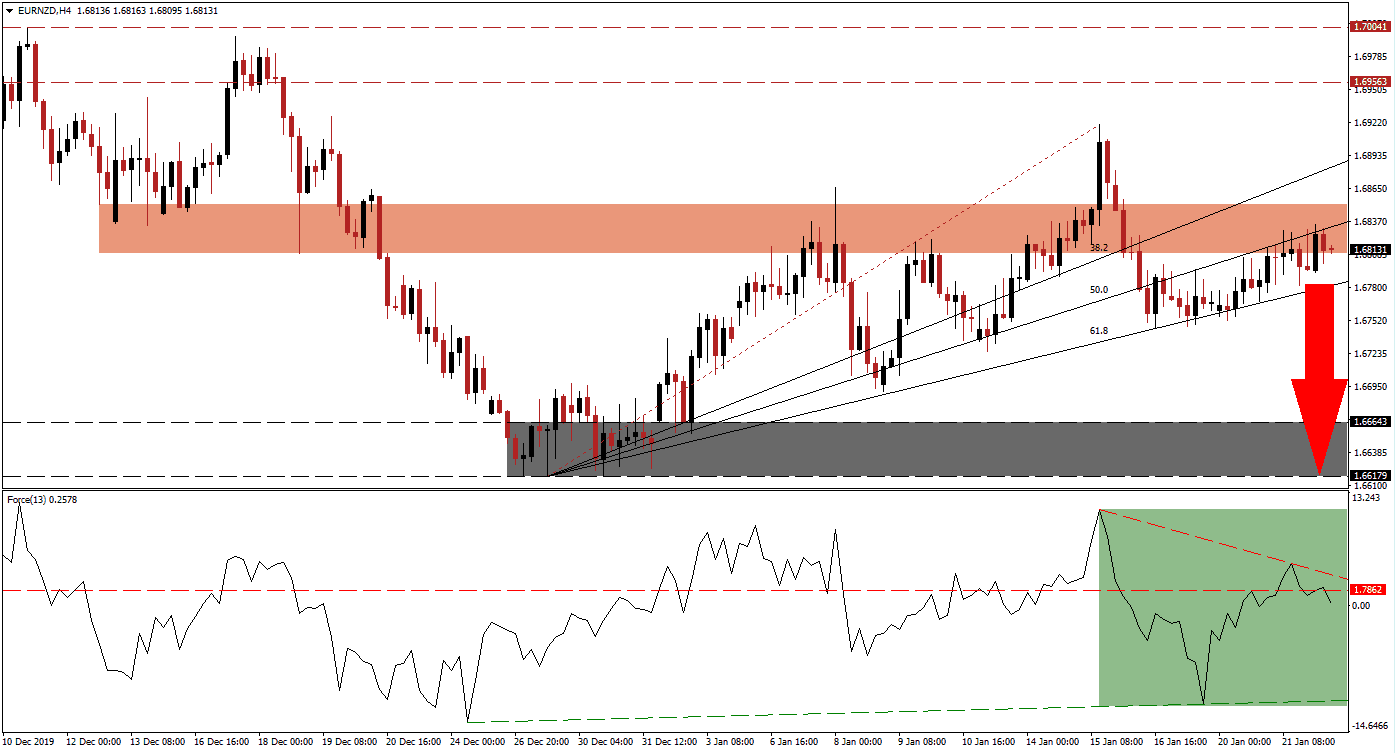

The Force Index, a next-generation technical indicator, confirms the increase in bearish momentum as the EUR/NZD is on the verge of a breakdown. The Force Index converted its horizontal support level into resistance, as marked by the green rectangle, with the descending resistance level adding to downside pressures. This technical indicator is expected to cross into negative territory, placing bears in control of price action, from where a collapse into its shallow ascending support level is favored.

A temporary breakout in the EUR/NZD above its short-term resistance zone located between 1.68095 and 1.68520, as marked by the red rectangle, was reversed into its ascending 61.8 Fibonacci Retracement Fan Support Level. Price action was able to ascend back into its resistance zone, but the loss in bullish momentum is anticipated to force an accelerated move to the downside. The Fibonacci Retracement Fan sequence is adding to breakdown pressures, and a profit-taking sell-off should follow.

Forex traders are advised to monitor the intra-day low of 1.67451, the low of the previous breakdown below its short-term resistance zone. A move below this level is favored to attract fresh net sell orders in the EUR/NZD, and intensify the corrective phase. Price action is likely to descend into its support zone located between 1.66179 and 1.66643, as marked by the grey rectangle. More downside is possible, but a new fundamental catalyst will need to emerge. You can read more about a breakdown here.

EUR/NZD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.68150

Take Profit @ 1.66200

Stop Loss @ 1.68700

Downside Potential: 195 pips

Upside Risk: 55 pips

Risk/Reward Ratio: 3.55

Should the Force Index sustain a breakout above its descending resistance level, the EUR/NZD may attempt to extend its advance. Due to the bearish fundamental outlook, supported by the developing technical picture, any breakout attempt remains limited to its long-term resistance zone. Forex traders are recommended to consider an advance as a good short-selling opportunity. The next resistance zone is located between 1.69563 and 1.70041.

EUR/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.68900

Take Profit @ 1.70000

Stop Loss @ 1.68500

Upside Potential: 110 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.75