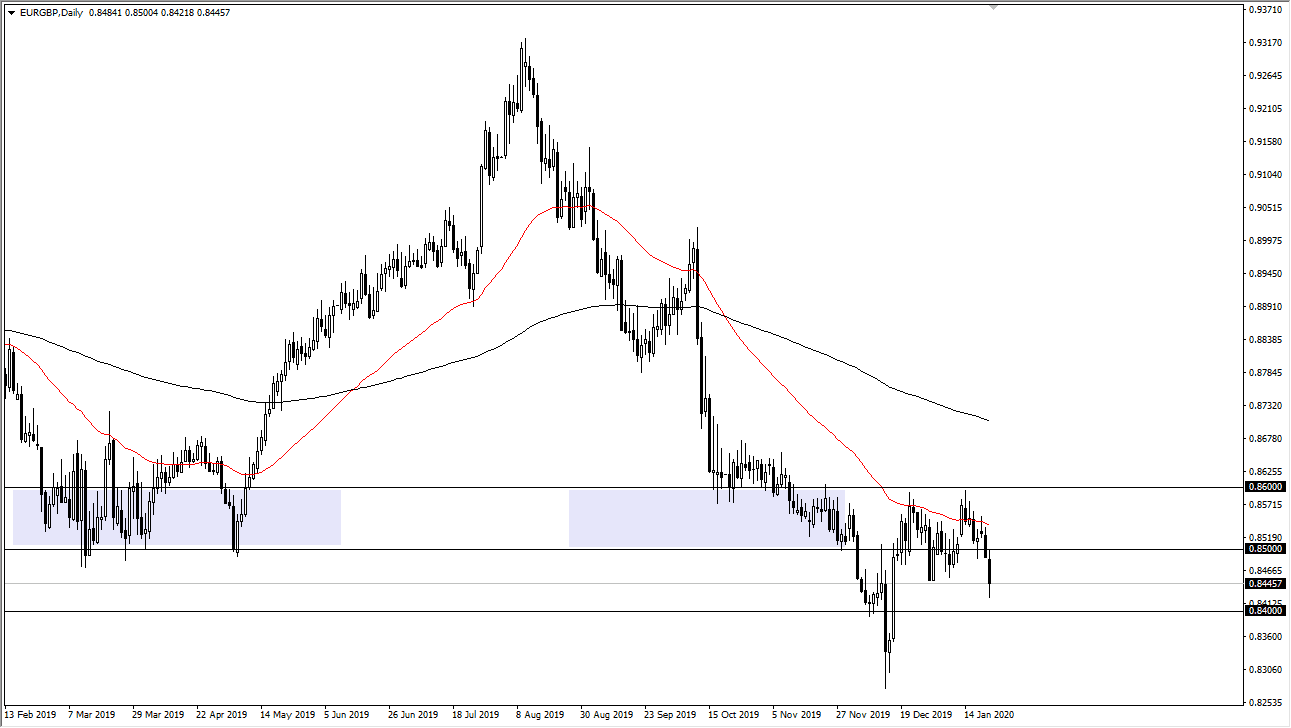

The Euro initially fell during the trading session on Wednesday but has bounced slightly after extending below the 0.8450 level. While this was a rather negative move followed by a nice bounce, the reality is that this pair is going to be extraordinarily choppy, but that really shouldn’t be anything new for you if you have placed trader this market before. It’s a bit different now though, because we also have Brexit nonsense going on, and political concerns will continue to be an issue.

The Euro has suffered a bit, but this probably has more to do with the British pound showing signs of strength as the employment situation in the United Kingdom has been better than anticipated. Because of this, people are starting to focus on whether or not the Bank of England will end up cutting interest rates. That being the case, the market is very likely to continue to see a lot of noise in general, but I think it still favors the downside. The 0.84 level will offer support, just as the 0.85 level use to. At this point, I like the idea of fading short-term rallies, but I would not expect explosive moves due to the fact that the Brexit will continue to provide plenty of headlines to cause chaos here.

If we can break down below the 0.84 level, then it’s likely that we go looking towards the 0.83 level. That is an area where we have seen a nice bounce from as of late, so at this point there is the possibility that we not only revisit that level but could break down below it. If we do, then the market most certainly will unwind drastically. This would probably coincide with the British pound strengthening around the world, as it is so “cheap” at the moment.

That being said, if we were to turn around a break above the 0.86 level it would change everything for this pair, as it would suggest that the trend was changing to the upside again. Overall, I anticipate that the pair will continue to find sellers on rallies, but my “line in the sand” is that previously mentioned 0.86 handle. If it gets violated, then you have to rethink the entire situation. It does look as if the trend has changed, at least to the downside for the short term, but that doesn’t mean that is going to be an easy path.