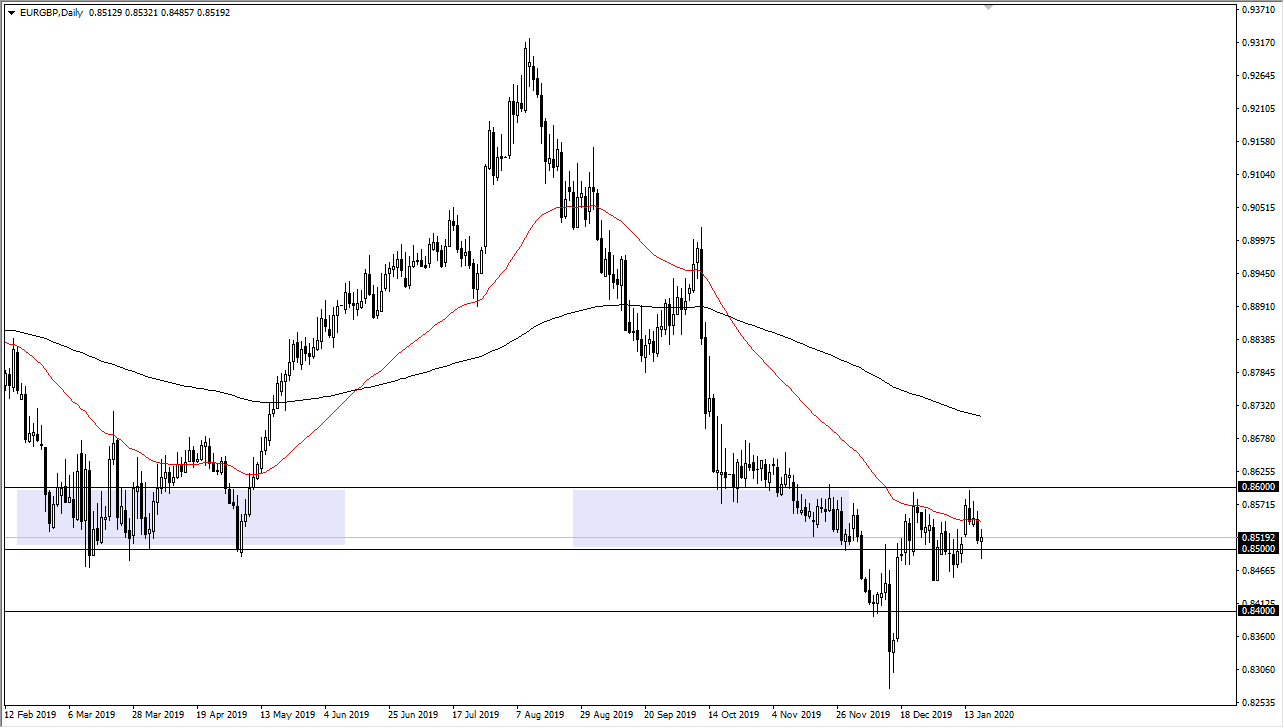

The Euro pulled back a bit against the British pound initially during the day on Friday but then turned around to form a bit of a hammer. This is not a huge surprise though, considering that the retail sales number in the United Kingdom was miserable, and the previous one was even revised lower. This of course is negative for the Pound, but at the end of the day there was a gap here that has now offered support.

One of the main reasons I am covering this pair now here at Daily Forex is that it is the epicenter of the negotiations between the United Kingdom and the European Union, and should give some insight into what’s going on in the negotiations or at the very least how the market perceives it. At this point, there is an interesting technical set up though, so it’s definitely worth paying attention to.

Breaking down below the bottom of the hammer that formed for the Friday session would of course be very negative for the pair, it should send it much lower. At that point, the market is likely to go towards the 0.8450 level, and then possibly the 0.84 level, followed by the 0.83 handle. This of course would be a sign that the British are getting more of what they want out of the negotiations. Ultimately, if we continue to see a lot of weakness in the United Kingdom, then that could send this market looking to the upside. Don’t forget, both central banks are very likely to be loose with monetary policy, and there is of course a lot of attention being paid to the fact that there is a possible rate cut coming out of London later this month, so that would be part of the argument to rally. At this point, we are still in a downtrend although recently we have seen a push to the upside. The 50 day EMA is just above, and I think at this point you can probably look at the 0.86 level as a bit of a “ceiling” in the market, at least short term. If we were to break above there though, that could change a lot of where we go from here. If we break above there, then the market is likely to continue going higher. Overall, I favor the downside, but we need to get through the bottom of the hammer that formed for Friday.