Japanese trade data for December showed the global economic slowdown extended, which drove safe-haven traders to the Japanese Yen. Optimism across financial markets remains elevated and is vulnerable for a sharp correction. Many are cheering weaker economic data based on the hope that central banks will continue to stimulate markets. Quantitative easing is long-term destructive to the overall health of the financial system, and safe-haven assets like the Japanese Yen stand to benefit. The EUR/JPY is currently in the midst of a bigger corrective phase, which started with the breakdown below its resistance zone.

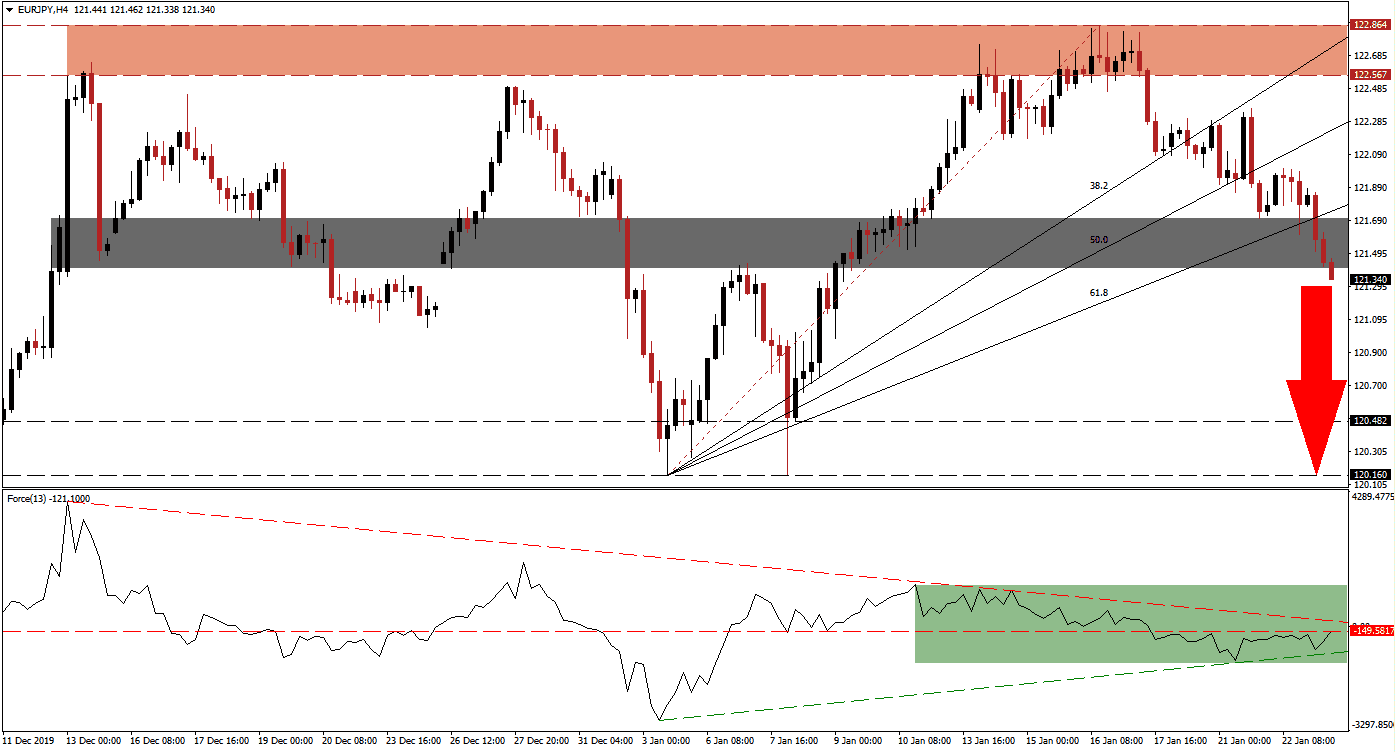

The Force Index, a next-generation technical indicator, shows the gradual contraction in bullish momentum, which started before this currency pair advanced into its resistance zone. After the horizontal support level was converted into resistance, the Force Index was able to recover off of its ascending support level, as marked by the green rectangle. This technical indicator remains in negative conditions, and the descending resistance level is adding to downside pressures, from where a breakdown is expected to precede more downside in the EUR/JPY. You can learn more about the Force Index here.

After this currency pair completed a breakdown below its horizontal resistance level located between 122.567 and 122.864, as marked by the red rectangle, a profit-taking sell-off followed. It was able to pressure the EUR/JPY below its entire Fibonacci Retracement Fan sequence. Today’s European Central Bank interest rate decision and press conference is anticipated to add volume and volatility to the breakdown sequence. The Eurozone produced isolated economic surprises, but this occurred from depressed levels while the general downtrend remains ongoing. You can learn more about the Fibonacci Retracement Fan here.

Adding to selling pressure was the breakdown in the EUR/JPY below its short-term support zone located between 121.404 and 121.704, as marked by the grey rectangle. This is favored to close a previous price gap to the upside, from where an accelerated move to the downside is likely to materialize. Forex traders are advised to monitor the intra-day low of 121.051, the low preceding the price gap. A move below this level is expected to attract new net short positions. The next support one awaits price action between 120.160 and 120.482.

EUR/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 121.350

Take Profit @ 120.250

Stop Loss @ 121.700

Downside Potential: 110 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 3.14

A breakout in the Force Index above its descending resistance level is likely to inspire a breakout attempt in the EUR/JPY. This may allow the Fibonacci Retracement Fan sequence to guide price action to the upside, which remains confined to its long-term resistance zone. The fundamental outlook for this currency pair is increasingly bearish, and any breakout attempt includes a good short-selling opportunity.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 122.150

Take Profit @ 122.850

Stop Loss @ 121.850

Upside Potential: 70 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.33