Brexit is five days away, but the UK will remain under EU rules until the end of the transition period. This will last until December 31st 2020, where tough negotiations between both sides are expected. During this period, the UK is allowed to start trade talks with other countries. Prime Minister Boris Johnson is delivering on the results of the 2016 referendum, and the outlook for the UK economy is increasingly bullish. At the same time, the Eurozone is faced with more problems and a divided central bank. The EUR/GBP is anticipated to move farther to the downside, following the conversion of its short-term support zone into resistance.

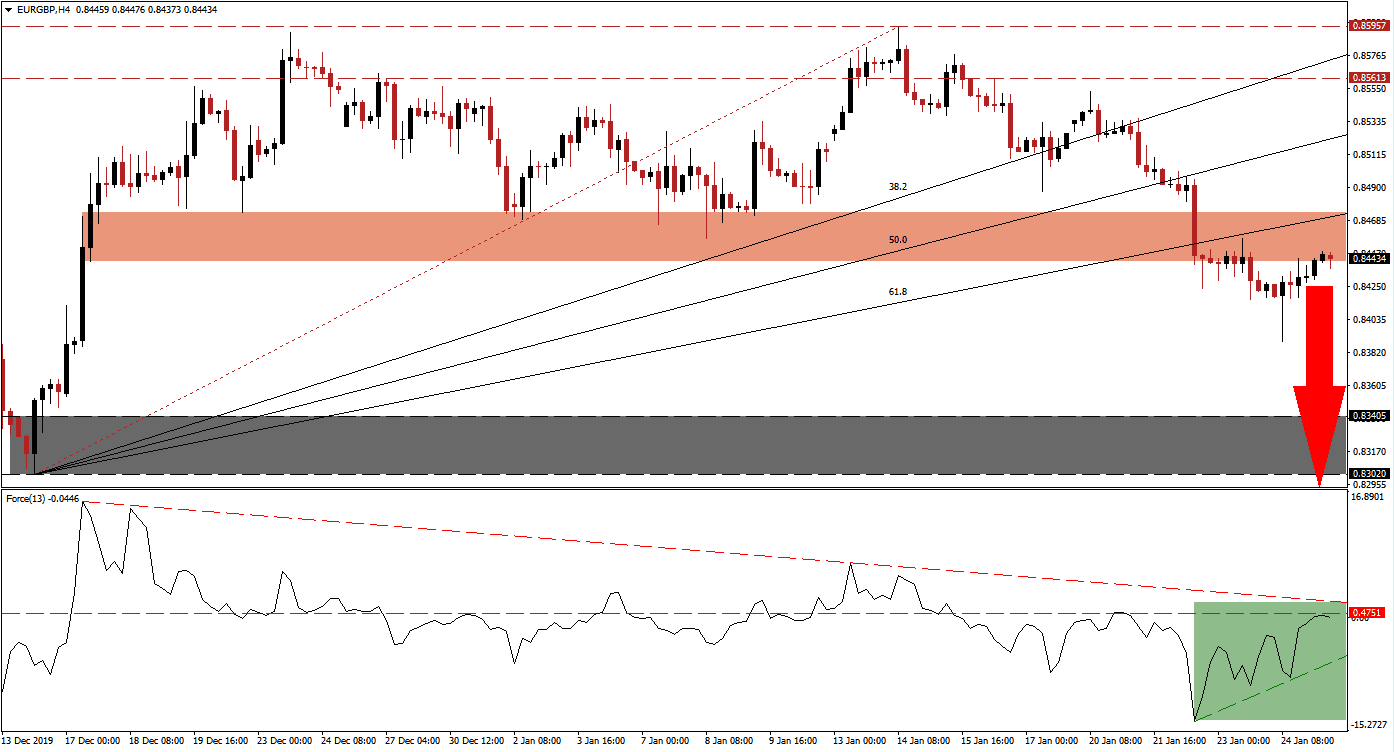

The Force Index, a next-generation technical indicator, recovered from a lower low, and an ascending support level emerged. It mirrored the reversal of the breakdown in this currency pair, following the most recent push to the downside. The Force Index is now faced with a dual resistance level, provided by its horizontal and descending resistance levels, as marked by the green rectangle. This technical indicator is favored to descend more profound into negative conditions, with bears in control of the EUR/GBP.

Bearish pressures are on the rise after this currency pair completed a breakdown below its short-term support zone, which converted it into resistance. This zone is located between 0.84415 and 0.84738, as marked by the red rectangle. The EUR/GBP additionally moved below its ascending 61.8 Fibonacci Retracement Fan Support Level and turned the entire Fibonacci Retracement Fan sequence into resistance. A test of this new resistance zone is common before price action can resume its corrective phase.

Forex traders are advised to monitor the intra-day low of 0.83893, the current low of the breakdown sequence in the EUR/GBP. A move below this level is likely to result in the addition of new net short positions. This should move price action into its support zone located between 0.83020 and 0.83405, as marked by the grey rectangle. Given the long-term bearish outlook in this currency pair, a further breakdown cannot be ruled out. You can learn more about a breakdown here.

EUR/GBP Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.84400

Take Profit @ 0.83000

Stop Loss @ 0.84850

Downside Potential: 140 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 3.11

A breakout in the Force Index above its descending resistance level could result in a breakout attempt in the EUR/GBP. The upside potential remains limited to its resistance zone located between 0.85613 and 0.85957, as a result of the long-term fundamental outlook in this currency pair. Any advance from current levels should be viewed as an excellent short-selling opportunity.

EUR/GBP Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.85150

Take Profit @ 0.85850

Stop Loss @ 0.84850

Upside Potential: 70 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.33