Australian producer prices eased in the fourth quarter of 2019, reflecting a slowing global economy. Today’s PMI data out of China provided a minor fundamental catalyst to the Australian Dollar, the primary Chinese Yuan proxy currency. Eurozone economic data points towards more issues and the EU is losing the UK as a member in less than sixteen hours. This allowed the EUR/AUD to halt its advance, with price action in the process of attempting a breakdown below its resistance zone.

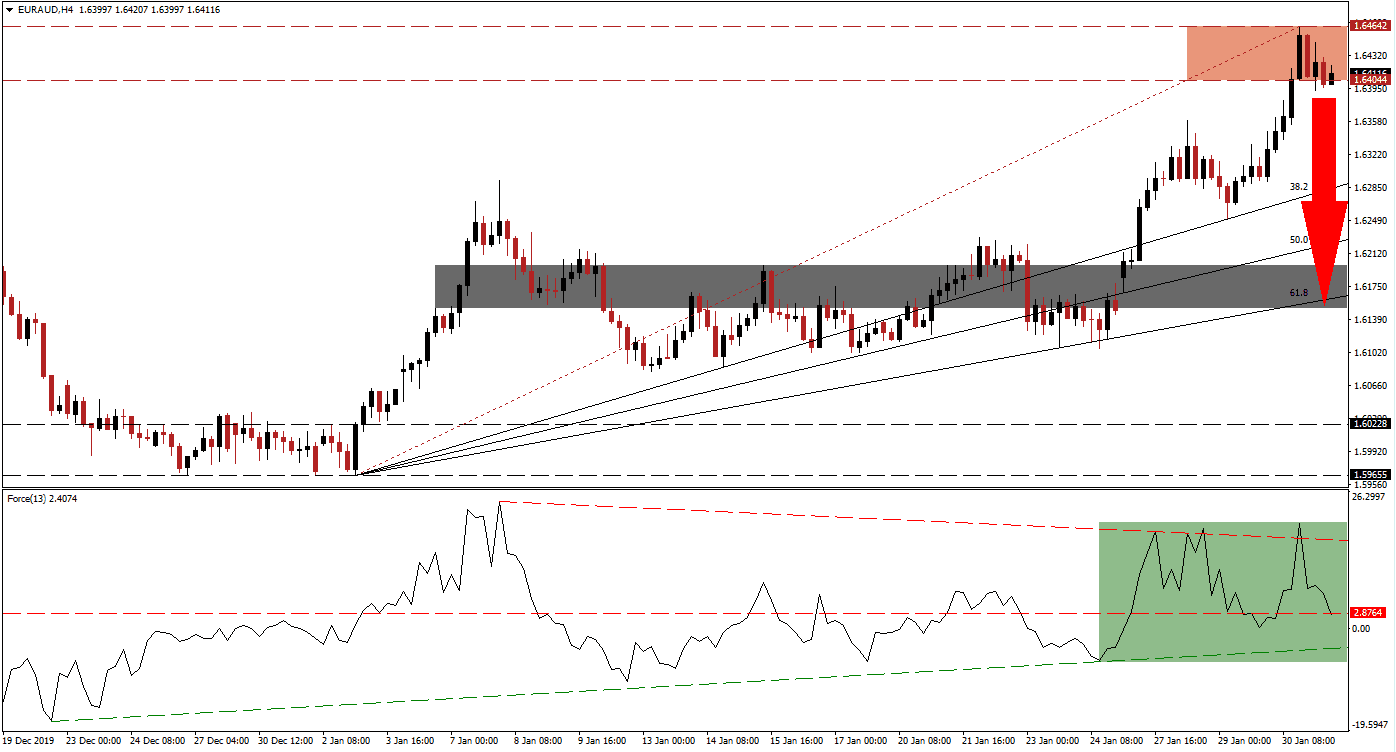

The Force Index, a next-generation technical indicator, points towards the loss in bullish momentum after reversing from a marginally higher high. After price action reached its resistance zone, the Force Index quickly contracted, converting its horizontal support level into resistance, as marked by the green rectangle. This technical indicator is now position to collapse into negative territory, below its ascending support level, and place bears in control of the EUR/AUD.

A breakdown in this currency pair below its resistance zone located between 1.64044 and 1.64642, as marked by the red rectangle, is expected to initiate a profit-taking sell-off. This will close the gap between the EUR/AUD and its ascending 38.2 Fibonacci Retracement Fan Support Level. Forex traders are advised to monitor the intra-day high of 1.63591, the peak of a previous breakout that was reversed into its 38.2 Fibonacci Retracement Fan Support Level. A breakdown below this level is likely to result in the net addition sell orders. You can learn more about a profit-taking sell-off here.

Another critical area to monitor is the intra-day low of 1.62495, the low from where the most recent advance originated, after bouncing off of its 38.2 Fibonacci Retracement Fan Support Level. The bullish chart pattern will be violated if the EUR/AUD completes a breakdown below this level. Price action is anticipated to extend its sell-off into its short-term support zone located between 1.61509 and 1.61983, as marked by the grey rectangle, enforced by its 61.8 Fibonacci Retracement Fan Support Level.

EUR/AUD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.64000

Take Profit @ 1.61500

Stop Loss @ 1.64700

Downside Potential: 250 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.57

Should the Force Index maintain a breakout above its descending resistance level, the EUR/AUD is favored to attempt one of its own. The upside potential remains limited to its next resistance zone located between 1.66253 and 1.66886. Forex traders are advised to consider this a great short-selling opportunity, as the fundamental outlook for this currency pair remains bearish.

EUR/AUD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.65150

Take Profit @ 1.66300

Stop Loss @ 1.64700

Upside Potential: 115 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 2.56