Bullish momentum in the ETH/USD is collapsing quickly after this cryptocurrency pair rode a wave of optimism in other assets higher. The crumbling fundamentals remain in place, and price action already completed a breakdown below its resistance zone. Bullish sentiment across the cryptocurrency sector rose with a host of coins in extreme rally mode. Ethereum Classic, created after a messy split from Ethereum following the DAO hack in 2016, completed it Agharta hard fork last Sunday with the mining of block 9,573,000. It is intended to increase interoperability between Ethereum Classic and Ethereum.

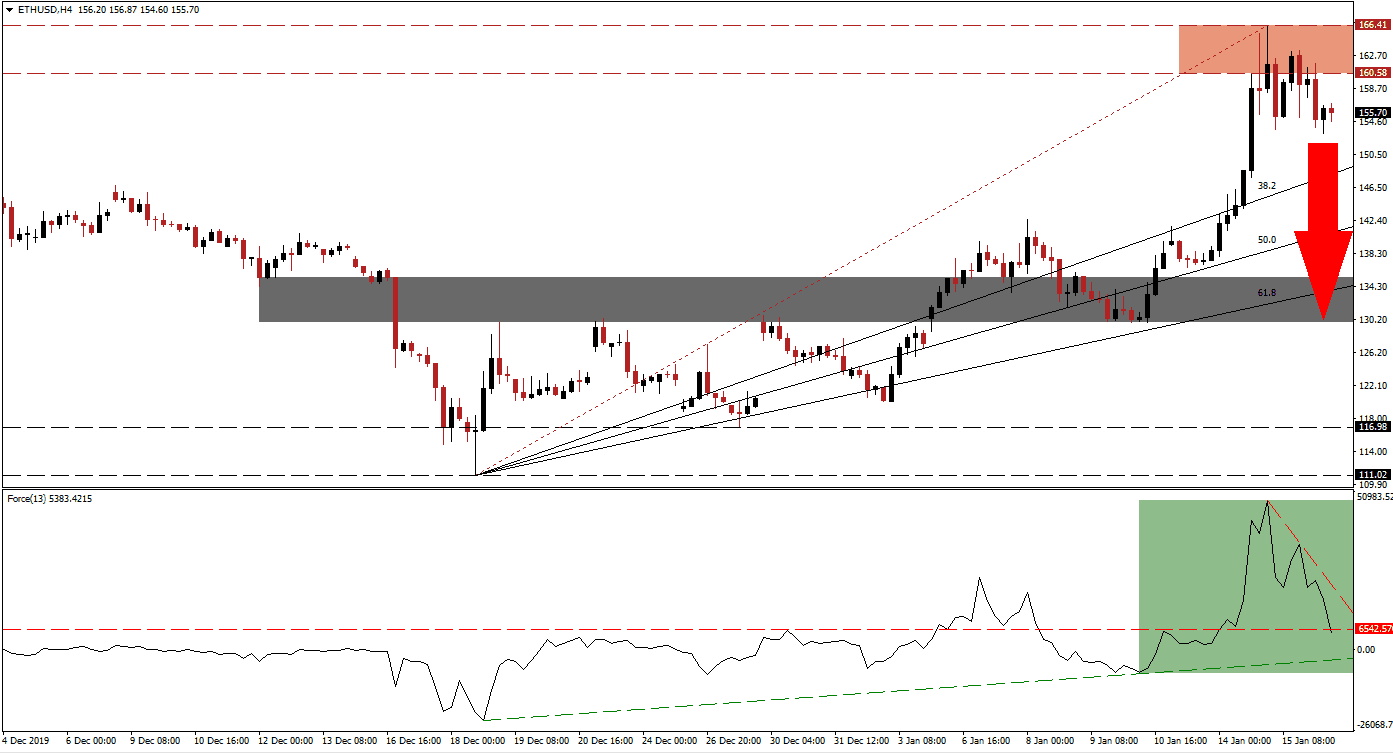

The Force Index, a next-generation technical indicator, confirmed the spike in price action and recorded a fresh multi-week high. Following the breakdown in the ETH/USD below its resistance zone, bullish momentum collapsed, as marked by the green rectangle, and a steep descending resistance level emerged. The Force Index converted its horizontal support level into resistance with a breakdown, and more downside is favored. This technical indicator possesses enough momentum to push below its ascending support level, into negative territory, and place bears in control of this cryptocurrency pair. You can learn more about the Force Index here.

With the overall optimism across the cryptocurrency market elevated, the second-largest coin by market capitalization enjoys a degree of support. Adding to bearish developments is the move in the ETH/USD below its Fibonacci Retracement Fan trendline, which emerged inside its resistance zone. This zone is located between 160.58 and 166.41, as marked by the red rectangle. Ethereum continues to face increasing competition from TRON, EOS, Binance, and Tezos. As more developers and miners leave Ethereum for superior projects, downside pressure will increase amid a fundamental collapse.

Ethereum attempts to hard-fork its way out of mounting problems, delaying inevitable events, and banking on hope. At the same time, other assets are delivering real-world applications with a growing and credible user base. The ETH/USD is expected to reflect this ongoing development with a new breakdown sequence, which will initially take it below its ascending 38.2 Fibonacci Retracement Fan Support Level. An extension into its next short-term support zone located between 129.89 and 135.43, as marked by the grey rectangle, is anticipated. A full reversal of the rally into its long-term support zone between 111.02 and 116.98 remains a possibility.

ETH/USD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 155.50

Take Profit @ 130.00

Stop Loss @ 163.50

Downside Potential: 2,550 pips

Upside Risk: 800 pips

Risk/Reward Ratio: 3.19

In the event of a sustained breakout in the Force Index above its ascending support level, the ETH/USD could attempt a fresh push higher. As a result of fundamental weakness in Ethereum, the upside potential remains limited to its next resistance zone located between 185.64 and 189.89. Traders are recommended to take advantage of any advance with short-positions, due to the growing bearish outlook for this cryptocurrency pair.

ETH/USD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 170.00

Take Profit @ 186.00

Stop Loss @ 163.50

Upside Potential: 1,600 pips

Downside Risk: 650 pips

Risk/Reward Ratio: 2.46