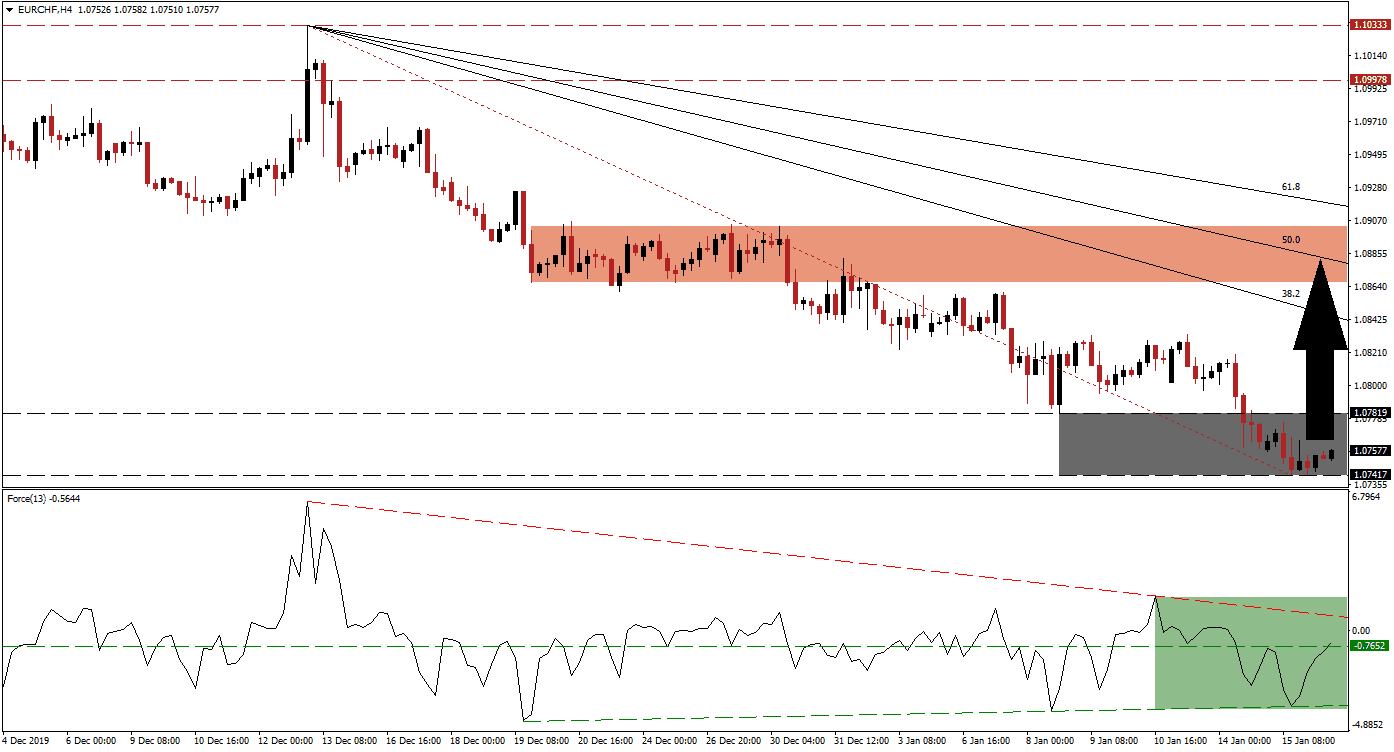

With the long-term downtrend in this currency pair intact, supported by fundamental developments, the short-term technical picture suggests a short-covering rally is pending. Doubts about the phase-one US-China trade truce have surfaced, centered around the $95 billion worth of commodity purchases. As the manufacturing recession is leading the global economic slowdown, the EUR/CHF is favored to push farther to the downside following a short-covering rally.

The Force Index, a next-generation technical indicator, shows the build-up in bullish momentum as it recovers from a marginally higher low. It resulted in the formation of a shallow ascending support level, and the Force Index was able to accelerate to the upside. This technical indicator has now pushed above its horizontal resistance level, converting it into support, as marked by the green rectangle. An extended push higher is anticipated to take it into positive conditions, placing bulls in charge of the EUR/CHF, until the Force Index will reach its descending resistance level.

Another bullish development emerged after this currency pair moved above its Fibonacci Retracement Fan trendline inside of its support zone. This zone is located between 1.07417 and 1.07819, as marked by the grey rectangle. A short-covering rally is expected to close the gap between the EUR/CHF and its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to monitor the intra-day high of 1.08327, the peak of a previous pause in the sell-off. Should price action eclipse this level, more net buy orders are likely to follow.

Price action may conclude its counter-trend advance as it reaches its 50.0 Fibonacci Retracement Fan Resistance Level, which will keep the long-term downtrend intact and ensure the longevity of it. This level is currently passing through its short-term resistance zone located between 1.08667 and 1.09029, as marked by the red rectangle. A fresh breakdown sequence in the EUR/CHF is expected to materialize, which is favored to lead to a lower low. Eurozone economic data remains weak as safe-haven demand is likely to keep demand for the Swiss Franc elevated. You can learn more about a breakdown here.

EUR/CHF Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.07550

Take Profit @ 1.08750

Stop Loss @ 1.07300

Upside Potential: 100 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 4.00

Should the Force Index reverse to the downside, driven by its descending resistance level, the EUR/CHF is anticipated to complete a breakdown below its support zone. It will invalidate the short-covering scenario, and extend the dominant bearish move in this currency pair. The next support zone awaits price action between 1.06563 and 1.06702, which will close a previous price gap to the upside.

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.07100

Take Profit @ 1.06600

Stop Loss @ 1.07300

Downside Potential: 50 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.50