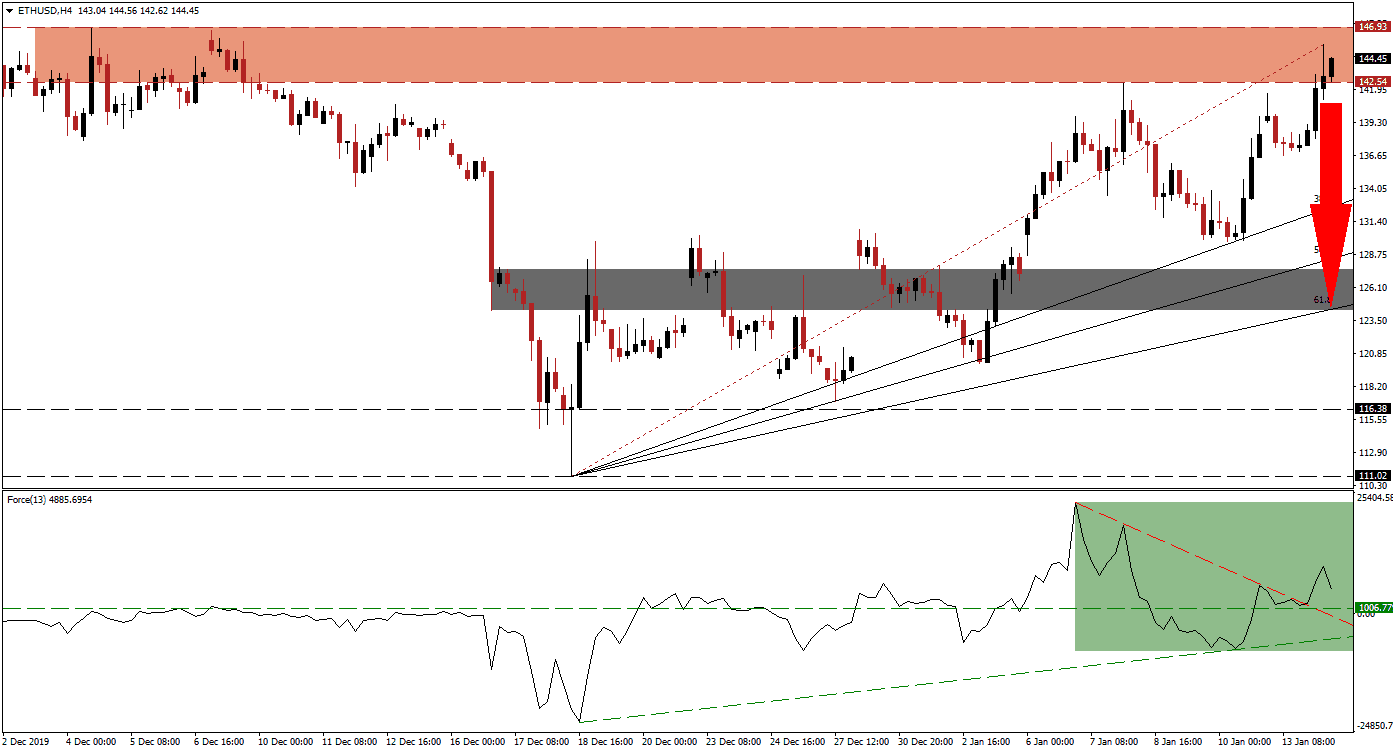

2020 allowed for an impressive recovery across the cryptocurrency sector, but signs of a new breakdown sequence started to materialize. The rally over the past two weeks elevated most established cryptocurrencies, but divergences are expected to follow. Ethereum pushed into its resistance zone, resulting in the redrawing of the Fibonacci Retracement Fan sequence. Bullish momentum is contracting, and if the current intra-day high holds, it will represent a lower high in the ETH/USD.

The Force Index, a next-generation technical indicator, supported the advance in this cryptocurrency pair off of its ascending 38.2 Fibonacci Retracement Fan Support Level. It converted its horizontal resistance level into support, as marked by the green rectangle. While the ETH/USD extended its advance, the Force Index started to contract, and a negative divergence formed. Bulls remain in charge as this technical indicator maintains its position in positive territory, after the breakout above its descending resistance level. The weakening uptrend is anticipated to surrender to a new breakdown, preceding a corrective phase in price action.

One of the most critical issues for Ethereum, asides from the developer churn-rate and mining unprofitability, is the unresolved scaling issue. Ethereum is now basing its future potential on Ethereum 2.0, years away from now. In the meantime, other projects are providing real-world applications that Ethereum hopes it may handle in a few years. A breakdown in the ETH/USD below its resistance zone located between 142.54 and 146.93, as marked by the red rectangle, is favored to initiate a profit-taking sell-off.

A corrective phase will close the gap between the ETH/USD and its ascending 38.2 Fibonacci Retracement Fan Support Level. Traders are advised to monitor the intra-day low of 136.65, the low of a previous breakdown preceding the latest push to the upside. A move below this level is expected to attract new net sell orders in this cryptocurrency pair, initiating a new breakdown sequence. Price action is anticipated to challenge its short-term support zone located between 124.26 and 127.59, as marked by the grey rectangle, and enforced by its 61.8 Fibonacci Retracement Fan Support Level.

ETH/USD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 144.50

Take Profit @ 124.50

Stop Loss @ 149.00

Downside Potential: 2,000 pips

Upside Risk: 450 pips

Risk/Reward Ratio: 4.44

In case of more upside in the Force Index, enforced by its ascending support level, the ETH/USD could attempt to extend its advance. The next resistance zone is located between 170.31 and 176.43, which will close a previous price gap to the upside. With the long-term bearish outlook for this cryptocurrency pair, any push higher should be viewed as a sound short-selling opportunity.

ETH/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 156.00

Take Profit @ 171.00

Stop Loss @ 149.00

Upside Potential: 1,500 pips

Downside Risk: 700 pips

Risk/Reward Ratio: 2.14