Bearish pressures are on the rise, as the EUR/GBP is challenging the bottom range of its resistance zone. Economic data out of the Eurozone continues to be weak, with Germany leading negative surprises. With Brexit less than three weeks away, the transition period may provide a headwind for the British Pound in 2020. The EU has noted that it won’t be enough time to reach a trade deal, but strong UK economic data will counter this. Today will feature a broad range of critical economic reports that may provide the next catalyst.

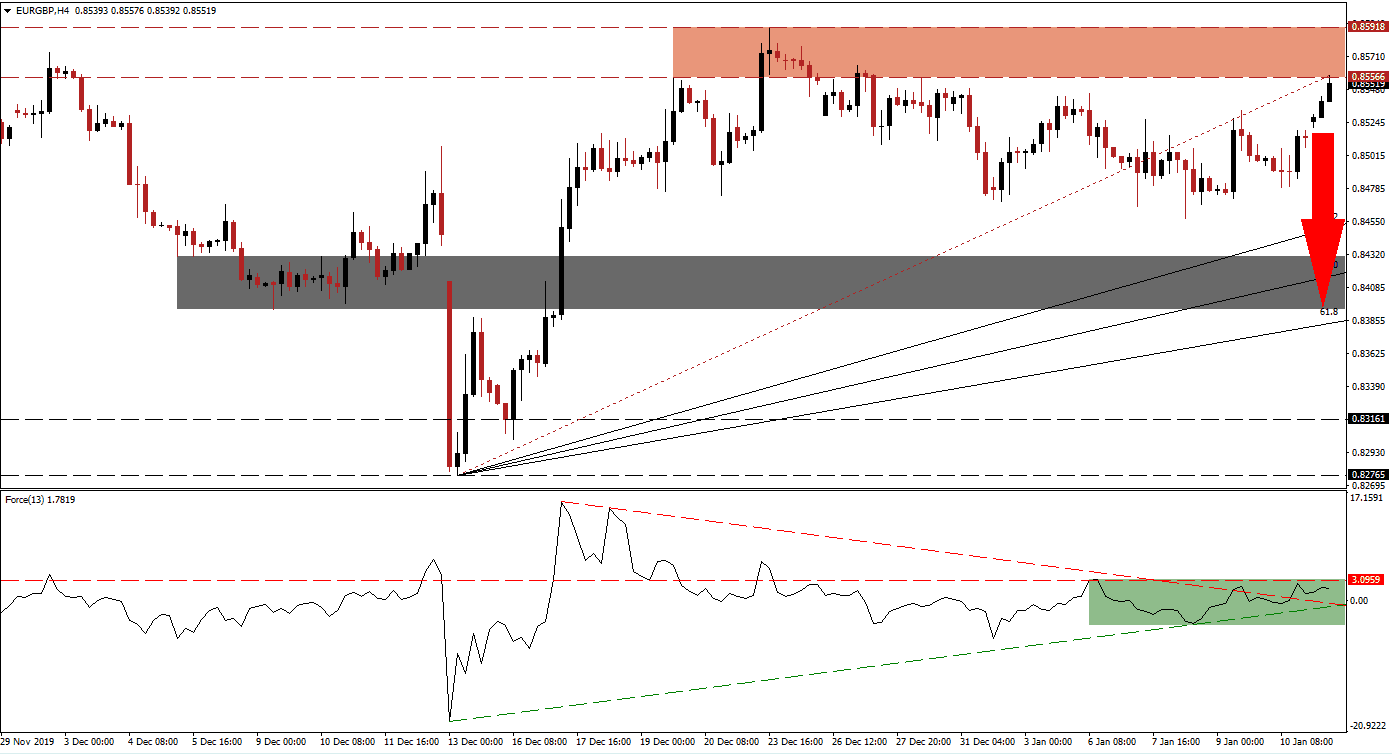

The Force Index, a next-generation technical indicator, remains confined in a narrowing range between its ascending support level and its horizontal resistance level. This suggests an exhausted advance vulnerable to a reversal. The Force Index was able to push above its descending resistance level, and remains in positive conditions, as marked by the green rectangle. Due to the lack of bullish momentum, a breakdown is anticipated to place bears in charge of the EUR/GBP, leading to a corrective phase. You can learn more about the Force Index here.

As a result of the most recent recovery in this currency pair, the Fibonacci Retracement Fan has been redrawn. The long-term fundamental outlook for the EUR/GBP remains increasingly bearish, but the Euro is expected to attract sporadic capital inflows in 2020, on the back of US Dollar weakness. A series of lower highs and lower lows is anticipated to materialize moving forward. This currency pair may be faced with a profit-taking sell-off, inspired by its resistance zone located between 0.85566 and 0.85918, as marked by the red rectangle.

Price action is favored to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level, from where a push into its short-term support zone is likely to follow. This zone awaits the EUR/GBP between 0.83932 and 0.84303, as marked by the grey rectangle, enforced by the 61.8 Fibonacci Retracement Fan Support Level. The awaited correction into this zone will additionally close a previous price gap to the downside. A breakdown cannot be ruled out, but a new fundamental event will be necessary. You can learn more about a price gap here.

EUR/GBP Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.85550

Take Profit @ 0.83950

Stop Loss @ 0.86050

Downside Potential: 160 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.20

A breakout in the Force Index above its horizontal resistance level, initiated by its ascending support level, could precede a breakout attempt in the EUR/GBP. With the bearish fundamental outlook for this currency pair, the upside remains limited to its next resistance zone, located between 0.86948 and 0.87410. Forex traders are advised to view this as a solid opportunity to enter short positions.

EUR/GBP Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.86250

Take Profit @ 0.87150

Stop Loss @ 0.85800

Upside Potential: 90 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 2.00