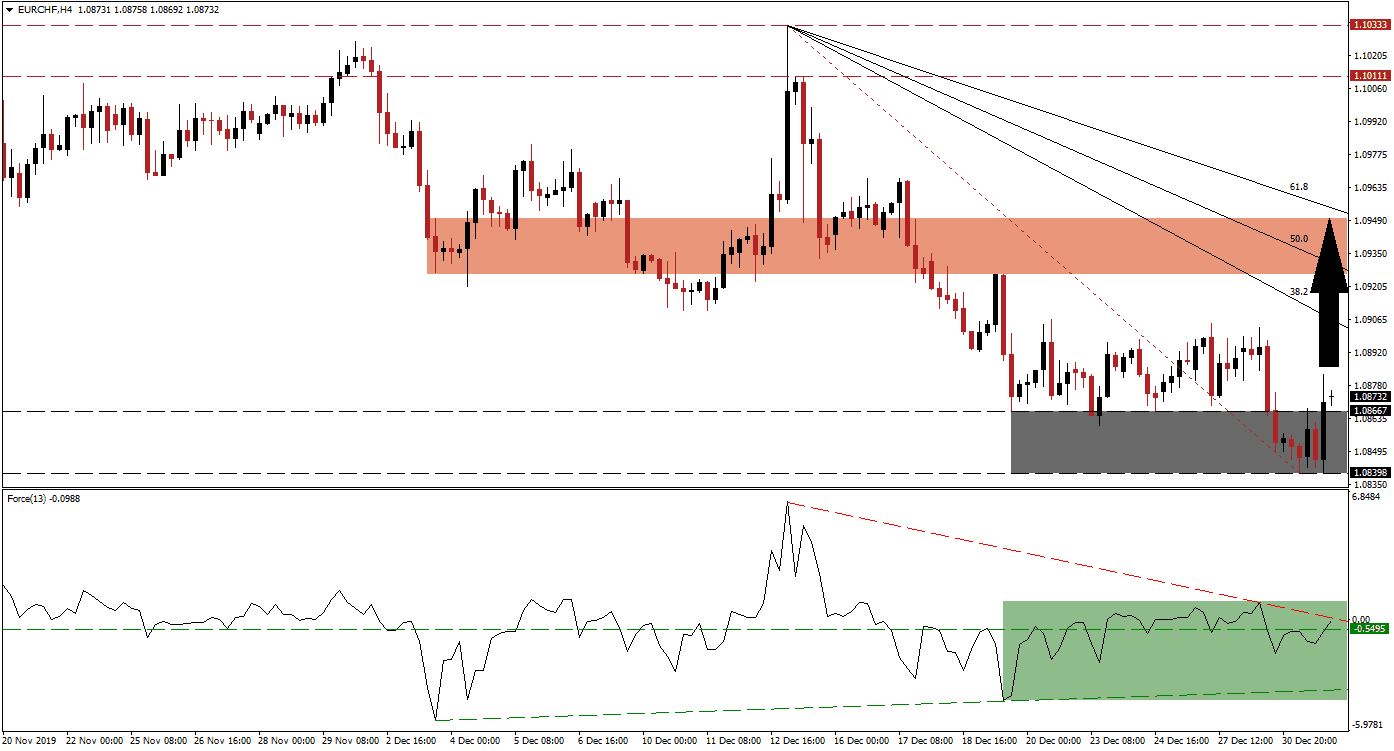

While the long-term outlook for the EUR/CHF remains bearish, a short-term recovery is favored to take this currency pair out of extreme oversold conditions. The Swiss Franc is the second-most utilized safe-haven currency, trailing only the Japanese Yen. Economic reports continue to disappoint, highlighting a weaker-than-priced-in global economy. With more sluggishness in store for the Eurozone, a divided European Central Bank, and a fresh round of quantitative easing, more long-term pain is expected. The breakout in price action above its support zone may extend in the short-term before a reversal is anticipated.

The Force Index, a next-generation technical indicator, confirms the recovery in bullish momentum as the EUR/CHF completed a breakout above its support zone. The Force Index converted its horizontal resistance level into support, and a shallow ascending support level is providing a floor. This technical indicator remains in negative conditions and is now faced with its descending resistance level, as marked by the green rectangle. A temporary breakout is expected to carry the Force Index into positive territory, placing bulls in control of price action.

Another bullish development materialized after this currency pair moved above its Fibonacci Retracement Fan trendline. This occurred inside the support zone located between 1.08398 and 1.08667, as marked by the grey rectangle. The breakout in the EUR/CHF above this zone is anticipated to initiate a short-covering rally, which will close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders are recommended to monitor the intra-day high of 1.09029, the peak before the descending to a lower low. A push above this mark may provide more upside pressure.

Due to the long-term bearish fundamental outlook for the EUR/CHF, the upside potential is limited to its next short-term resistance zone. This zone awaits price action between 1.09256 and 1.09499, as marked by the red rectangle. The 50.0 Fibonacci Retracement Fan Resistance Level is on the verge of crossing below it, with the 61.8 Fibonacci Retracement Fan Resistance Level soon to enter the top range. A breakout would require a fresh fundamental catalyst, which remains unlikely. You can learn more about a resistance zone here.

EUR/CHF Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.08700

Take Profit @ 1.09450

Stop Loss @ 1.08500

Upside Potential: 75 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 3.75

Should the Force Index be pressured to the downside by its descending resistance level, the EUR/CHF may follow through with a breakdown attempt. This will invalidate the expected short-covering rally, and extend the long-term downtrend in this currency pair. The next support zone is located between 1.07793 and 1.08061. A breakdown will require a new catalyst, but take this currency pair through a previous price gap to the upside.

[CAD:Alpari Trade Now Button - Inside Article

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.08300

Take Profit @ 1.07800

Stop Loss @ 1.08500

Downside Potential: 50 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.50