Reports that US President Trump and French President Macron called a truce in pending tariffs and taxes at the World Economic Forum in Davos, Switzerland, provided a temporary relive to the Euro. While US President Trump warmed up to a truce with France, tariffs on Mexican goods are expected to remain in place and may escalate unless Mexico stops the flow of illegal immigrants to the US. The combination of events allowed the EUR/MXN to complete a breakout above its support zone. You can learn more about a breakout here.

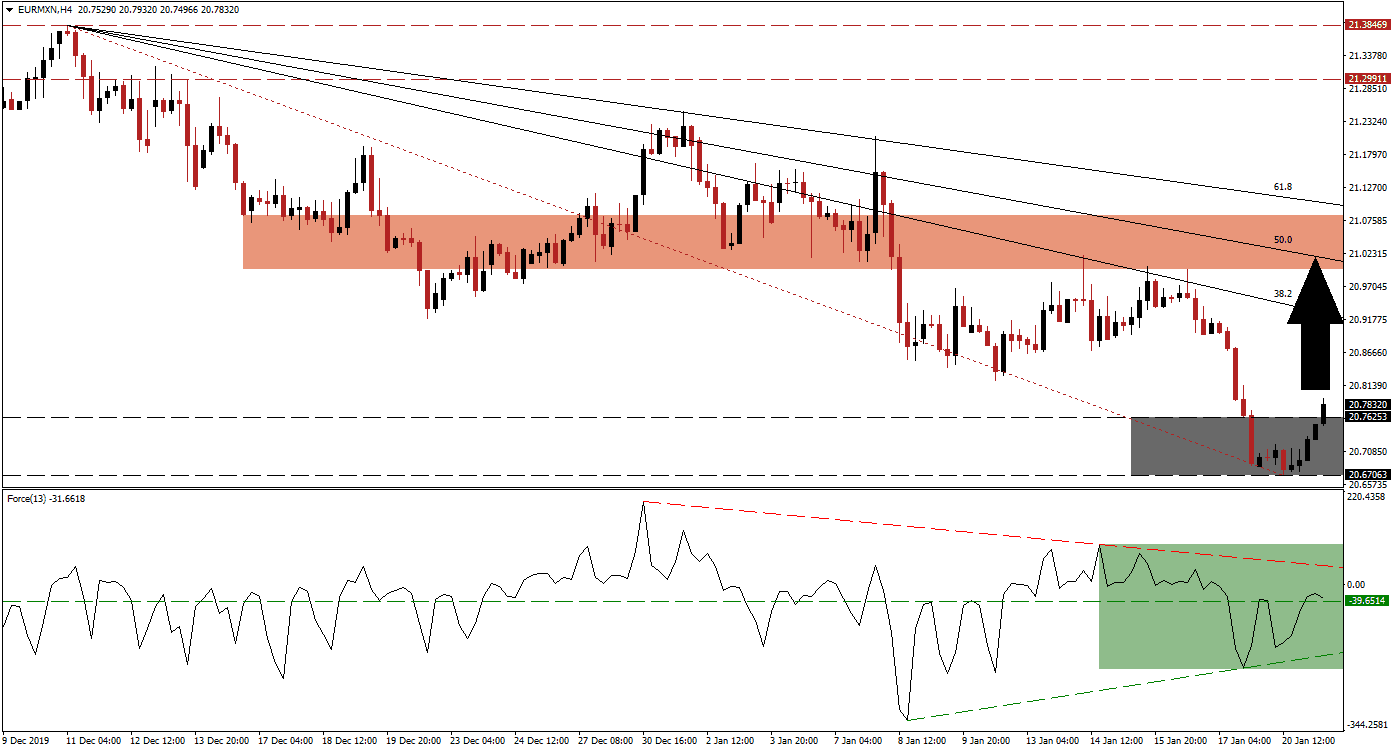

The Force Index, a next-generation technical indicator, has provided an early indicator that a price action reversal may be imminent. While the EUR/MXN drifted to the downside, recording a lower low, the Force Index started to advance, and a positive divergence formed. This technical indicator was able to push through its horizontal resistance level, turning it into support, as marked by the green rectangle. With the ascending support level and the descending resistance level converging, a breakout in the Force Index is anticipated to place bulls in charge of price action.

This currency pair pushed out of its support zone located between 20.67063 and 20.76253, as marked by the grey rectangle, and a short-covering rally is favored to follow. It should close the gap between the EUR/MXN and its descending 38.2 Fibonacci Retracement Fan Resistance Level. Adding to bullish developments was the move in price action above its Fibonacci Retracement Fan trendline. One critical level to monitor is the intra-day low of 20.82160, the bottom from where the failed breakout attempt materialized, which led to a lower low.

Economic worries are likely to persist, as evident by the latest IMF downgrade to the global economic outlook for 2020. A separate survey by PwC showed that 53% of global CEOs predict a contraction in the growth rate. This marks the highest percentage since the survey was started in 2012. The expected breakout extension in the EUR/MXN may be limited to its 50.0 Fibonacci Retracement Fan Resistance Level, which is crossing through its short-term resistance zone located between 20.99740 and 21.08350, as marked by the red rectangle. It will keep the long-term downtrend intact and ensure its longevity.

EUR/MXN Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 20.78250

Take Profit @ 21.00000

Stop Loss @ 20.72000

Upside Potential: 2,175 pips

Downside Risk: 625 pips

Risk/Reward Ratio: 3.48

In the event of a breakdown in the Force Index below its ascending support level, the EUR/MXN is likely to extend its long-term bearish trend. Economic challenges remain for Mexico and the Eurozone. The interest rate differential, together with the individual economic outlook, favor more downside. The next support zone awaits this currency pair between 20.32034 and 20.42743.

EUR/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 20.62000

Take Profit @ 20.33000

Stop Loss @ 20.72000

Downside Potential: 2,900 pips

Upside Risk: 1,000 pips

Risk/Reward Ratio: 2.90