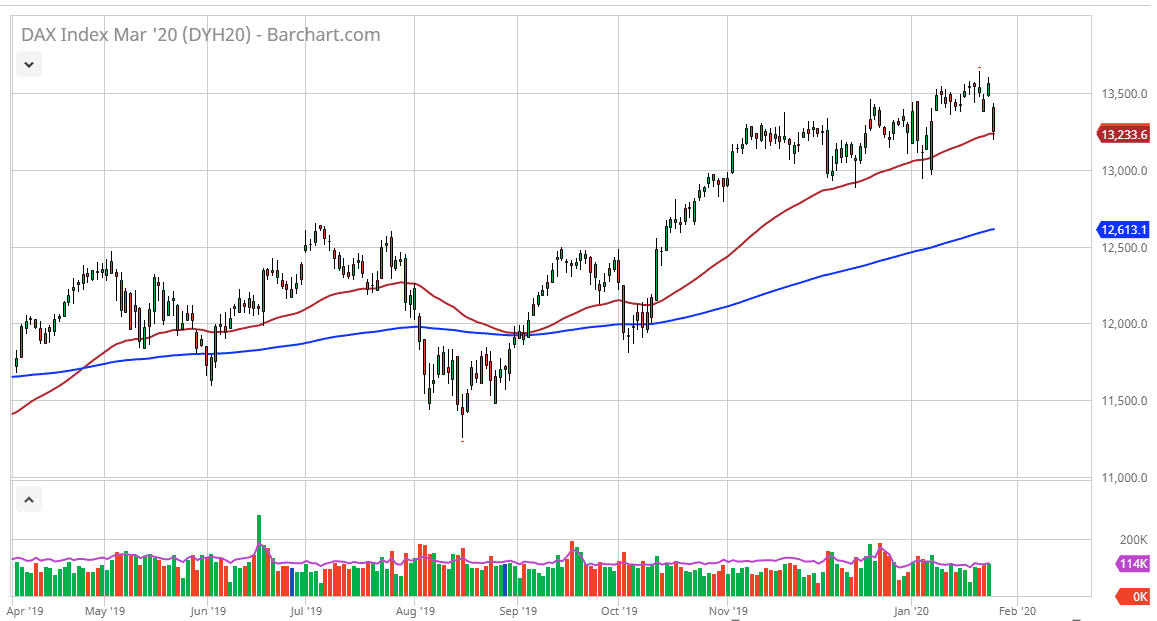

The German DAX gapped lower to kick off a very negative session on Monday, as futures dropped all the way down to the 50 day EMA. The gap broke through the €13,500 level, an area that of course would be psychologically important, so the fact that we blew right past it is a sign that things are getting worse when it comes to risk appetite. However, if you step back and take a look at the technical analysis, and perhaps not worry so much about the latest crisis of the day, you will see that the market looks very likely that there are buyers underneath.

The 50 day EMA, which is currently trading at the €13,233 level, has been relatively stable in unpredictable for support, and the fact that the session closed right at that level after bouncing from the absolute lows of the day suggests that there are in fact going to be buyers underneath. Looking at the chart, there is also supported underneath near the €13,000 level, and I think that will be the short term “floor” in the market. That of course is an area that has shown itself to be crucial more than once, as we have bounced a couple of times. Ultimately, the market looks as if it is simply trying to form some type of bullish channel.

At this point, most of the reaction was probably due to the concerns about the China coronavirus situation, as traders react to the latest headline and drama the comes out over new sites. The reality is that the more important negative during the day was the German Ifo Business Climate number, coming in lower than anticipated. Ultimately, this is a market that has sold off a bit but with the European Central Bank looking to buy more assets, and of course keep a very extraordinarily loose monetary policy, it makes sense that the DAX continues to gain as a result. As long as the ECB is looking to liquefy the markets, traders will continue to come in and pick up the DAX because it is considered to be the “blue-chip area” when it comes to the European Union in general. If we do break below the ¥13,000 level though, the next move will be down to the blue 200 day EMA underneath. Ultimately though, the market looks very likely to attract value hunters given enough time.