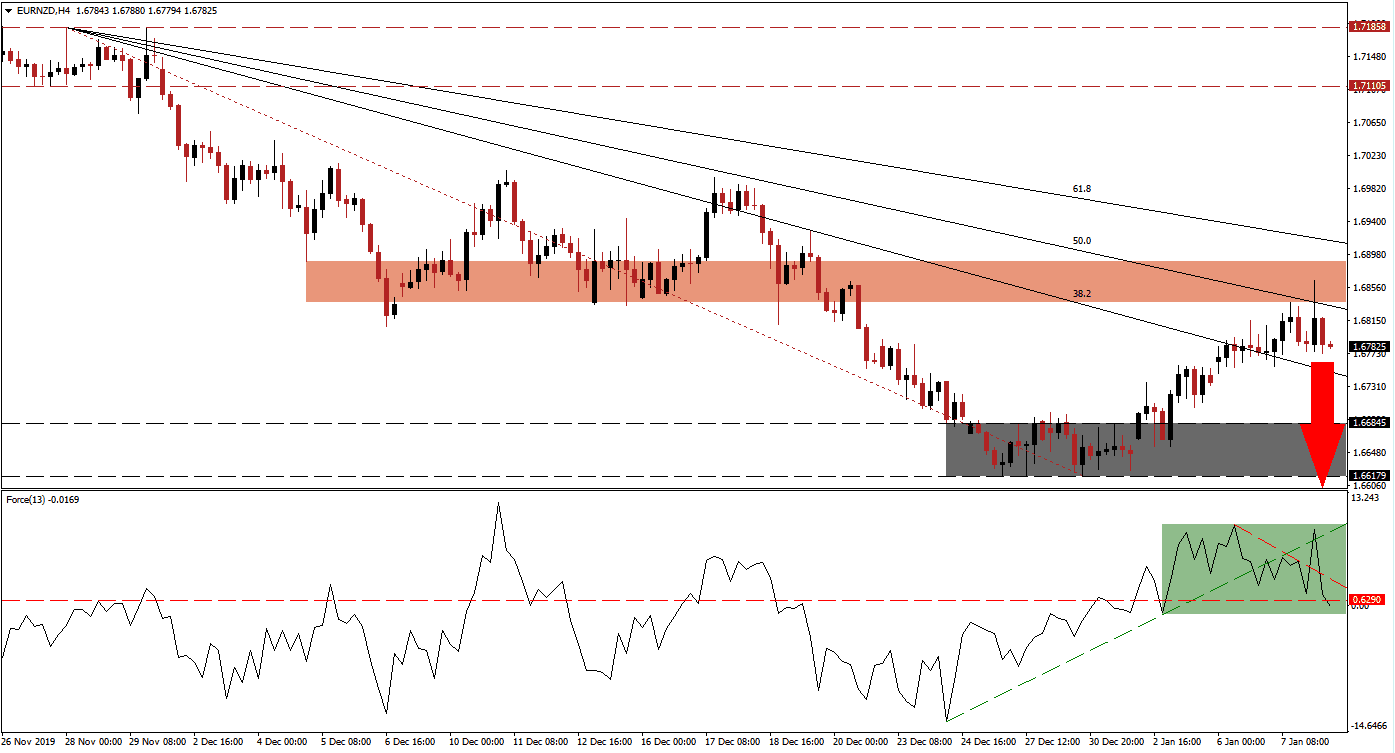

Upward revisions to final December PMI data across the Eurozone and better-than-expected retail sales failed to boost the Euro significantly, and the EUR/NZD was rejected by its short-term resistance zone. Tension ins the Middle East has lifted the commodity sector, providing bullish momentum for the New Zealand Dollar. The descending Fibonacci Retracement Fan is favored to extend the long-term downtrend in this currency pair with a fresh breakdown sequence. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, initially advanced with price action. Bullish momentum collapsed as this currency pair was rejected by its short-term resistance zone, and the Force Index pushed below its horizontal support level. It also moved below its ascending support level, which now acts as temporary resistance. The descending resistance level is adding bearish pressures on this technical indicator, as marked by the green rectangle. The Force Index has now moved into negative territory with bears in control of the EUR/NZD.

This currency pair recovered to the upside at the start of this year but failed to push through its short-term resistance zone. The descending 50.0 Fibonacci Retracement Fan Resistance Level already moved below this zone, located between 1.68372 and 1.68900, as marked by the red rectangle. More downside is anticipated to follow, with a breakdown in the EUR/NZD below its 38.2 Fibonacci Retracement Fan Support Level. The preceding recovery ensured the longevity of the long-term bearish chart formation. You can learn more about a breakdown here.

With the tension between the US and Iran expected to remain at elevated levels, upside pressure on the commodity market should remain in place. The contraction in the US Dollar is adding to bullish momentum across soft and hard commodities. The EUR/NZD is anticipated to descend into its support zone located between 1.66179 and 1.66845, as marked by the grey rectangle. A breakdown is favored to follow, and the next support zone awaits price action between 1.64296 and 1.64806.

EUR/NZD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.67800

Take Profit @ 1.64300

Stop Loss @ 1.68700

Downside Potential: 350 pips

Upside Risk: 90 pips

Risk/Reward Ratio: 3.89

In case of a breakout in the Force Index above its descending resistance level, the EUR/NZD could attempt to push farther to the upside. A breakout above the 61.8 Fibonacci Retracement Fan Resistance Level will be required for this currency pair to keep the advance alive. The dominant bearish fundamental outlook limits the overall upside potential to its next long-term resistance zone between 1.71105 and 1.71858. Forex traders are advised to consider this a good short-selling opportunity.

EUR/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.69600

Take Profit @ 1.71450

Stop Loss @ 1.68700

Upside Potential: 185 pips

Downside Risk: 90 pips

Risk/Reward Ratio: 2.06