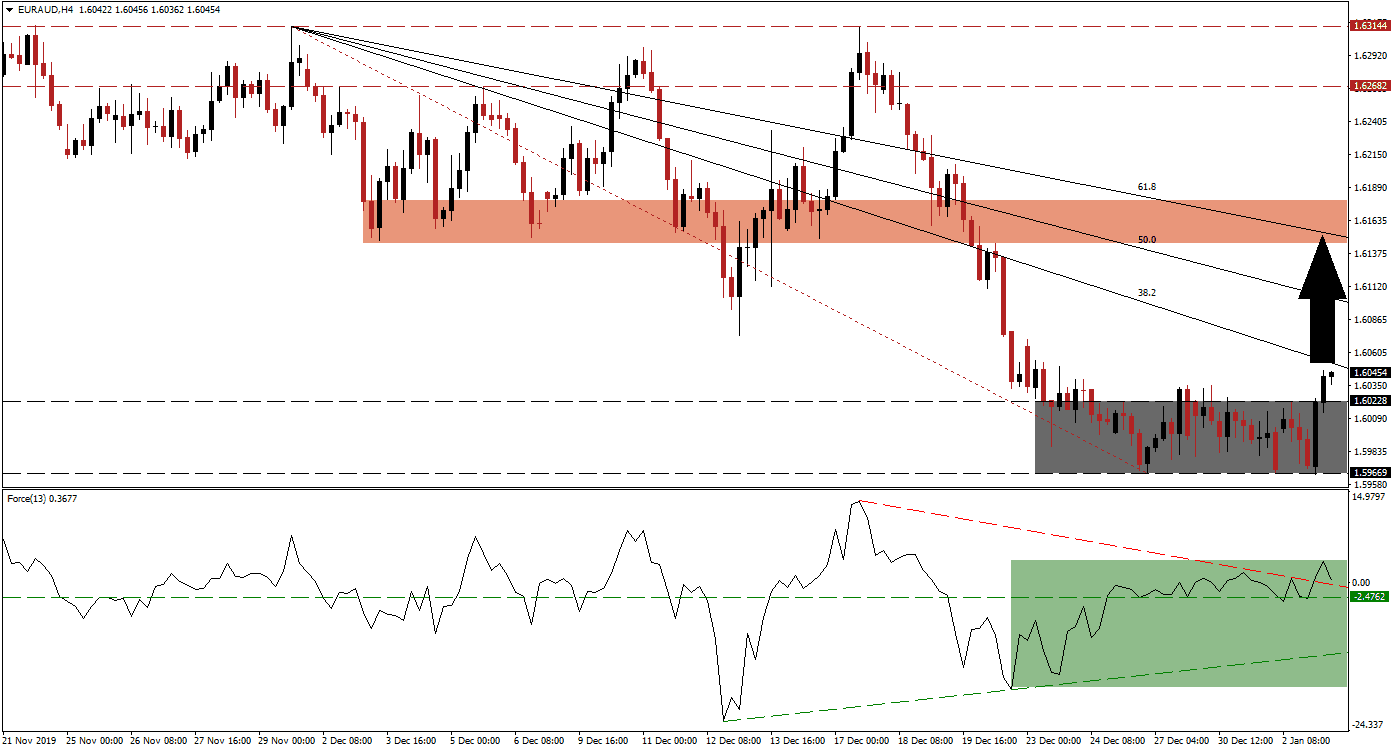

After entering a sideways trend inside its support zone, the EUR/AUD managed a breakout. This materialized after the US killed a top Iranian general in Iraq, stirring up tensions and giving forex traders a reason to take profits and adjust positions. The downtrend in this currency pair was exhausted and ripe for a counter-trend advance. Price action is now faced with its descending 38.2 Fibonacci Retracement Fan Resistance Level, a breakout above it is expected to initiate a short-covering rally.

The Force Index, a next-generation technical indicator, started to ascend after this currency pair reached its support zone. Throughout the sideways trend in the EUR/AUD, bullish momentum increased and an ascending support level formed. The Force Index was able to convert its horizontal resistance level into support. After confirming support, this technical indicator pushed above its descending resistance level, as marked by the green rectangle. Bulls took control of price action after the Force Index moved into positive territory.

Following the breakout in the EUR/AUD above its support zone, located between 1.59669 and 1.60228 as marked by the grey rectangle, an extension is favored. Bullish momentum should suffice to pressure this currency pair above its 38.2 Fibonacci Retracement Fan Resistance Level, which will add buying pressure. Forex traders are advised to monitor the intra-day low of 1.60737, the low of a previous breakdown below its short-term resistance zone. A move above this level is likely to result in more upside momentum. You can learn more about the Fibonacci Retracement Fan here.

With the long-term bearish trend intact, the expected advance is limited to its short-term resistance zone from where a resumption of the corrective phase is expected. This zone is located between 1.61460 and 1.61793, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is crossing through this zone, and a breakout remains unlikely unless a major fundamental catalyst emerges. An advance by the EUR/AUD into its short-term resistance zone should be considered a solid short-selling opportunity.

EUR/AUD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.60400

Take Profit @ 1.61500

Stop Loss @ 1.60100

Upside Potential: 110 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.67

Should the Force Index complete a breakdown below its ascending support level, the EUR/AUD is anticipated to follow suit. This would resume the long-term bearish trend, but volatility is likely to remain elevated. The next support zone, following a confirmed breakdown, awaits this currency pair between 1.58055 and 1.58519. More downside is possible, but a fresh catalyst would be necessary.

EUR/AUD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.59500

Take Profit @ 1.58100

Stop Loss @ 1.60000

Downside Potential: 140 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 2.80